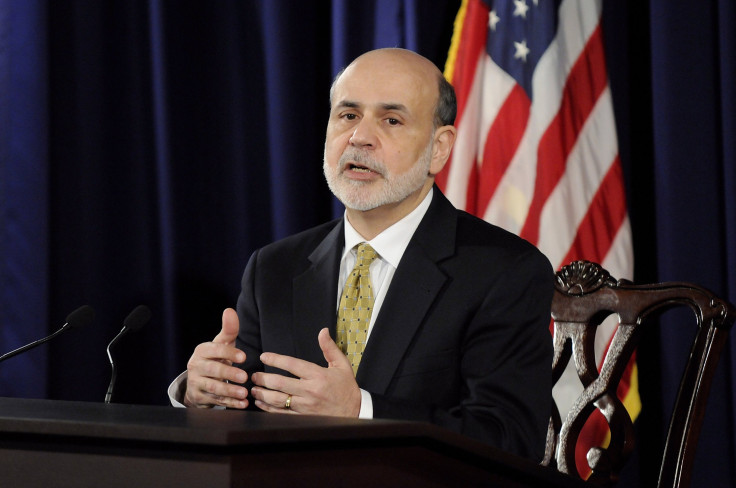

Bernanke Defends Federal Reserve's Loose Money Policy, Known As Quantitative Easing, Denying It Leads To A Currency War; Says Emerging Markets' Currencies Are Not Being Hurt

The head of the U.S. central bank, Ben Bernanke, on Monday dismissed worries that the Federal Reserve’s money printing is raising the likelihood of a global currency war.

Bernanke, speaking at the London School of Economics with prepared remarks, never once used the expression “currency war” but dwelled extensively on accusations from emerging market leaders in Brazil and elsewhere that the Fed’s quantitative easing, as its $85 billion per month bond purchases is called, was hurting emerging markets by raising the value of their currencies and thus making their exports more expensive.

“Do these policies [of quantitative easing] constitute competitive devaluations? To the contrary, because monetary policy is accommodative in the great majority of advanced industrial economies, one would not expect large and persistent changes in the configuration of exchange rates among these countries,” Bernanke said.

“The benefits of monetary accommodation in the advanced economies are not created in any significant way by changes in exchange rates; they come instead from the support for domestic aggregate demand in each country or region. Moreover, because stronger growth in each economy confers beneficial spillovers to trading partners, these policies are not ‘beggar-thy-neighbor’ but rather are positive-sum ‘enrich-thy-neighbor’ actions.”

Bernanke’s only concession to critics was to say that even if their scenarios played out it is not at all clear that it would hurt the emerging markets.

“Even if the expansionary policies of the advanced economies were to lead to significant currency appreciation in emerging markets, the resulting drag on their competitiveness would have to be balanced against the positive effects of stronger advanced-economy demand,” Bernanke said. “Which of these two effects would be greater is an empirical matter.”

© Copyright IBTimes 2024. All rights reserved.