The Borst Setup

Want to make big bucks trading biotech stocks? How about seeing your profits drop by 70%? Look no further than the Borst setup. That's the name of a new trading setup. Refer to the link and read the entire article before you trade using this setup. There is a large risk of failure but the profits can be obscene, too. Here are the steps to picking a biotech stock for a long term hold.

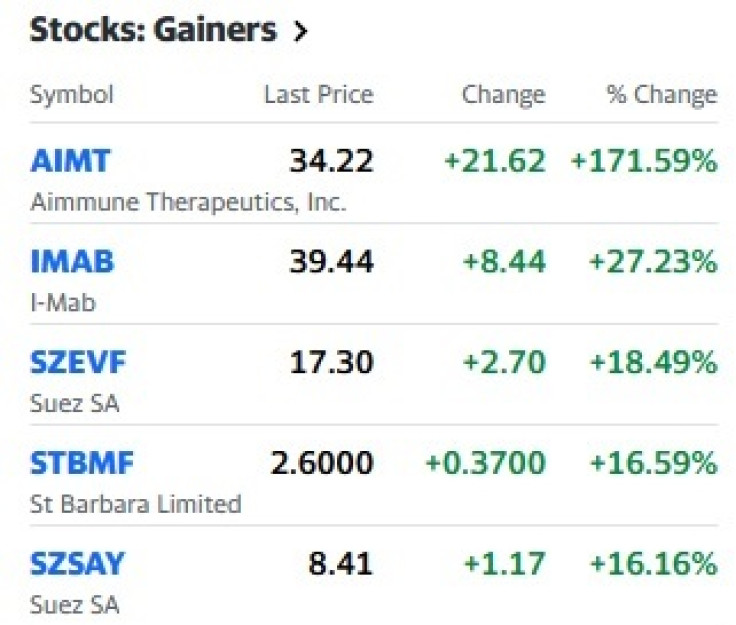

- Large % Gainers on Yahoo. Go to yahoo!finance and look down the left side of the page, toward the bottom. You'll find something similar to the figure on the right. Click on Most Price % Change after the market close each day and then scan down the list. Look for pharmaceutical companies. If you find one then click on Profile to read what the company makes. Often the search will end there because they make products that are not of interest. Just be aware that the information may be out of date. If it says Phase 2 clinical trials, the company could have moved into phase 3.

- Number of employees. Look at the number of full time employees listed on the profile page. This is a indication of the size of the company. Do you want to buy a company with just 5 employees or one with 50? The smaller the company, the larger the risk of failure and the less likely they will come up with a billion dollar winner. I like to see at least 50 employees on the payroll. A large payroll shows stability, that others are willing to take the risk of working for the company.

- Pipeline. On the profile page is a link to the company website. Visit their site. Once there, they often list Pipeline as one of their menu options, so look at the number of drugs under development. The more drugs in late-stage (phase 3) clinical trials, the better. That way, if one drug fails you still have others to bank on (but expect a large loss anyway. Investors don't like negative surprises). If the company only has one drug in development and it fails, your investment could be wiped out (or nearly so).

- Phase 3 only! When looking at their pipeline of drugs, you are most interested in drugs in Phase 3 clinical trials because this could be the last stage before the company submits a drug to the FDA for approval. Borst will only buy a company with drugs in Phase 3 trials. Why? Because it could be years for the drugs to pass through Phases 1 & 2, and they could fail along the way.

- Target market size. Somewhere on the company's website is an evaluation of the size of the intended market. Sometimes this is buried in the 10-K report but many times they have the evaluation listed as a bullet item. What good is developing a drug that only 3 people in the world need? Instead, look for a huge potential audience for the drug.

- Avoid orphans! Avoid drugs with orphan status. That means the drug gets special treatment since the market is small. To make money, the company has to charge big bucks for the drug because few people need to take it.

- Any competition? A good candidate is a drug that has no competition. If there is competition, make sure it is unique.

- Investors page. Visit their Investors page and read what's there.

- Fundamentals: Revenue, issuing new shares. Look at revenue. Do they have any to support their development efforts? If revenue is miniscule, then expect the company to issue stock periodically. When that happens, the stock will take a hit. Metalico (a building materials company) issued 6 million shares at $4.18 (about 18% of shares outstanding). The stock dropped 22% from a close of 4.80 before the announcement to the next day's low of 3.76. The stock has been weak ever since (to date, August 2009, about a month since the sale), bottoming at 3.64 so far.

Mannkind announced the offering of 7.4 million shares (about 8% of shares outstanding) on August 5, 2009, and the stock dropped 11% from a close of 8.13 to a low of 7.21 a day later.

- Burn rate. What is the burn rate? Burn rate is the amount of cash available to fund operations. If expenses chew up $10 million every quarter and they have $20 million in cash on hand with no income, then they have 2 quarters worth of life left. That is a simplistic example, but you want to know how close to the edge are they riding? How quickly will they have to dip into the well to replenish their cash on hand? Sometimes the website has that information. You can try asking investor relations and see what they say. Ask them how they intend to finance operations and the drug trial.

- Phase 3 ends when? The phase 3 trial will likely last many months, perhaps a year or more. Find out when the trial is expected to be completed and preliminary results released. If the company looks promising, you will want to buy into the stock before they announce results. On the announcement day, assuming it's a success, price can shoot up dramatically. Dendreon doubled in a day but moved from 4 to 27 in about a month.

- Check latest news. Be sure to read the latest news while on the website. See what happened during the quarterly earnings announcements to the stock. If earnings are due within 3 weeks, then postpone buying. Otherwise, the stock could tumble on the news. If they have issued new stock to fund operations, then see how much the stock dropped as a result.

- Post approval: build factory? Partner with another company? Once the drug gets approval, then what? Will they have to partner with another company to market it? Will they have to build a factory to produce it? If so, they will have to get financing from somewhere. Read the 10-K report which addresses these issues and others. Have they conducted a survey of doctors to see if the doc's will prescribe the thing? You may be able to find an answer to that on their website, but if not, then email the company and ask.

-- Thomas Bulkowski

Join the Discussion

Editor's pick