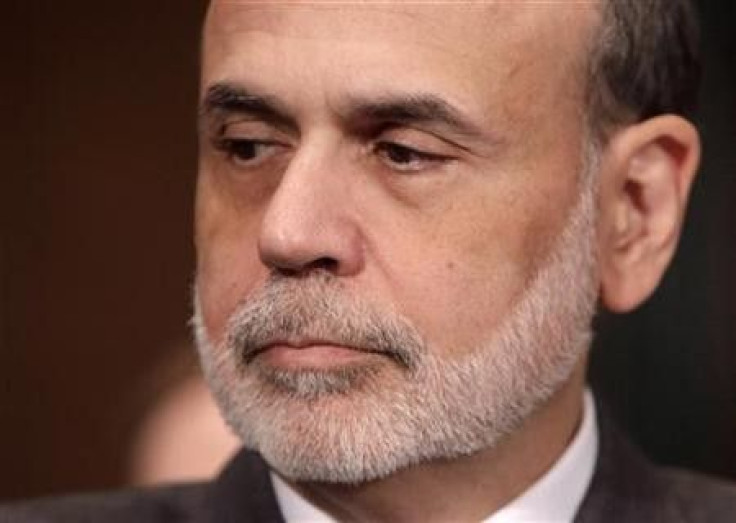

Bernanke Announcement Could Be Best Part Of QE3

The biggest impact from QE3 could come from Ben Bernanke announcing it rather than it actually going into effect, says a leading economist.

Steen Jakobsen, chief economist at Saxo Bank, points to most academic studies showing that the biggest impact from quantitative easing on markets comes from the announcement of it rather than the execution of it. An analysis of the two prior QE introductions point to a 50 to 100 basis point reduction on bond yields and subsequent inflation of equities via a feel good factor - the so-called wealth effect, he says.

Beyond those good feelings, past QE attempts haven't done much, according to Jakobsen. Realistically, what has been the net impact of QE1 and QE2? Chairman Bernanke has used 3,000 billion U.S. dollars to create what? Nothing! Unemployment is still above 9.0 per cent, the housing market is still in a slump, and now the only successful thing going for the Fed is the stock market's rise from the floor at 666.00 in March 2009, he said in a recent statement.

Watching the fed in action is sort of like watching the movie Groundhog Day, says Jakobsen. At best I foresee two to eight weeks of relief risk-on trading, but with the market no longer willing to remain idle while policy makers buy even more time. Thus the positive tone could change sooner rather than later. Putting numbers on the upside potential on the stock market it is important to note that the start of QE1 created a 78 percent rally in stocks, while QE2 saw a 29 percent rally, so the impact is clearly smaller from one QE to another, he said.

© Copyright IBTimes 2024. All rights reserved.