Caribbean Economic Outlook: Less U.S. Tourism and Remittance Hurt

The economic outlook of several Latin America and Caribbean economies has been hurt by the protracted U.S. economic recovery.

More than two years after the Great Recession, the U.S. consumer is still feeling pinched and wary.

The net worth of U.S. household and nonprofit organization remains nearly 9 percent below its pre-recession peak. The unemployment rate remains near 9 percent.

As a result, U.S. consumers have cut down on tourism, which is considered a luxury good. Several Latin American and Caribbean countries have been noticeably affected by this cutback.

The Bahamas and Antigua & Barbuda, for example, derive close to 30 percent of their GDP from tourism, according to a 2011 report from the United Nations. For the Caribbean region as a whole, it is 17 percent.

Unfortunately, spending per tourist in the Caribbean has fallen to the lowest level since 2004, according to Evridiki Tsounta, an IMF economist.

Latin American countries with a significant tourism sector (and thus vulnerabiltiy to the U.S. tourism slowdown) include Mexico, Costa Rica, and Panama.

Many Latin American and Caribbean countries also heavily depend on remittance inflow, or money their people in foreign countries send back (mostly to their families). In 2010, remittances received as a percentage of GDP was 22 percent for Haiti, 17 percent for Honduras, 16 percent for El Salvador, and 14 percent for Jamaica.

The bulk of Latin American and Caribbean remittance comes from the U.S.

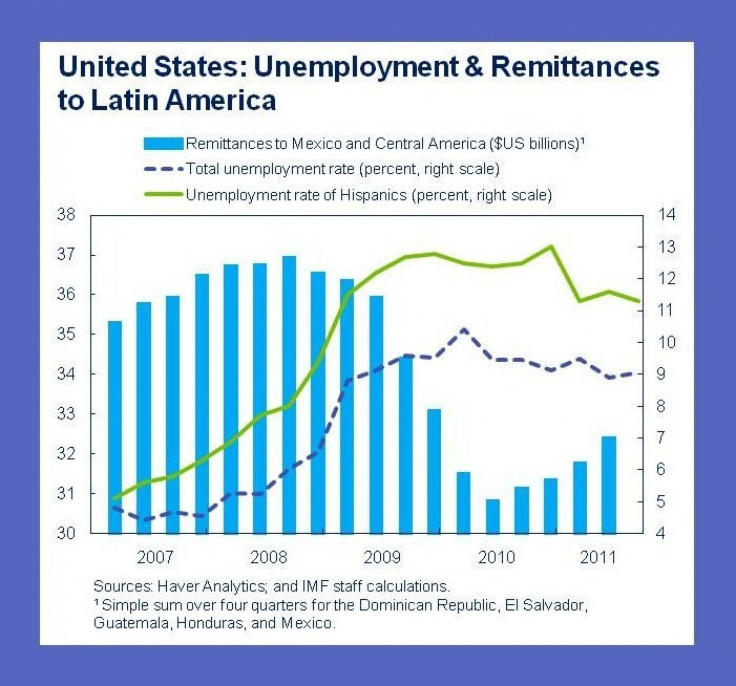

In the wake of the Great Recession, however, U.S. remittances plunged (chart below, from IMF/Tsounta).

One factor that contributed to the sharpness of the drop is that U.S. Hispanic unemployment rate is disproportionally high.

In the foreseeable future, most economists expected the U.S. consumers to continue to struggle with unemployment and balance sheet damage.

For countries that rely on U.S. tourism, Tsounta recommends tapping into other tourism markets like South America and Asia to cope with the U.S. slowdown.

For countries that rely on U.S. remittances, she recommends “diversifying their export base away from advanced economies.”

While the fruits of these new ventures may not materialize immediately, it may pay to begin today, said Tsounta.

© Copyright IBTimes 2024. All rights reserved.