Caterpillar Inc (CAT) Earnings Preview: Q2 Profit Hit By Continued Mining Weakness

Caterpillar Inc. (NYSE:CAT), the world's largest maker of construction and mining equipment, is expected to report lower second-quarter profit due to a sharp drop in demand as mines scale back on investments in equipment because of lower prices for commodities like iron ore and copper.

Caterpillar, which reports earnings on Wednesday before markets open, is likely to book a profit of $1.76 per share on revenue of $14.97 billion, based on the average estimate of analysts surveyed by Thomson Reuters. In the same period a year earlier, EPS was $2.54 on $17.37 billion in revenue. Excluding one-time items, Caterpillar is expected to report earnings of $1.70 a share.

The Peoria, Ill.-based company didn’t give quarterly guidance but lowered its 2013 outlook in April after posting first-quarter earnings and revenue that both missed Wall Street expectations. Caterpillar revised the company’s 2013 sales outlook to a range of $57 billion to $61 billion, with profit per share of about $7 at the middle of the sales and revenues outlook range. Management said the cut was necessary "because our expectations for mining have decreased significantly."

The previous outlook was in the range of $60 billion to $68 billion and earnings of $7 to $9 a share.

“Mining is the primary reason for the decline in the outlook,” Michael DeWalt, director of investor relations for Caterpillar, said during an April 22 earnings conference call.

Caterpillar’s mining equipment sales, which constitute around one-third of its total, are facing pressure from the decline in capital spending from mining companies.

“Previously, we had expected that after depressed order levels for mining during the second half of 2012, that we’d begin to see some improvement as 2013 unfolded,” DeWalt said. “Unfortunately, that hasn’t happened.”

Overall, mining orders have remained depressed. As a result, Caterpillar has significantly reduced its sales expectations for this year. The company now expects sales of traditional mining machines -- large trucks, large loaders, large bulldozers and the like -- in the aggregate to be down about 50 percent from 2012 and mining machines from the Bucyrus acquisition to be down about 15 percent.

“Because the decline in the outlook is largely mining and that’s generally more profitable than construction and power system, the impact on the outlook is not just sales volume, it’s been also negative to product mix,” DeWalt said, adding that Caterpillar is aggressively reducing costs and capital expenditure to mitigate the impact of lower sales and profit margins.

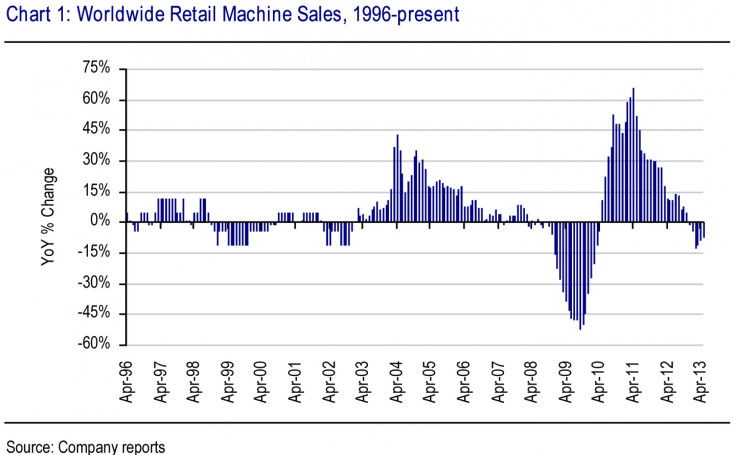

The latest dealer statistics released by Caterpillar showed that retail demand for the company’s construction and mining equipment continued to be sluggish in April and May, though the sales picture appeared to be improving in every market.

The company said worldwide dealer sales of its earth-moving machines fell 7 percent in May from the prior year. That represented an improvement from April, when sales were down 9 percent, and March, when sales were down 11 percent.

China Slowdown

Caterpillar's distinctive yellow machines are in service in nearly every country in the world, with 63 percent of revenues derived outside of North America in 2012. While revenue from China represents less than 5 percent of Caterpillar’s total sales, it is serves as an important indicator for the health of general commodity demand, which drives mining equipment orders.

“Time and time again, there have been renewed hopes that China capital equipment demand will recover, only to falter,” said Lawrence De Maria, an analyst for William Blair & Co., in a note to clients.

As per the latest data, China's economic growth slowed to 7.5 percent in the second quarter of 2013, a far cry from the double-digit growth rates posted until two years ago.

Famous short-seller Jim Chanos, who has long argued that China's economy is headed for a crash, told the audience at the CNBC “Delivering Alpha” conference in New York last Wednesday that his big new idea is shorting Caterpillar, whose operating profit margin will likely “revert to the mean” or lower as a global mining equipment boom, prompted by China’s housing boom, cools.

“It’s an iconic American company, but it’s tied to the wrong products at the wrong time in the cycle,” the founder of Kynikos Associates said, referring to the commodities super-cycle, which he said had been built on Chinese demand and was coming to an end. About 25 percent of Caterpillar's revenue comes from the Asia/Pacific region.

In fact, Chanos, who rose to fame with his early spotting of problems at Enron Corp., argued that mining capital expenditures will collapse as opposed to the more moderate percentage declines expected by many analysts.

“Mining remains a headwind, but management has taken actions to reduce the downside,” said J.P. Morgan analyst Ann Duignan.

Caterpillar deployed a variety of cost-reduction actions, including four-week layoffs for some support and management employees, restrictions on travel and controlled hiring.

In mid-June, the company announced it would lay off one-third of its production workforce in Wisconsin in response to falling demand for mining equipment. "Customer orders for those products are weaker than when compared to last year," Caterpillar said in a statement. "With lower orders from mining customers, we must take steps to bring production in line with demand."

Back in April, Caterpillar laid off 460 workers, or about 11 percent of its workforce, at an Illinois plant that makes mining equipment, and said it had 11,000 fewer people working for it at the end of the first quarter of 2013 than in the year-ago period.

Stock Performance

For the 10 years through 2012, Caterpillar recorded compound annual growth rates of 12.6 percent for revenues and 23 percent for earnings per share, according to S&P Capital IQ. “In light of the extreme cyclicality of its businesses, we find these operating growth rates particularly impressive,” S&P equity analyst Michael Jaffe said.

Moreover, the company’s capital allocation is becoming more shareholder-friendly.

Caterpillar's priorities for cash usage in order are as follows: maintain its single-A credit rating, invest in growth, fund the long-term pension plan, steadily increase the dividend and return excess cash to shareholders through repurchases.

With capital expansion plans scaled back, and more than $4 billion in free cash flow forecast this year, the company announced in April that it would resume its previous program a bit sooner under the existing $7.5 billion plan dating from 2007, which has $3.7 billion remaining, and will repurchase $1 billion this year, starting in the second quarter.

At around current levels, a billion dollars of share repurchases could mean an additional 6 cents to 7 cents of EPS this year and more than 10 cents next year assuming another $1 billion of stock is repurchased, although it could be more, according to William Blair & Co.’s De Maria.

With many fearing a multiyear decline in mining revenue, the buyback should help offset this impact in coming years.

Caterpillar competes with machinery makers such as CNH Global NV (NYSE:CNH), Deere & Co. (NYSE:DE), Joy Global Inc. (NYSE:JOY), Cummins Inc. (NYSE:CMI) and Astec Industries Inc. (NASDAQ:ASTE).

Shares of Caterpillar Inc. (NYSE:CAT) closed up 0.41 percent, to $86.00 a share in Monday's session. So far this year, the stock has lost 4 percent.

© Copyright IBTimes 2024. All rights reserved.