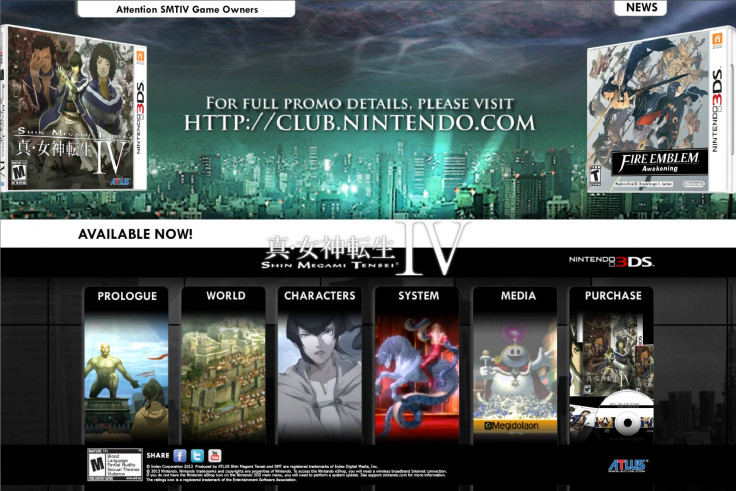

Atlus A Prize Asset In Index Corp Bankruptcy Sale: Will Hardware Manufacturer Nintendo Acquire Software Publisher Of The Hit ‘Shin Megami Tensei IV’?

Both commercially and critically, “Shin Megami Tensei IV” appears to be a big hit for the video-game developer Atlus, a brand of the Index Digital Media Inc. unit of the Index Corp. (TYO:4835). And that’s a good thing for everybody concerned because the bankrupt parent company appears poised to begin auctioning its assets as early as this week, Bloomberg News reported, citing a couple of sources familiar with the matter.

On the commercial side, the latest entry in the durable “Megami Tensei” role-playing game series was released on the Nintendo 3DS portable game console in Japan May 23 and immediately rocketed to the top of the country’s consumer-software sales chart for the week of May 20-26, with 188,562 copies sold, according to the Japanese-language 4gamer. On the critical side, the new RPG has been given rave ratings by the well-regarded Famitsu, 37/40, Polygon reported; IGN, 8.5; and Joystiq, 4/5 stars. (FYI: The “Shin Megami Tensei IV” release dates are July 16 in North America and Sept. 19 in Europe.)

The Index Corp., based in Tokyo, is seeking as much as 15.0 billion yen ($148.7 million) in the asset sale to assist it in dealing with its 24.5 billion yen ($242.9 million) of debt, Bloomberg News said. And Index Digital Media Inc., headquartered in Irvine, Calif., seems to be one of the holding company’s most valuable properties, thanks to Atlus’ development of games for use on consoles manufactured by all Big Three on the hardware side of the video-game industry: the Microsoft Corp. (NASDAQ:MSFT), Nintendo Co. Ltd. (OTCMKTS:NTDOY) and Sony Corp. (NYSE:SNE).

According to the International Business Times’ corporate sibling International Design Times, Nintendo actually may be the most interested bidder after the Index Corp. auction starts, presumably before the bankrupt company’s shares are delisted by the Osaka Securities Exchange July 28. Per the iDesignTimes: “The single most likely bidder for Atlus in the … bankruptcy case is Nintendo. As a matter of fact, I’d like to suggest that a Nintendo-led acquisition of Atlus may actually have been in the works for some time. That’s because Nintendo has been working unusually closely with Atlus lately, treating them practically like an in-house studio. That may be because Atlus is about to become one.”

Whether Atlus does or does not, the Index Corp. apparently would like to reach an agreement on its asset sales as soon as September, Bloomberg News reported.

The backstory bringing the Index Corp. to this point began to become public June 12, when Japan’s Securities and Exchange Surveillance Commission indicated it was investigating the company due to suspicion it had falsified financial reports, Bloomberg News said. The firm was forced to seek court protection from its creditors June 27, the news agency said.

The deleterious effect of all this is suggested by the Index Corp.’s closing share price, which fell from 1,720 yen ($17.16) on June 11 to 78 yen (78 cents) on July 19, a plummet of 95.5 percent.

© Copyright IBTimes 2024. All rights reserved.