2014 Global Economic Forecast In Charts: Societe Generale

What will the world’s economic landscape look like in 2014? Answering this question would involve analyzing literally hundreds of indicators across the world’s major economies – a daunting task for most investors.

Luckily, for those of us who don’t have 29 hours in a day, economists at Societe Generale have already done the hard work. As a special supplement to their 2014 Global Economic Outlook report, they have selected just two indicators for each economy that they consider the most critical to building a picture of the whole.

U.S. (Aneta Markowska)

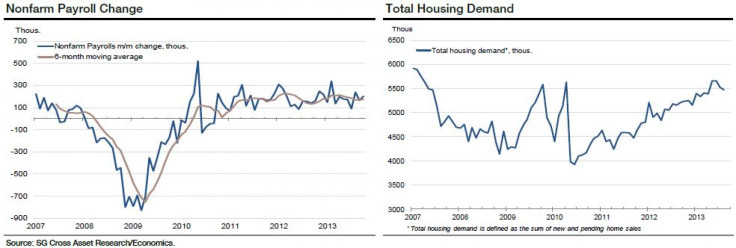

* Nonfarm payroll change / Critical level -- 175,000 - 200,000 is consistent with a first-quarter 2014 taper and with 2016 rate hikes.

One of the conditions for the U.S. Federal Reserve to start scaling back its $85-billion-a-month in bond purchases is continued progress on employment. Markowska believes this means nonfarm payroll growth has to remain at least in the 175,000 - 200,000 range before the Fed feels comfortable reducing the pace of asset purchases. Maintaining this pace of job growth will also put steady downward pressure on the unemployment rate, with "breakeven" job growth now estimated at around 80,000 - 90,000 per month.

* Total housing demand / Critical level -- any decline in this indicator below the January 2013 level of about 5,300 (down 2.5 percent from current pace) could potentially put tapering on hold.

Housing is another important litmus test for the Fed executing its exit strategy. Before allowing bond yields to rise further (first via tapering, eventually via tightening), the Fed needs solid evidence that the housing recovery remains on track.

Euro Zone (Michel Martinez)

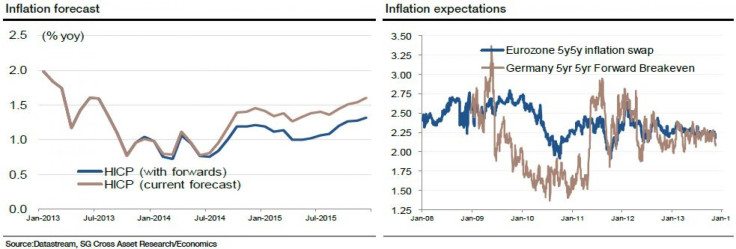

* Inflation forecast / Critical level -- 0.5 percent for monthly annual rate, 1.0 percent for the 2014 average.

The European Central Bank's November rate cut came in the backdrop of deflationary fears after euro zone inflation hit a four-year low of 0.7 percent in October, well below the ECB target of "below, but close to 2 percent." The central bank left rate unchanged at the final policy meeting of the year on Thursday after the latest data showed that inflation accelerated to 0.9 percent in November. The ECB expects inflation to remain low on the back of subdued economic activity in the single-currency bloc.

* Inflation expectation / Critical level -- 2 percent.

Measures of inflation expectations five years out starting in five years remain anchored. The ECB seems to suggest that it would meet its mandate so long as it can ensure long-term inflation expectations are in line with 2 percent.

Germany (Anatoli Annenkov)

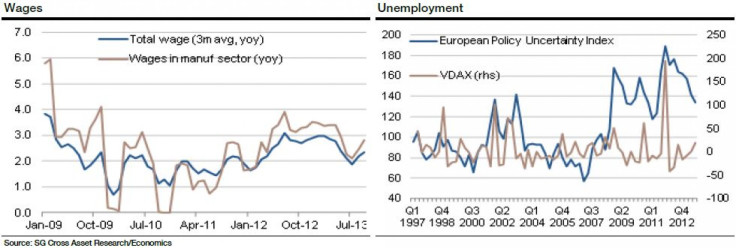

* Wages / Critical level -- 2.5 percent.

