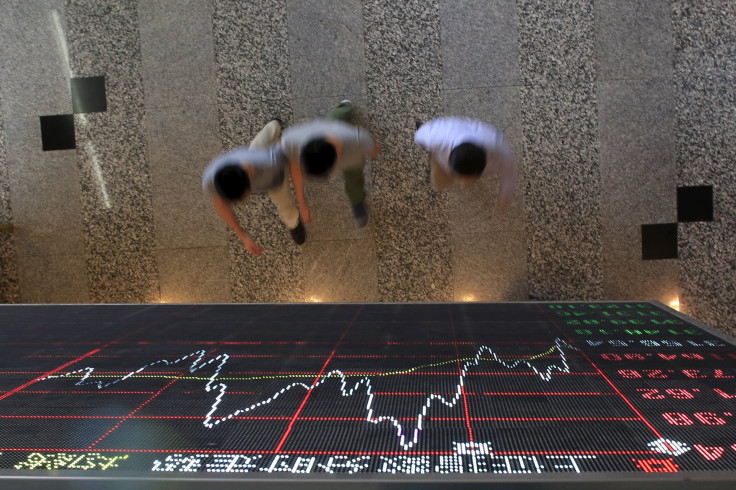

Asian Markets Recover, But Still Set For Worst Quarter In Years; Europe Buoyant While US Set To Open Positive

Asian stock markets rallied Wednesday, but remained on track to witness one of the worst quarters since the financial crisis amid several regional shocks. Stocks in Europe too looked set for a positive session with early gains while U.S. stock futures pointed to a strong start to the day's trading session.

On Wednesday, Japan's Nikkei-225 index rallied 2.7 percent to reverse the plunge in the previous session. China’s Shanghai Composite index gained 0.48 percent while Australia’s S&P/ASX 200 rallied 2.1 percent. India’s Sensex reversed its losses from Tuesday with a 1.46 percent gain. Hong Kong’s Hang Seng index was up 1.41 percent.

“Asian markets will be closing the month and quarter on what looks like a positive note,” Chris Weston, chief market strategist at IG Ltd. in Melbourne, told Bloomberg. “And given what an absolute shocker it’s been, traders will certainly take this.”

In Europe on Wednesday, the FTSE-1oo was trading up 2.19 percent while France's CAC-40 index was up 2.76 percent. Germany's DAX was trading up 2.54 percent. In the U.S., stock futures on the S&P 500, Dow Jones Industrial Average and Nasdaq indexes were all trading well over 1.1 percent.

In Asia, the rebound on the last day of the July-September quarter capped a period of sustained losses in Asian markets over the past three months, fueled by rising worries about the state of China's economic health -- made worse by the surprise devaluation of the yuan -- along with slowing growth in other countries in the region, and dropping commodity prices. The fall was also driven by ongoing uncertainty over the U.S. Federal Reserve’s decision to raise interest rates, a prospect that has spooked Asian investors.

The MSCI Asia Pacific Index is on track for its worst quarter in four years, having dropped 15 percent, Bloomberg reported. According to the Wall Street Journal, the Nikkei is set to close this quarter down almost 15 percent, its worst performance since June 2010, while Hong Kong’s Hang Seng index is set to fall a whopping 21 percent, putting it on track for its worst quarterly performance since September 2001. The S&P/ASX-200 is down 8.7 percent, and is set to face its worst quarter since September 2011.

Asian currencies are also set to see their biggest quarterly losses in years. Malaysia’s ringgit, the region’s worst-performing currency, is down 26 percent for this year, while Thailand’s baht weakened to 36.55 against the dollar as part of a sustained fall to a six-year low, Bloomberg reported.

Commodity prices have also hit multi-year lows in recent days but appeared to edge up Wednesday. As a result, mining giant Glencore plc's stock recovered almost 17 percent overnight after it fell to a record low at the start of the week. Prices of other industrial metals, including aluminum and zinc, also halted their falls in overnight trading.

"The current environment represents a winding back of the overly bullish expectations of both commodity demand and Chinese growth – to a more balanced expectation of progressive, not exponential, growth," Angus Gluskie, managing director of White Funds Management in Sydney, told Reuters.

China is also set to deliver another shock Thursday, when the Chinese Purchasing Managers' Index (PMI) is likely to reveal that the country’s factory sector shrank for a second month running in September.

© Copyright IBTimes 2024. All rights reserved.