5 Fast Facts About The Cryptocurrency Industry

Cambridge University recently published one of the most comprehensive cryptocurrency research reports to date, a study spanning across global markets. It includes data from 144 different cryptocurrency organizations, companies and miners, compiled by researchers Michel Rauchs and Garrick Hileman. It’s now official; The cryptocurrency is a legit sector of the white-collar blockchain industry.

Here are some of the facts we learned about the burgeoning cryptocurrency industry:

1. The cryptocurrency industry currently employs more than 1,876 people.

Most bitcoin developers, as well as other cryptocurrency makers, work on a volunteer basis. So job creation isn’t a great measurement of how many people are actually working to keep the ecosystem running smoothly. It’s also important to note many companies, including large-scale mining operations, didn’t provide the researchers with any employment data. At best, this figure is a conservative estimate of old school office jobs.

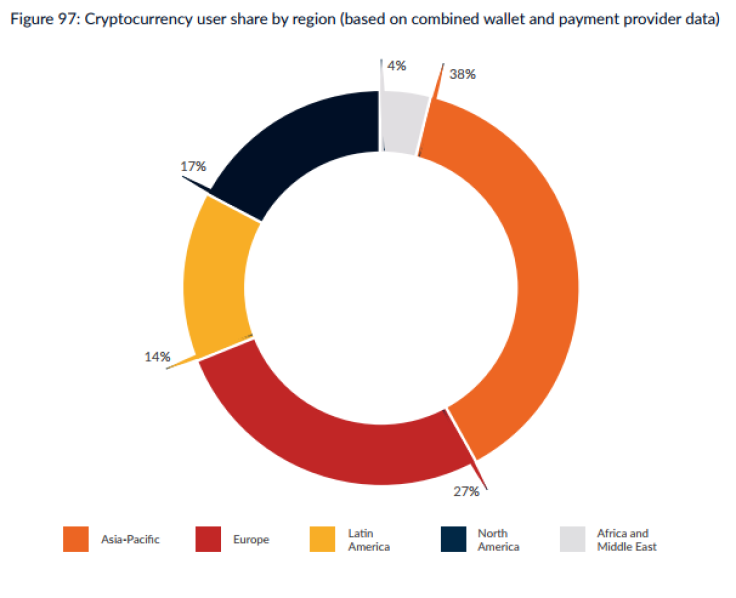

However, limitations aside, it is interesting to note where people are paying their bills with cryptography skills. Most full-time cryptocurrency jobs are in Asia-Pacific, a whopping 720 jobs, followed by North America. Likeminded companies in Latin America have around 105 employees.

2. Most cryptocurrency professionals work at a currency exchange.

Most people with a full-time job in the cryptocurrency industry work at a currency exchange like Coinbase or Safello. Even if they don’t currently work at an exchange, many of the industry’s leading professionals got their start at an exchange.

There are all kinds of technical jobs at an exchange platform, not only roles related directly to blockchain networks. On average, 13 percent of employees are devoted to security. Even so, most exchanges outsource the bulk of their cybersecurity tasks.

3. Europe has the highest number of cryptocurrency exchanges, many of which work with government licenses.

Europe is home to more cryptocurrency exchanges than any other region, 37 percent of all exchange platforms. Europe has lots of niche companies with 11 employees or less, while North America and Asia are home to a few huge ones like Hong Kong-based Bitfinex.

More than half of small European exchanges have government licenses, compared to just 35 percent of large exchanges. These findings hint at the importance of studying niche European companies if regulators want to learn more how to issue licenses without suffocating competition. So far, North American licenses in places like New York and Washington have been a disaster.