Societe Generale's key scenario is based on solid support from household income. Given the labor market situation, with growing signs of labor shortages, Annenkov expects wage growth to remain robust, at around 3 percent. Over the year, however, there has been a weakening trend in wages due to considerable uncertainty on the growth outlook. Annenkov expects this uncertainty to ease gradually and this should allow for a return of wage growth around or above 3 percent.

* Unemployment / Critical level -- continued improvement expected, gradually approaching pre-crisis levels.

German machinery and equipment investment appears to have been heavily affected by European policy uncertainty in recent years. Annenkov is looking for a return to pre-crisis levels over the course of next year.

France (Michel Martinez)

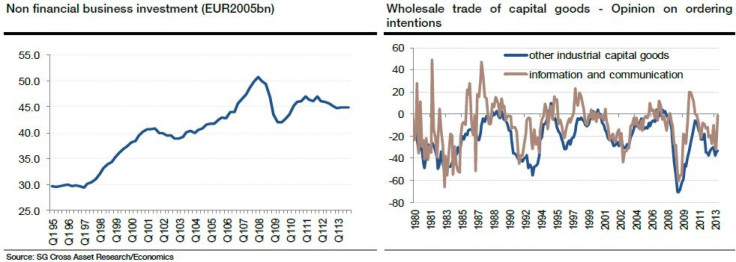

* Nonfinancial business investment / Critical level -- 3 percent year-over-year.

France managed to pull out of a recession in the second quarter of this year, but the latest readings on its services and manufacturing sectors have sparked fear that the country could be heading back into recession. One of the assumptions behind Societe Generale's below-consensus growth forecast for 2014 (median 0.9 percent, SG 0.5 percent) is related to corporate investment behavior. After a rebound in the second quarter, capital expenditures fell again in the third quarter.

* Wholesale trade of capital goods: opinion on ordering intensions / Critical level -- negative 20.

Surveys of wholesale trade of capital goods generally provide good signal of a recovery in capital expenditure. Opinion on ordering intentions in the capital goods sector remain in the doldrums, at negative 40. Levels close to negative 20 suggest a cyclical recovery in capital expenditure.

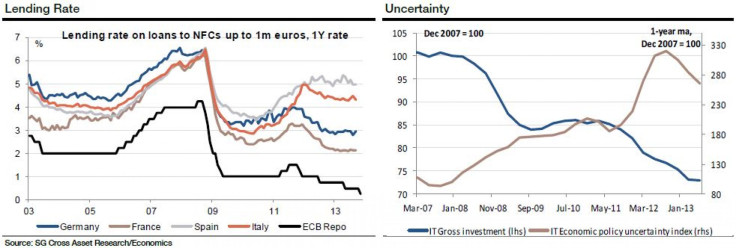

Italy (Yacine Rouimi)

* Lending rate / Critical level -- 3 percent.

It remains difficult for Italian nonfinancial corporations to borrow money at an affordable rate. Having made some progress on fragmentation in terms of bank funding, lending remains subdued, also due to heightened risk aversion and uncertainty. This is a key objective that is to be addressed by the upcoming Asset Quality Review and ECB President Mario Draghi emphasized that, for the AQR to be effective, it will have to be credible, and that in turn will require a transparent and rigorous approach.

* Uncertainty / Critical level -- 185.

"A lasting reduction in uncertainty would prompt us to revise our growth projections, as there would be the likelihood of a reversal of the negative implications it had on both growth and employment," Rouimi said. Societe Generale believes that consumer spending could see some upside but, above all, business investment could make a recovery from the historically low levels seen in recent quarters. The firm estimates that, if policy uncertainty were reduced to pre-crisis levels, this would provide a 2 percentage-point boost to Italian real GDP growth after three years, and create more than 20,000 new jobs.

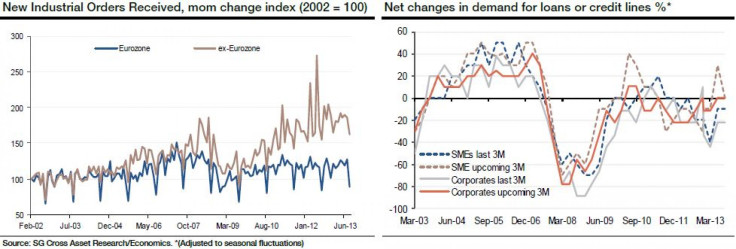

Spain (Souheir Asba)

* Exports and industrial orders / Critical level -- 250 for the aggregate.

