3 Reasons to Invest in Palladium

Missed Out on the Gold Surge? No Problem. It's Got a Cousin That's Set to Run.

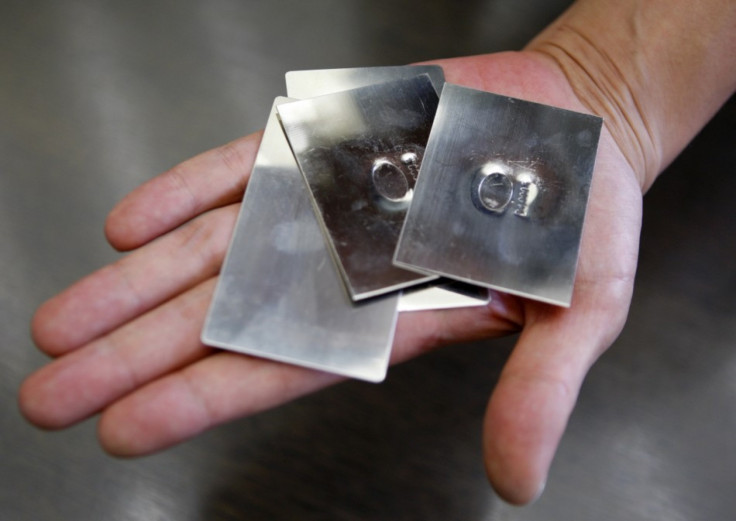

The value of palladium, the least known of the world's four major precious metals, is set to rise more sharply than its more popular cousins, thanks to three factors.

You may not know much about palladium, so here's a quick primer. It is used as both an investment vehicle, just like gold, silver and platinum, but it also has several industrial functions. It is used in catalytic converters that comprise car and truck exhausts. Palladium is also used in fuel cells, which combine hydrogen and oxygen to make electricity, heat and water.

Here are three reasons to put your money on palladium.

The supply is threatened. Earlier this month Norilsk Nickel, the world's largest producer of palladium, reported its palladium output was down 7 percent, year over year. More serious is the possibility of strikes in South Africa, which has the world's second largest palladium reserves. The National Union of Mineworkers is negotiating contracts with Northam Platinum and Lonmin, and has reached an impasse with Implats. The union this week repeated its threat to strike if a deal is not reached with Implats.

Demand is growing. Auto makers in emerging markets like China are growing much faster than their counterparts in the developed world, which are also increasing. Auto sales worldwide were falling in the first half of this year, but more recently have been rising. Jon Anderson, UBS Emerging Markets Economist, has documented how the pace of recovery in the emerging markets' auto industry far exceeds that of the auto industry of the developed world. The more cars and trucks they make, the more palladium they need. This industry accounts for about 63 percent of palladium demand.

The price is rising. Palladium has been growing in value for several years. In 2009 it averaged $262 an ounce. The next year it averaged $526. This year, according to Barclays, it is estimated to average $798 an ounce. Further, on Wednesday palladium futures on the CME Comex hit their highest level in a month, reaching $11.15 to settle at $790.45 per ounce. Add to that the fact that this year's increases in the price of gold, silver and platinum have exceeded the increases in palladium -- it closed at $800 on the first day of trading this year and since then has ranged up to $832 and down to $703 -- and you have prospects of a catch-up rally.

Just keep in mind that palladium is more thinly traded than gold and silver so it is often more volatile. But if you have the stomach for the ups and downs, you could come out a winner.

© Copyright IBTimes 2024. All rights reserved.