The Case For The iPhone 5se: Why Apple Inc. Needs A Smaller, Cheaper Smartphone

Yet another iPhone is widely expected to take the stage in March. No, it’s not the “iPhone 7.” Instead, Apple is expected to show off a new 4-inch smartphone, dubbed the iPhone 5se.

The device is expected to be priced lower than the $549 iPhone 6 and come with some newer features, such as the Apple Pay mobile payment system and an upgraded camera. But at the same time it may also lack some cutting-edge additions, like the pressure-sensitive 3D Touch display found in the iPhone 6S.

The iPhone 5se comes as Apple’s smartphone growth is stagnating; in the three months ending March 26 the Cupertino, California, tech giant expected to post its first year-over-year iPhone sales decline.

One way Apple could blunt its anticipated 2016 shortfall is by pushing into new and emerging smartphone markets. India, in particular, is one country the company has floated as the next market it wants to aggressively pursue. And with well over a billion people — a population second only to China — Apple has a huge potential consumer base it could tap, especially with a cheaper iPhone.

But for India, a lower-priced iPhone may not be cheap enough. While Apple has tried to appeal to consumers with its older 4-inch iPhone 5S priced between 22,000 rupees and 30,000 rupees ($323-$442), that’s still far above the cost of devices from a crowded field of competitors, many of which have phones priced in the $150-$200 range.

One example is Huawei’s 13,000-rupee ($191) Honor 5X, which comes with modern features such as a fingerprint reader and large 5.5-inch screen. “These aren't your father's low-cost Android smartphones anymore,” said IDC mobile phones research manager Ramon Llamas. "In many cases, we're starting to see a lot of midrange smartphones masquerading as low-cost devices.”

When it comes to smartphones in India, Apple’s 2 percent national market share barely registers on the radar, according to IDC. That compares to the remaining 98 percent of the market, about a quarter of which belongs to Samsung, with Lenovo and domestic manufacturers such as Micromax, Intex and Lava taking sizable shares as well.

A cheaper iPhone could also help Apple grow market share in China, where it already holds about 70 percent to 75 percent of the premium-smartphone market, or devices priced $400 or higher, according to a January research note by Cowen and Company.

In addition to price, another barrier that Apple may have in Asia and other emerging markets is the love for big-screen phones, particularly devices with 5-inch displays, according to a study by market research group Jana. One possible reason for this is that in emerging markets such as India, household computer ownership barely crosses the 10 percent threshold, the Pew Research Center reports. So in most cases, the smartphone is the primary way consumers access the internet.

“It's not about having the highest-quality experience. These are people who may never have had a touchscreen experience before,” said Jeff Orr, research director at ABI Research.

Analysts aren’t expecting Apple to price the iPhone 5se any lower than its iPhone 5S — about $450. So it’s hard to see how it will gain a foothold in a market flooded with larger-screen phones at cheaper prices. However, there’s one area where the device can potentially make headway: Apple’s own existing iPhone user base.

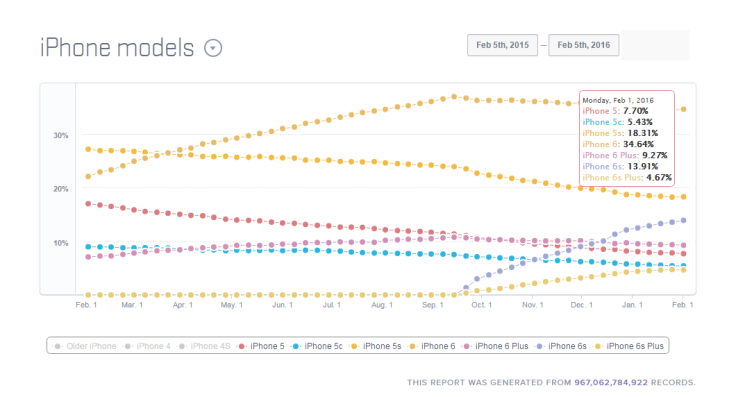

Despite new smartphone launches from Apple over the past couple of years, about 30 percent of its global iPhone customer base is still using 4-inch iPhones, namely the iPhone 5S, 5C and 5, according to data from mobile analytics company Mixpanel. While some of Apple’s customers have upgraded to the 6 and 6 Plus, of the user base that existed prior to the 2014 launch of the iPhone 6, 60 percent of them are still on older devices, said Apple CEO Tim Cook during a January earnings call.

“This model is for people who really love the iPhone 5S,” said Hyperstop Managing Partner Johnny Won. “It’s another opportunity for people to stay within the Apple ecosystem.”

The iPhone 5se could be another avenue for Apple’s consumers to upgrade to newer devices. But it’s also a chance for Apple to appeal to consumers who deem larger smartphones too unwieldy for their hands — a smartphone attribute that Apple itself even derided in a 2012 iPhone 5 commercial.

As with any cheaper product, there is some risk of Apple diluting the iPhone’s average selling price with the iPhone 5se. But where it could pay off for the company is its growing portfolio of services, which grew 26 percent to $6.06 billion in the holiday quarter. This product segment includes revenue from Apple Pay, Apple Music, licensing, iCloud and other services. That said, at least for the time being, it’s still a drop in the bucket compared to the $51.6 billion in revenue that the iPhone accounted for during the same period.

© Copyright IBTimes 2024. All rights reserved.