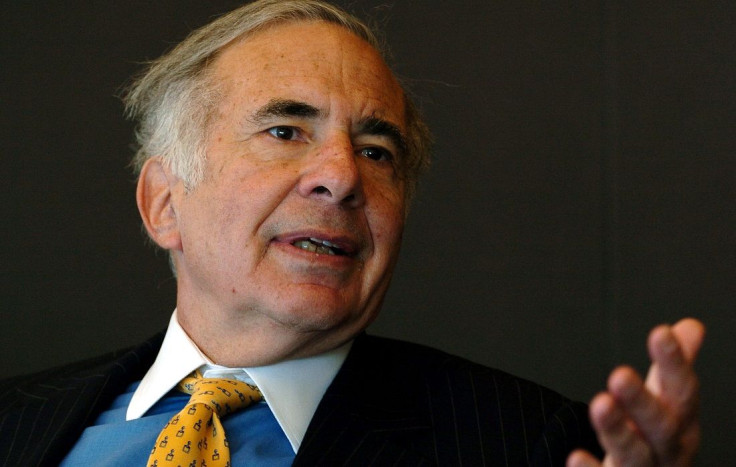

Carl Icahn Vs Apple Inc. (AAPL): Read The Letter, Then See Other Top Investment Stars That Hold Millions In Apple Shares

Carl Icahn issued his latest appeal to Apple Inc. (NASDAQ:AAPL) on Thursday to give up some of its cash-hoard to shareholders, the same day he upped his position in the Cupertino, Calif.-based tech giant by $500 million. Basically, the 77-year-old activist investor is calling on Apple shareholders to authorize a $50 billion share buyback to distribute some of Apple’s $146 billion in cash, cash equivalents and short- and long-term marketable securities.

“[Apple CEO] Tim Cook himself has expressed on more than one occasion that Apple is undervalued, and as the company states, it already has in place ‘the largest share repurchase authorization in history.’ We believe, however, that this share repurchase authorization can and should be even larger,” Icahn wrote in a letter to Apple shareholders filed with the Securities & Exchange Commission on Thursday. In its last earnings report, Apple showed $40.5 billion in cash, cash equivalents (marketable securities with maturities of less than three months from the time of purchase) and short-term investments (marketable securities that mature between three months and a year from the time of purchase).

Apple’s cash flow will be updated on Monday, when the company posts its fiscal first- quarter earnings. The tech giant was expected to report $12.67 billion in net profit, a 3.1 percent decline from the year-earlier period. Icahn owned 3,875,063 shares worth $2.14 billion, as of the fourth quarter of 2013, according to NASDAQ data. His latest position takes the value of his Apple holdings to $3.6 billion. Apple is Icahn’s largest investment. Among his top positions also include CVR Energy Inc., Federal-Mogul Corp., Netflix Inc., Forest Laboratories Inc., Chesapeake Energy Corp., Herbalife Ltd., Transocean Ltd. and Nuance Communications Inc.

Apple is about 60 percent held by institutional investors as of the fourth quarter of last year, with eight major firms owning more than 10 million shares, with a combined valuation of more than $100 million. The Pennsylvania-based investment management company Vanguard Group is Apple’s top investor. A number of well-known individuals, including Icahn, are among Apple’s top investors.

Below are the big name with ownership of more than a mill and four other well-known wealth managers that are major Apple shareholders (owning more than a million shares) and their other recent top 10 stock positions. The number of shares and valuations are based on data from Sept. 30.

Greenlight Capital Inc., the 17-year-old New York based hedge fund founded by David Einhorn, is a shareholder who, like Icahn, wants to see Apple give up some of its cash to investors. Last year Einhorn sued the Cuptertino, Calif.-tech company to issue what he called “iPrefs,” perpetual 4 percent dividend-bearing preferred stock. He dropped the suit in March 2013 after winning an injunction against Apple to block a controversial proposal designed by Apple to limit the issuance of preferred shares that Einhorn claimed would limit future attempts to unlock the company’s massive cash stockpile.

Greenlight had 2,397,706 shares of AAPL worth $1.33 billion, as of the start of the fourth quarter of last year. Apple was Greenlight’s top position at the time. Other top 10 positions held by Greenlight: Marvell Technology Group Ltd., General Motors Co., Micron Technology Inc., Cigna Corp., Aetna Inc., Oil States International Inc., NCR Corp, Market Vectors ETF and Delphi Automotive Plc.

Baillie Gifford & Co., the 105-year-old Scottish investment management firm whose star manager James Anderson has been an outspoken critic of his fund management industry for crashing banks and destroying companies: 2.19 million shares worth $1.22 billion. Other top 10 positions held by Baillie Gifford & Co.: Baidu Inc., Amazon.com, Google Inc., Illumina Inc., eBay Inc., Facebook Inc., Salesforce Com Inc., Whole Foods Market Inc. and Intuitive Surgical Inc.

D.E. Shaw & Co., L.P., the 15-year-old New York-based hedge fund headed by computer scientist David Shaw, a pioneer of high-speed trading: Apple is the fund’s top position with 1.92 million shares worth $1.07 billion. The other nine top positions as of the fourth quarter were: Actavis Plc, Berkshire Hathaway Inc., Facebook Inc., Priceline Com Inc., American International Group Inc., Johnson & Johnson, Twenty First Century Fox Inc., Wal-Mart Stores Inc., Phillips 66.

Fayez Sarofim & Co., the Houston-based investment firm owned by Egyptian-born fund manager Fayez Sarofim, who is known to favor old and well known global brands. The firm owned 1.37 million shares of AAPL worth $760.9 million as of the start of the fourth quarter last year. Apple is the firm’s sixth-largest position as of the fourth quarter. The other top nine positions read like a traditional buy-and-hold portfolio: Philip Morris International Inc., Exxon Mobile Corp., Coca-Cola Co., Chevron Corp., Altria Group Inc., Procter & Gamble Co., Price T. Rowe Group, Johnson & Johnson and Enterprise Productions Partners LP.

© Copyright IBTimes 2024. All rights reserved.