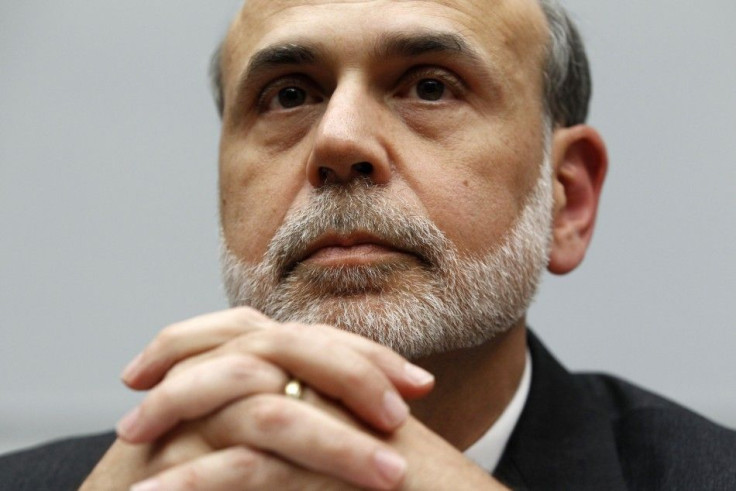

Bernanke: Fed Weighing QE3 to Stimulate U.S. Economy

The Federal Reserve, while categorizing the shocks that have slowed the U.S. economy as temporary, is nevertheles examining several untested means to stimulate growth, if the slowdown worsens, including a possible third phase of quantitaive easing, or QE3, Fed Chairman Ben Bernanke said Tuesday.

In prepared remarks prior to Capitol Hill testimony, Bernanke said the Fed was considering three options.

The first option, would involve the Fed providing more explicit guidance to the pledge that rates will stay low for an extended period.

A second option would involve another round of asset purchases, or quantitative easing, a so-called QE3, or having the Fed increase the average maturity of our holdings.

Under the third option, the Fed could also reduce the Federal Funds rate -- the quarter percentage point rate of interest that it pays to banks on their reserves, thereby putting downward pressure on short-term rates more generally.

However, Bernanke was careful to point out that the next Fed move could also be to tighten monetary, if conditions warrant it.

As of now, the Bernanke said the Fed expects that the U.S. economic recovery will likely remain moderate, and that the U.S. unemployment rate will fall only gradually. Inflation is expected to subside in coming months.

Bernanke's testimony occurred one day after the release of the minutes from the Federal Reserve's last meeting, held June 21-22. The minutes revealed that Federal Reserve officials were concerned about a weakening job market that might hinder the current economic expansion, but were divided over whether the Fed should take additional steps to help the economy.

Certain Congressional Republicans have criticized the quantitative easing program -- with some GOP members even calling for a return to the gold standar -- arguing that the Fed's unconventional tactic is the equivalent of 'monetizing the debt' and will lead to rising, if not double-digit inflation.

However, Bernanke disagrees, and has held his ground, arguing that Fed program does not 'monetize the debt' because it's purchasing assets that have value -- U.S Treasuries -- and that inflation, as measured by a accurate long- term price indicator, the 12-month Core PCE index, while it has edged up, is still within the Fed's 'comfort-zone' for inflation.

Monetary Policy Analysis: Place one data point in the bulls' camp. The reason? Fed Chair Bernanke is signalling that the Fed is not satisfied with the U.S.'s anemic growth rate and high unemployment rate, and while keeping an eye on inflation, remains at-the-ready to implement novel, and extraordinary techniques to stimulate the U.S. economy, including a possible QE3.

© Copyright IBTimes 2024. All rights reserved.