Amazon Share Plunge Wipes Out $9 Billion in Value

Shares of Amazon.com, the world's biggest e-retailer, plunged 12 percent in pre-market trading, wiping out $9 billion in value, after the company reported disappointing third-quarter results.

In pre-market trading, shares were at $199.75, down $27.35 from Tuesday's close. The plunge would effectively lower the Seattle-based company's market capitalization from about $103 billion to around $91 billion.

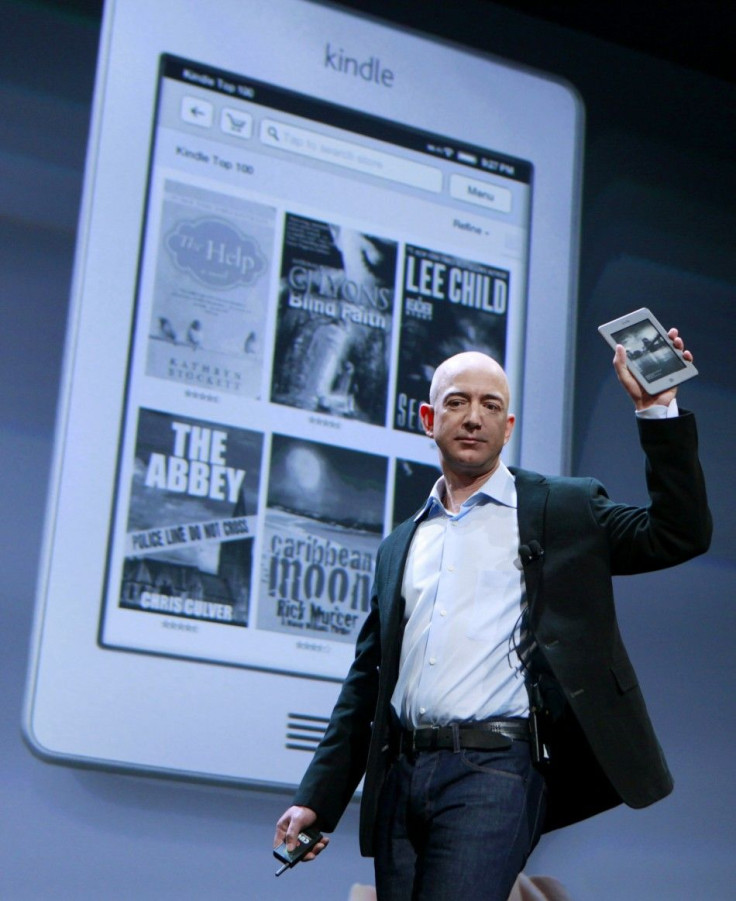

Amazon said current-quarter rollout of the Kindle Fire tablet could result in an operating loss as high as $200 million, although there could be profit as high as $200 million. Analysts like Youseff Squali of Jefferies told IBTimes the company may have taken in orders for as many as four million Kindle Fires as well as 12 million for regular Kindles.

Amazon reported third-quarter net income of $63 million, or 14 cents a share, well below the 24 cents expected by analysts. Revenue jumped 44 percent to a record $10.9 billion.

In an investor call Tuesday night, Chief Financial Officer Thomas Szkutak explained Amazon was spending heavily to get the Kindle Fire into a tablet market dominated now by Apple but expected good results from customers who will use it to also order content.

We feel very good about growth going forward, he said, adding the company expects fourth-quarter revenue as high as a record $18.7 billion

Analysts like Squali advised investors to buy Amazon shares on any fallback because its aggressive investment strategy should pay off over time.

© Copyright IBTimes 2024. All rights reserved.