3 Ways To Save On Ethereum Gas Fees

Celebrities know that there is a cost to popularity — losing privacy. The more attention they draw, the less they have to give back. Such is the case in the world of blockchains as well. The more traffic a blockchain receives, its network of nodes and validators suffers greater throughput stress.

Blockchain's set of features to deal with this problem is commonly known as scalability, as a part of blockchain trilemma between decentralization, security and scalability. In other words, if there is an emphasis on one aspect, the other two tend to suffer. For instance, far more centralized blockchains, such as Solana or Binance Smart Chain, have drastically lower transaction fees.

What is the current state of Ethereum transaction fees?

In the case of Ethereum, as one of the most decentralized smart contract platforms with over 275,000 validators, the network's throughput stress manifests in the form of high fees.

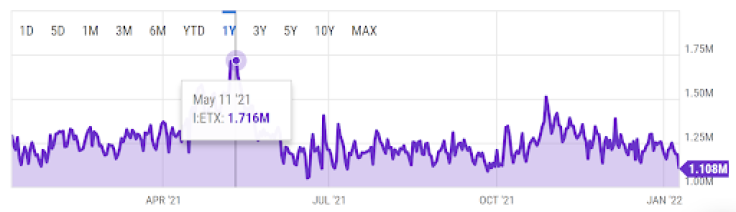

As you can see, the ETH gas fee highly correlates with how many transactions the smart contract network has to process, as shown below. When there were an unusually high number of transactions in May 2021, Ethereum's gas fee skyrocketed to become unaffordable for most retail investors, who just want to trade in popular NFTs.

The higher the number of transactions, the higher the ETH gas fee, which means Ethereum hasn't yet tackled its scalability problem. While EIP (Ethereum Internet Proposal) 1559 did somewhat reduce ETH gas fees by making them more predictable, it still isn't enough. For this reason, Vitalik Buterin proposed EIP 4488 to make the blockchain more financially inclusive.

Of course, these EIPs are all improvements in the transitory period toward Ethereum's major overhaul known as ETH 2.0. Likely happening in H2 2022, Ethereum's old Proof-of-Work (PoW) blockchain will dock with Proof-of-Stake (PoS) Beacon Chain; thus, Ethereum becomes fully PoS.

More importantly, sometime in 2023, Ethereum will integrate shard chains to increase its capacity to process and store data. Therefore, this upgrade will also affect gas fees in a major way. However, before all of these complex scalability solutions are implemented, here is what you can do right now to avoid Ethereum's volatile and high gas fees.

1. Not all Ethereum transactions are equal

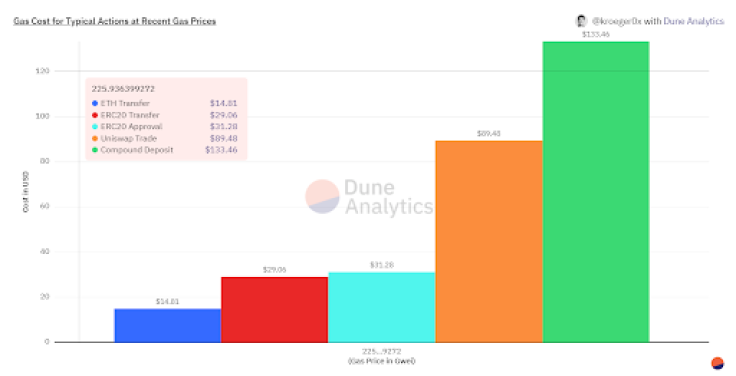

The more complex your interaction is with DeFi smart contracts, the higher the gas fee will be. Case in point, transferring native ETH cryptocurrency will cost the least, while layered smart contract protocols, such as compound deposit, will exert the highest cost.

In practice, this means you should combine actions falling into the same category whenever possible. For instance, if you happen to have two addresses, both holding tokens you wish to stake in a DeFi protocol, transferring them from each address would be expensive.

Instead, it would be much cheaper to first combine the tokens from the two addresses, i.e., transfer them from address A to address B. Then, staking those tokens into a DApp would only count as one complex action.

2. Simply wait the congestion out

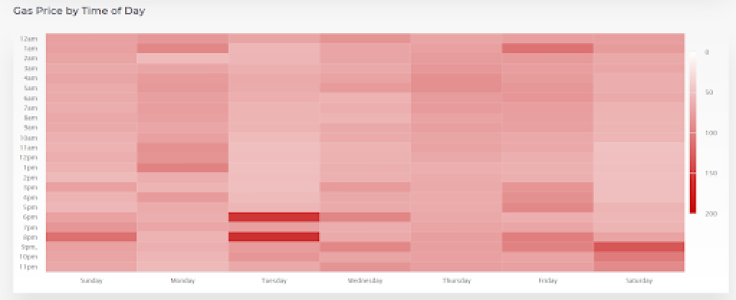

There is a drastic difference in ETH gas fees -- daily, weekly and monthly. Finding an opportune moment to execute the transaction at the lowest fee level means monitoring network congestion and planning ahead. You can do so with this tool to get a sense of congestion patterns and plan accordingly.