Industrial orders received will be a leading indicator for export trends. Europe remains the main destination for Spanish exports as its recent recovery is absorbing the effects of slowing demand from emerging markets.

* Credit growth / Critical level -- above 0 levels would be indicators of a recovery in credit demand.

Companies' restricted access to credit is undermining growth. There has been no significant improvement in credit growth over the past year. The scars from the housing and constructin bubble -- which was responsible for high credit growth prior to 2008 -- are still evident.

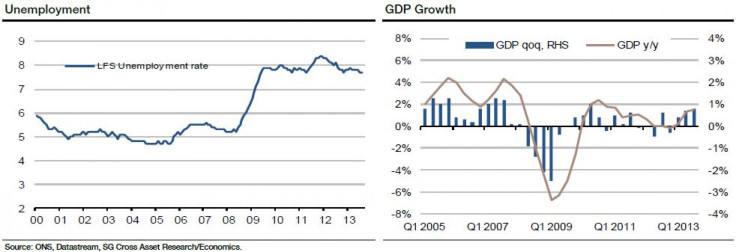

U.K. (Brian Hilliard)

* Unemployment / Critical level -- 7.2 percent.

This lies at the heart of the Bank of England's forward guidance framework. The threshold for a reconsideration for interest rate policy is a 7 percent unemployment rate. The central bank now predicts that, on unchanged rates, this level could be reached in the last quarter of next year. "We expect them to lower the threshold as that number looms into view because the central bank will be in no rush to raise rates, as long as inflation remains reasonably well behaved," Hilliard said.

* GDP growth / Critical level -- 3.0 percent year-over-year for several years.

Currently, the British economy is at a sweet spot with growth suddenly accelerating far above potential. The central bank has very aggressive GDP forecasts, well above market. The longer the economy maintains the current pace of growth, the more likely are market rate expectations to continue moving nearer. Chancellor George Osborne raised his forecast for U.K. growth over the next few years when he delivered the Autumn Statement on Thursday. Osborne raised GDP expectations for this year to 1.4 percent, well above the 0.6 percent predicted by the Office for Budget Responsibility in March. Looking further ahead, he also raised GDP forecasts for 2014 from 1.8 percent to 2.4 percent.

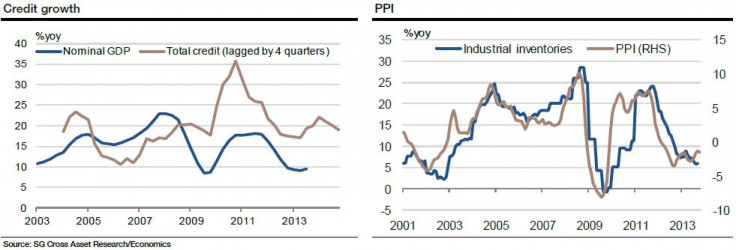

China (Wei Yao)

* Credit growth / Critical level -- Total credit should trend lower and converge with the rate of economic growth in five years.

Total credit is calculated by taking the sum of bank loans, trust loans, entrust loans, bankers’ acceptance bills and nonfinancial corporate bonds. Growth of total credit usually leads economic growth by three to four quarters and also closely correlates with liquidity conditions in the domestic financial system. Hence, it's not only a good leading indicator for growth but a timely barometer of financial tensions. Total credit growth has significantly outpaced nominal GDP growth since 2009, resulting in a big increase in the overall leverage of the Chinese economy. "The new leadership has recognized that deleveraging is the right path to take to ensure long-term sustainability and has set about working on it," Yao said.

* PPI / Critical level -- 0 percent year-over-year.

This indicator captures the relative speed of demand recovery against capacity consolidation in China. A higher year-over-year rate suggests that demand is increasing faster than capacity, thus improving profit margins for manufacturers. This series also correlates well with inventory cycles.