4. There are somewhere between 5.8 to 11.5 million active wallets storing cryptocurrency.

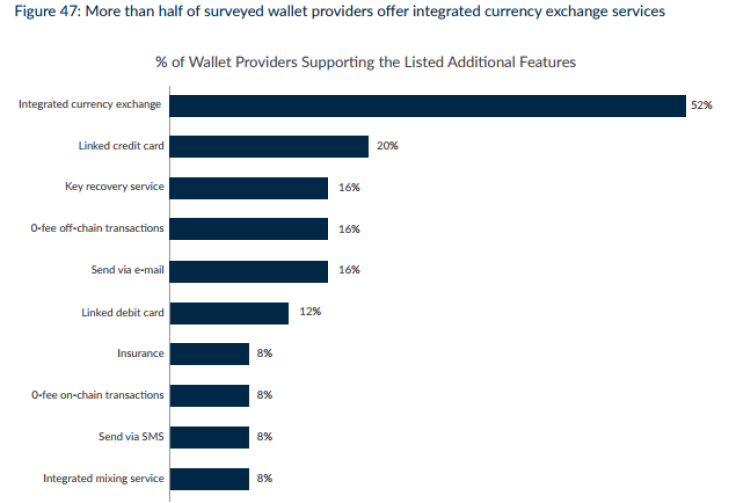

It’s safe to say there are millions of cryptocurrency users around the world. Just like a leather wallet, some people may have more than one digital wallet. Some groups may even share a communal wallet. Regardless, 20 percent of digital wallets can be linked to credit card services, which implies personal use. A few wallets even allow users to send cryptocurrency via email or text message. More than half of all cryptocurrency wallets offer features beyond mere storage.

Many Chinese cryptocurrency users keep their earnings in third party exchange accounts, which are vulnerable to hackers and government seizure. This is actually a common rookie mistake worldwide. On the other hand, the majority of wallet providers and users both are based in North America, 34 percent, followed by the United Kingdom, which is home to 15 percent of wallet providers.

5. Alternative coins like dash and monero are rising fast. And it looks like they are here to stay.

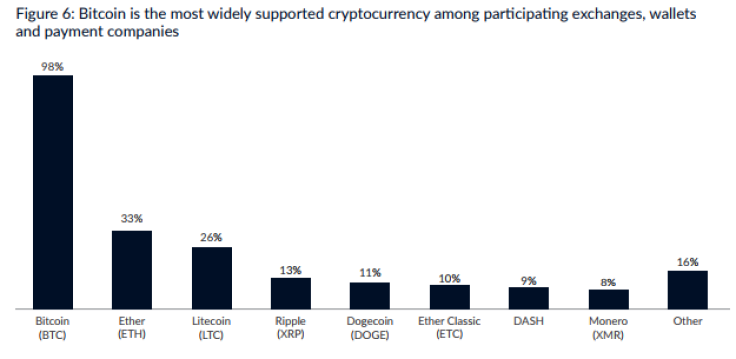

Bitcoin dominates the cryptocurrency market. But it’s not the only digital currency making waves. Dash, monero and ether have shown dramatic, consistent growth over the past year. According to CoinMarketCa p, dash currently has a market cap around $2.47 billion, while Ethereum’s ether tokens have a global market cap over $27.2 billion.

These alternative coins are good for more than speculative trading; 33 percent of surveyed businesses, including payment companies and wallets, support ether while 26 percent support litecoin. Researchers found monero and dash transaction volumes appear to be growing the fastest. The study even noted some users consider dash a “safe haven” asset, compared to bitcoin’s relative volatility.

The biggest takeaway from this study is cryptocurrency is truly a global industry. There is no bitcoin equivalent to tech industry’s epicenter in Silicon Valley, or London’s unofficial status as the global finance industry’s historic capital.

Users in specific regions may dominate certain aspects of the cryptocurrency ecosystem. For example, China is home to 58 percent of large mining pools. Mining, aka contributing computing power to verify transactions, is the fuel that powers decentralized cryptocurrency networks. In 2016, global mining operations pulled in an estimated $563 million. Beyond profits, miners have considerable influence on protocol development, meaning they can sway how the technology will work in the future. However, the variety of sectors is so geographically diverse that no region or company controls the networks themselves.

Lastly, the cryptocurrency industry appears to be a relatively sustainable sector of the broader tech industry. Students can study cryptocurrency at colleges like Stanford University, if they prefer classrooms and offices to online forums and digital watering holes like Twitter, then expect to get traditional jobs in a growing field. Industry profits are considerable, although less interesting than underlying business use cases.

This Cambridge study showed 86 percent of surveyed payment companies used bitcoin as their primary payment rail for cross-border transactions. Cryptocurrency companies usually use a mix of currencies to run their business. This proves banks aren’t the only financial service providers that stand to benefit from the growth of blockchain networks. All signs point to cryptocurrency slowly becoming the new standard for cross-border money transfers.

© Copyright IBTimes 2024. All rights reserved.