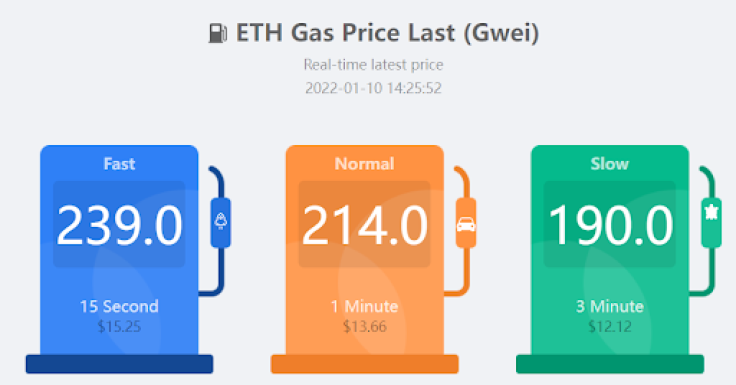

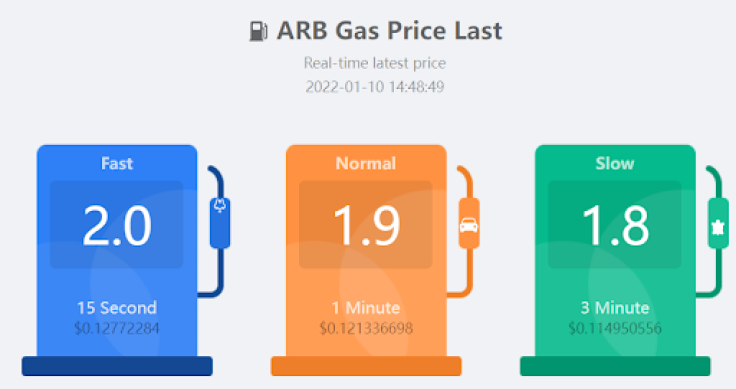

Such a congestion map also allows you to estimate how much gas you need for the transaction to follow through at a given time period. Otherwise, the transaction will fail, and the window will close until the next one opens. Likewise, you can check the CoinTool app to see the difference in gas fees between fast, normal and slow transactions, with the latter being at around three minutes.

3. Take advantage of Layer 2 scalability solutions

By far, the best way to drastically lower ETH gas fees is to make use of Layer 2 scalability solutions in the form of sidechains and rollups. These terms simply refer that Ethereum's main chain — Layer 1 — connects to other networks — Layer 2 — via bridges.

In turn, these protocols take up Ethereum's traffic load, alleviating its congestion. The most popular L2 scalability solutions for Ethereum are:

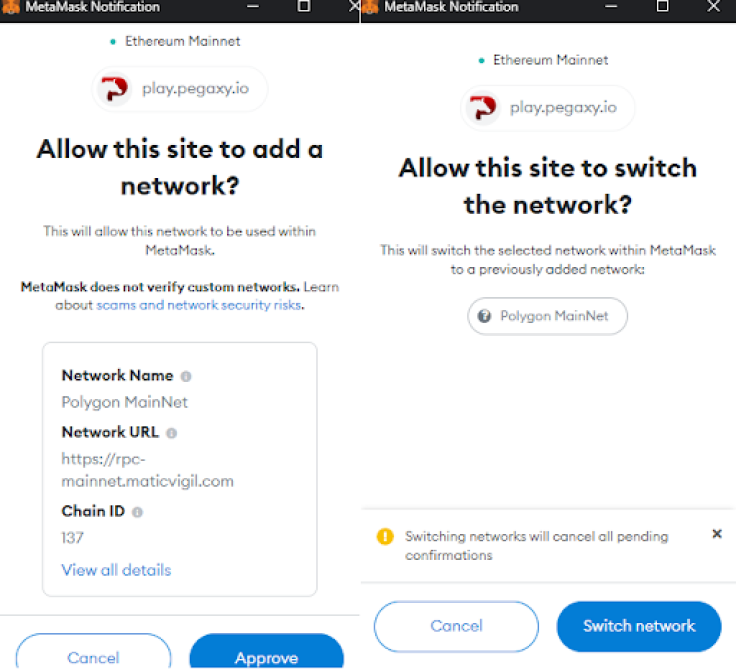

They all work by simply connecting to them via MetaMask wallet. To illustrate, let's say you want to play-to-earn (P2E), a blockchain game called Pegaxy, listed on dappradar under Polygon category. Once you click on “Open Dapp,” you will be transferred to Pegaxy's site, where you will be able to connect it to your MetaMask wallet.

With your MetaMask wallet set to default Ethereum Network, connecting a Polygon DApp will just mean adding the site to its network and then switching to it.

Likewise, Loopring devs have made a simple tutorial to get you started.

New to Loopring L2 + Ethereum?

— Loopring💙🏴☠️ (@loopringorg) November 29, 2021

Check out our new quick guides to help you become an L2 wizard in minutes🧙♂️✨

You'll learn how to:

🌟 connect MetaMask to Loopring L2

🌟 deposit to Loopring L2

🌟 transfer L2 <> L2

🌟 withdraw back to Ethereum L1

👇👇https://t.co/ihMyPKEOXy pic.twitter.com/DG3abGSZM7

Each L2 network has its own system of imported Ethereum DApps, with drastically lower gas fees. Presently, Arbitrum has by far the lowest of the bunch, which is likely to sharply increase its popularity in 2022 and beyond.

Extra L2 steps are worth it

Even with a fully upgraded Ethereum, it likely will always require L2 scalability solutions to, hopefully, onboard hundreds of millions of users. In turn, their own utility tokens are likely to skyrocket in the future. As L2 protocols further evolve and add more DApps, ETH gas fees are bound to become a thing of the past.

Furthermore, even if you can't be bothered to tap into L2 networks, organizing your Ethereum transactions ahead of time will significantly mitigate the cost of doing DeFi business.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2024. All rights reserved.