Japan (Takuji Aida)

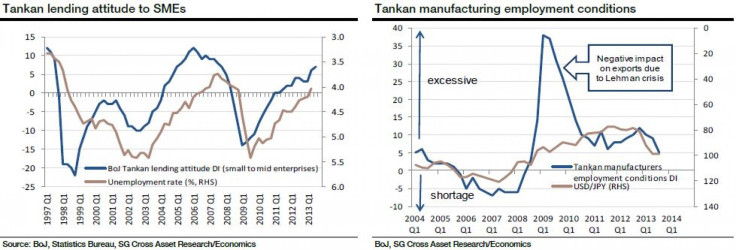

* Tankan lending attitude to SMEs / Critical level -- 12 (previous cycle peak)

"To see a sustainable recovery in domestic demand and an easing deflationary environment, we need to see strong expansion in aggregate wages," Aida said. "To achieve this, the unemployment rate needs to reach 3.5 percent, versus 4 percent at present." Most companies in the service sectors are small to mid-size, and these companies will be the main drivers for employment growth. The point is that these companies need to feel that the lending attitudes of financial institutions are easing before business expansion can occur.

* Tankan manufacturing employment conditions / Critical level -- 0 (perception of excess employment disappears at 0).

Among the nonmanufacturers employment conditions are expanding strongly. However, manufacturers have an lingering perception of excess employment, and remain focused on restructuring and cost-cutting rather than investing and hiring. This represents an obstacle to further improvement in the unemployment rate and the expansion of aggregate wages. "As the U.S. economy recovers, we expect exports to recover and the yen to depreciate further," Aida said. "Finally, the perception of excess employment should recede, allowing employment and wages to improve."

Poland (Janecki Jaroslaw)

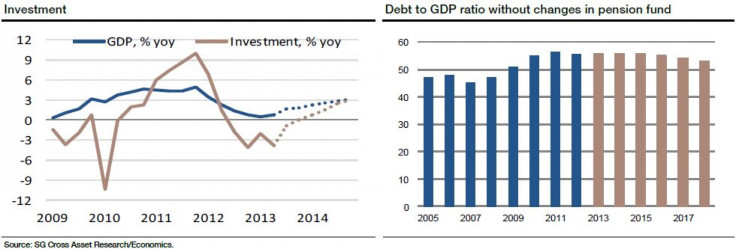

* Investment / Critical level -- 0 percent growth year-over-year.

In the period of stable growth, investment is one of the most-important components of GDP. But during the first wave of the crisis, investment fell by 10.3 percent year-over-year in the first three months of 2010. Jaroslaw forecasts investment will grow at the pace of 2 percent year-over-year in 2014.

* Debt-to-GDP ratio / Critical level -- 55 percent of GDP (in polish methodology), 60 percent of GDP (European System of Accounts's 1995 methodology).

The full impact of the new regulations regarding the changes in the pension system isn't yet known. It could lower public debt by around 9.2 percentage points of GDP in 2014. There are still some doubts it will be possible to maintain a lower debt-to-GDP ratio in the coming years without long-term measures. A debt-to-GDP ratio growth close to 55 percent will be a risky scenario for Poland's public finances. Jaroslaw forecasts debt-to-GDP ratio close to 56 percent without the changes in pension system.

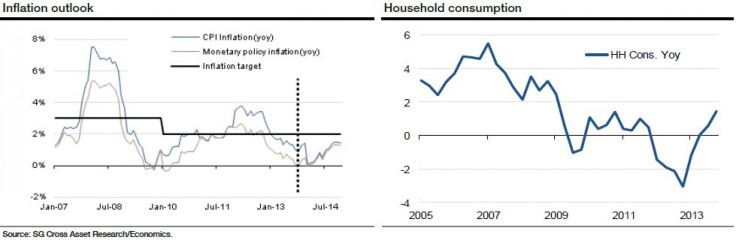

Czech Republic (Jiri Skop)

* CPI / Critical level -- 2 percent year-over-year.

Inflation is crucial for the timing of exit from the foreign exchange intervention regime. The Czech National Bank targets inflation at 2 percent year-over-year, and this level should be reached at the end of 2014, Skop predicts.

* Household consumption / Critical level -- 2 percent year-over-year.

If domestic demand recovers strongly than anticipated, demand-pulled inflationary pressures might speed up inflation toward the target. On the other hand, household consumption should be hurt by higher import prices at the beginning of 2014.

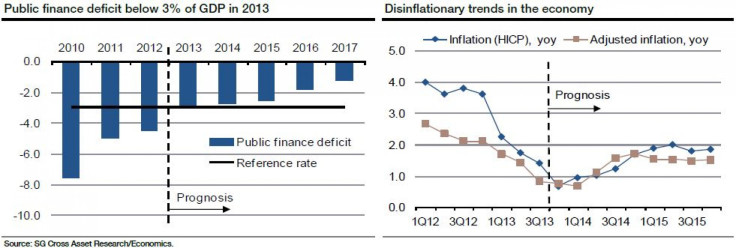

Slovakia (Miroslav Frayer)

* Public finance deficit / Critical level -- a deficit of 3 percent of GDP.

