Apple's iPhone and Google's Android One Struggle To Make A Mark In Booming Indian Smartphone Market

With Apple's iPhone losing market share in India and Google's Android One devices selling just 1.2 million units, the U.S. smartphone giants are struggling to make an impact in the world's fastest-growing smartphone market.

According to figures from International Data Corporation (IDC), Apple's share of the Indian smartphone market is less than 1 percent, making it the 18th-biggest manufacturer in the country, which saw year-on-year smartphone shipment growth of over 21 percent in the third quarter of 2015.

These figures suggest that Apple has lost 50 percent of its market share since earlier this year when CounterPoint Research said Apple held a 2 percent market share in the subcontinent. While Apple's latest iPhone can satisfy Indian consumers' desire for large-screen smartphones with 4G connectivity, their prohibitively high prices (the cheapest model costs over $950) have blocked widespread adoption in a country where the sub-$100 segment makes up the largest percentage of the market.

Android One

Apple is not the only company struggling in India. Google last year launched Android One with the lofty goal of connecting the 5 billion people on the planet without access to the Internet. The initiative saw Google work with local manufacturers in emerging markets around the world to produce budget smartphones with a great software experience.

Having failed to have much impact with the first version of Android One devices, Google took a second stab at it earlier this year in India with a pricier Pixel V1 model from local manufacturer Lava. According to figures from CounterPoint Research, reported by the Economic Times, Google shipped just 1.2 million Android One smartphones to India the entire first year the smartphones were available, which makes up just 3.5 percent of the $50-$100 phone market, the segment that sells the most phones.

The big problem is that while 4G was driving a lot of the growth in India, Google's Android One devices lacked this key feature. CounterPoint's Tarun Pathak told the paper: "The Pixel V1 started off well on account of aggressive marketing push, but lost to the competition in late Q3 of 2015 due to new LTE launches in the same segment targeted at the festive season." That aggressive marketing push was supported by a $10 million fund provided by Google, the Economic Times reported, citing sources.

4G

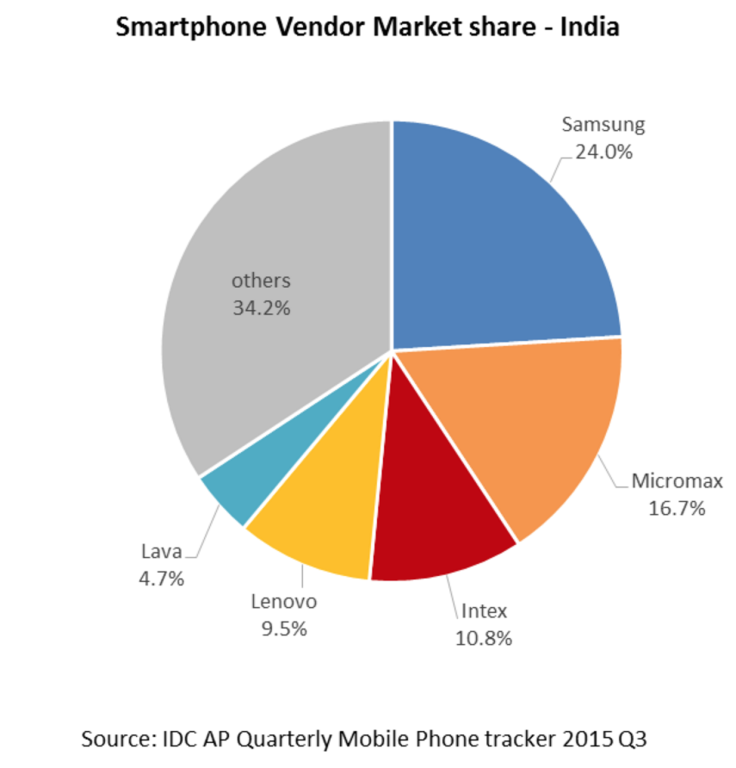

According to IDC's figures for the third quarter of 2015, Samsung was the dominant manufacturer followed by local players Lava, Micromax and Intex, and Chinese company Lenovo. IDC said that 4G-enabled devices witnessed an almost threefold increase in unit shipments over the previous quarter with Samsung's low-price Galaxy Grand Prime and Galaxy J2 helping secure the South Korean company's position as a bestseller.

"Almost one out of every two smartphones sold, had 5-inch plus displays," said IDC analyst Jaipal Singh. "Most of the popular models in the market today support 4G, have a large screen, and are attractively priced at less than $200."

© Copyright IBTimes 2024. All rights reserved.