The government plans a public finance deficit of 2.98 percent of GDP this year, followed by 2.83 percent in 2014, 2.57 percent in 2015 and 1.50 percent in 2016. The 2013 target is just below the European Union ceiling of 3.0 percent and would put Slovakia, a member of the euro zone, in better shape than many other countries in the debt ravaged 17-member euro zone and across the 27-member European Union.

* Dis-inflationary trends in the economy / Critical level -- 0 percent year-over-year.

Inflation has declined since October 2012, and in May 2013 it was below the ECB’s inflationary target for the first time since December 2010. In October, inflation amounted to 0.6 percent. "For now, we do not expect a further significant deceleration in the inflation rate, but the risk of a negative inflation rate is increasing," Frayer said. "A decline into negative territory for a longer period would change our outlook for the future economic recovery."

Russia (Evgeny Koshelev)

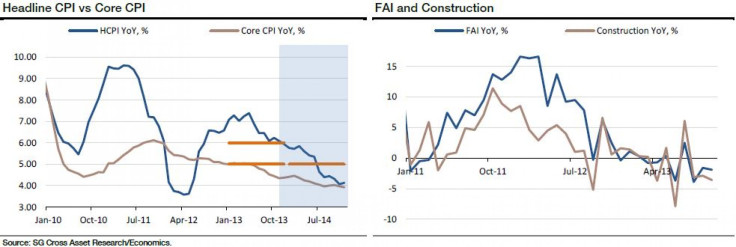

* Headline CPI / Critical level -- 5.70 percent to 5.80 percent in the first quarter of 2014, or two-three consecutive months of disinflation to trigger the key rate cut.

The Central Bank of Russia intends to finalize its transition to inflation targeting by 2015. Although the core component is moving lower, the most volatile components are of particular concern for the CBR and stand in the way of an outright cut to the policy rate.

* Fixed assets investments / Critical level -- Expect an acceleration in mandatory investments to counter the sentiment-driven slowdown.

Investment demand remains one of the weakest components of domestic demand and this too is standing in the way of a rebound in GDP. The government tends to apply stimulation to the economy via "backdoor" infrastructural spending and curbing tariff indexation.

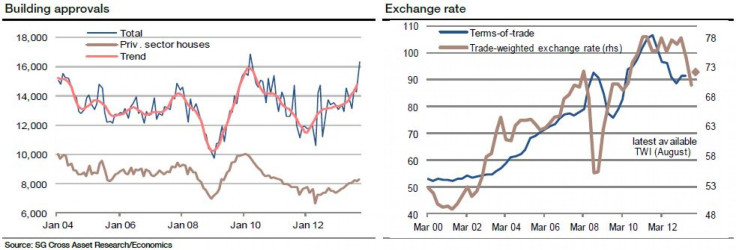

Australia (Klaus Baader)

* Building approvals / Critical level -- There's no critical level as such because this is a highly volatile series. What's important is that the trend remains at or above current levels, which are in themselves already quite high.

The biggest break on growth in Australia is the decline in mining investment. To avoid a severe slowdown in the economy in general, it's imperative that other sources of demand fill the void. In the first instance, that's likely to be residential housing activity -- including house prices driving consumption demand through the wealth effect. But more important is housing investment, and building approvals are a good leading indicator for this.

* Exchange rate / Critical level -- This depends on the terms of trade. What's important is that a moderate downtrend is maintained.

A second factor of key importance to successfully manage the transitions away from resource investment to other sources of demand is the exchange rate. It remains highly valued, and is thus putting downward pressure on manufacturing as well as key services exports (tourism, education). It's clear that policymakers would like a lower exchange rate, but whether this is in line with fundamentals is an open question. Historically, there has been a fairly close relationship with the terms of trade. Right now these are broadly in line with the TWI, but they are expected to decline.

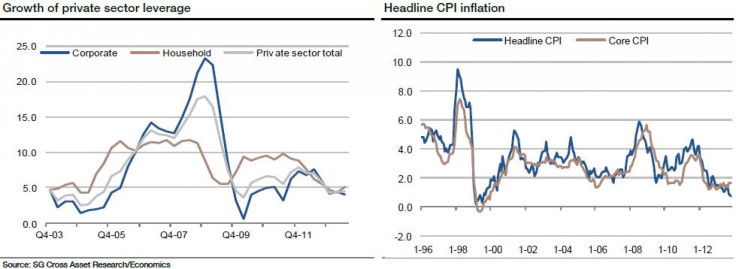

South Korea (Suktae Oh)

* Growth of private sector leverage / Critical level -- 8 percent, a previous high was seen in the fourth quarter of 2011. Societe Generale's base scenario of no credit boom assumes that private credit growth won't exceed this level. If growth in leverage rises above this level, both growth and inflation will be strengthened, and the chances of a Bank of Korea rate hike will increase.

The burden of private sector (household and corporate) leverage has been the key risk for the Korean economy, given that leverage as a percentage of GDP is as high as some highly leveraged developed economies. Societe Generale has recently observed the slowdown in private sector leverage, though the ratio of leverage to GDP isn't declining considering that GDP growth is also slowing.

* Headline CPI inflation / Critical level -- 2 percent, a psychologically important level for "normal" inflation in most developed economies. Societe Generale's base scenario assumes that headline inflation will rise above this level in the first half of next year. If headline inflation stays below this level into the second half of 2014, concerns on low inflation (or even deflation) will rise further and exert pressure on the BoK to cut rates.

Headline inflation has been undershooting the BoK’s target range since the second half of 2012, raising concerns regarding disinflation or even deflation. The inflation outlook will depend on the output gap, currency markets, credit growth and monetary policy. It appears that the BoK doesn't care about the lower limit of the inflation target range.

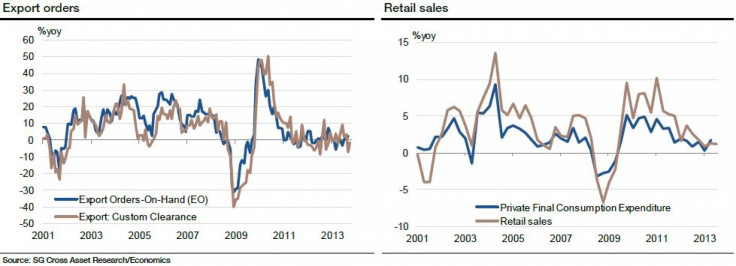

Taiwan (Wei Yao)

* Export orders / Critical level -- the higher the better.

Exports are the most important part of Taiwanese economy, accounting for nearly three-quarters of the economy. Export orders often lead exports by one or two months, thus providing some idea of the short-term outlook for the economy.

* Retail sales / Critical level -- the higher the better.

Retail sales are one of the timeliest indicators of household consumption in Taiwan.

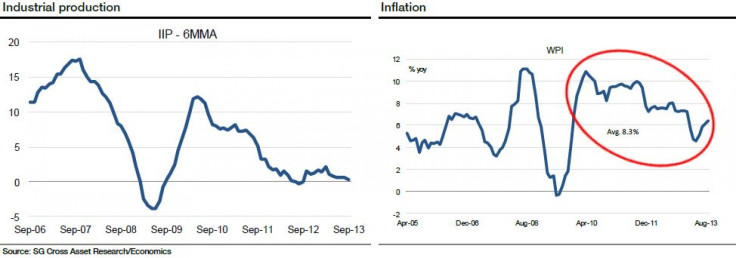

India (Kunal Kundu)

* Industrial production / Critical level -- 4.5 percent year-over-year.

India’s industrial production data (as given by the Index of Industrial Production) continues to remain weak, given the amount of demand destruction that the economy has been experiencing. While the monthly data is highly volatile, the six month moving-average data continues to trend down and is closer to zero-expansion level now. "We do not expect much reversal in here, given the extent of inventory accumulation that has taken place," Kundu said.

* Inflation / Critical level -- Headline WPI inflation averaging more than 6.5 percent year-over-year during fiscal year 2014 would raise a red flag.

With the government not doing its bit and leaving the Reserve Bank of India to fight a lone battle, monetary conditions are tight as inflation rages on and inflationary expectations remain stubbornly high.

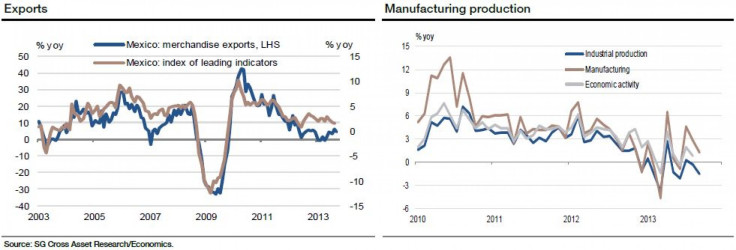

Mexico (Dev Ashish)

* Exports / Critical level -- 12 percent.

Being an open economy with high share of trade in GDP and strong co-movement of domestic demand and sentiment regarding external demand, exports become a key indicator. Importantly, Mexican exports rely heavily on U.S. demand growth. Since 2005, Mexican exports on average have grown by almost 10 percent annually. Substantially stronger export performance would add to the upside risk to growth.

* Manufacturing production / Critical level -- 5.5 percent.

The bulk of Mexico’s exports is manufacturing goods and a revival in manufacturing production (and overall industrial production) will also signal improvement in the external demand outlook. "Looking at past data, 5 percent to 6 percent annual manufacturing growth is consistent with slightly above trend growth which is what we are looking for the Mexican economy from 2014 onwards," Ashish said.

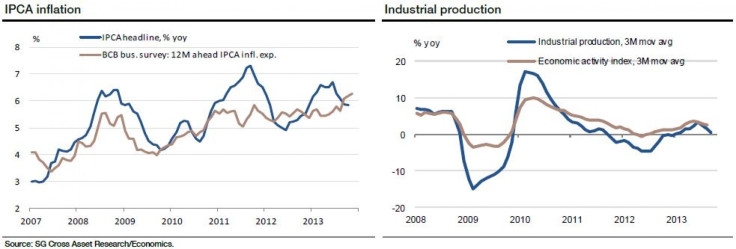

Brazil (Dev Ashish)

* IPCA inflation / Critical level -- 5.5 percent.

The IPCA, or Extended National Consumer Price Index, is the broadest measure of inflation and the single most-important indicator affecting monetary policy rate. The Central Bank of Brazi targets inflation at 4.5 percent, with a 2 percent tolerance range on either side. "We estimate 2013 inflation at 6.2 percent and expect it to fall to 5.7 percent in 2014, with the actual decline materialising in the second half," Ashish said. "A range of 5.3 percent to 6.0 percent annual inflation in 2014 will be most conducive for our forecasts."

* Industrial production / Critical level -- 4.0 percent.

IP is the largest component in the monthly economic activity index that tracks supply side GDP. A growth range of 3 percent to 5 percent in IP will roughly signal economy growing near trend. Above trend IP growth will also signal strengthening competitiveness of manufacturing exports.

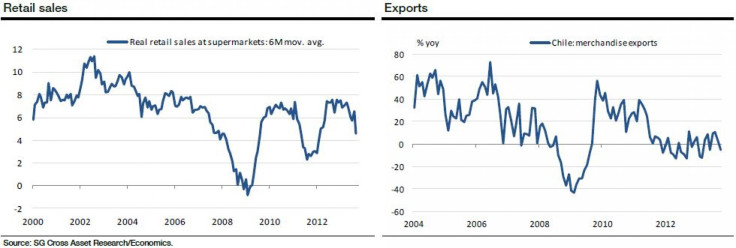

Chile (Dev Ashish)

* Retail sales / Critical level -- 5.5 percent.

Over the past several months, the strength of retail sales and overall consumption demand has been surprising given much weaker production side data. "The strength of consumption demand presents a challenge to our sub-trend outlook for Chile," Ashish said. "It’s possible that domestic consumption eventually lead manufacturing out of trouble for the time being." A 5 percent annual growth in retail sales is consistent with Societe Generale's slightly subtrend growth outlook.

* Exports / Critical level -- 12.0 percent.

Chile is a small, open economy with a high share of exports in GDP. The biggest component of Chilean export is metal (primarily copper). Improvements in export growth will also mean stronger investment demand in the domestic economy, improving the overall outlook. Since 2004, Chile recorded strong export growth of an average 17 percent annually on the back of strong commodity prices and metal demand. Weaker-than-average export growth will drag the economy’s actual and potential growth lower.

© Copyright IBTimes 2024. All rights reserved.