CBO Warns Of Recession But Says Ending High-Income Tax Cuts Could Save Almost $1 Trillion

The U.S. could be hurtling toward a recession next year if Congress fails to prevent a series of government programs and tax cuts from expiring in January, according to a new report from the Congressional Budget Office, or CBO, which set an ominous forecast for 2013.

Without action by Congress to avoid the so-called fiscal cliff -- the combination of massive government spending cuts and tax increases that are scheduled to be automatically enacted at the start of 2013 -- could lead to the loss of as many as two million jobs, sending the nation's unemployment back to 9 percent in the second half of the year.

Allowing the Bush-era tax cuts and payroll tax cuts to expire, while also permitting the automatic budget cuts under last summer's debt ceiling deal to go through -- it would cut funding for discretionary programs, including defense spending, and student loan aid -- will push the U.S. into another recession, with real GDP expected to decline by 0.5 percent, the nonpartisan agency reports. While that figure hardly compares to the 3.1 percent decline the nation saw in 2009, it's still a despondent forecast after seeing the GDP slowly inch up in 2010 and 2011.

If it maintained current policies by waiving the components of the fiscal cliff, the country would avoid a recession in 2013, but at the cost of increasing the federal deficit and potentially delaying an eventual fiscal crisis, according to an analysis of the CBO report from the Committee for a Responsible Federal Budget . But that would require serious action from Congress before the end of the year.

While the CBO's current scenario would reportedly put the country's debt trajectory on a "sustainable path," the committee reports that would only occur by simultaneously "throwing the economy into a double-dip recession and relying on many blunt and sudden policies that could inhibit long-term growth and would fail to address the real drivers of the debt."

Instead of allowing the U.S. to reach the fiscal cliff, there could be another way to make up for some of the savings that would be enacted under those spending cuts and tax increases: allowing the Bush-era 2001 and 2003 income tax cuts to expire on incomes above $250,000.

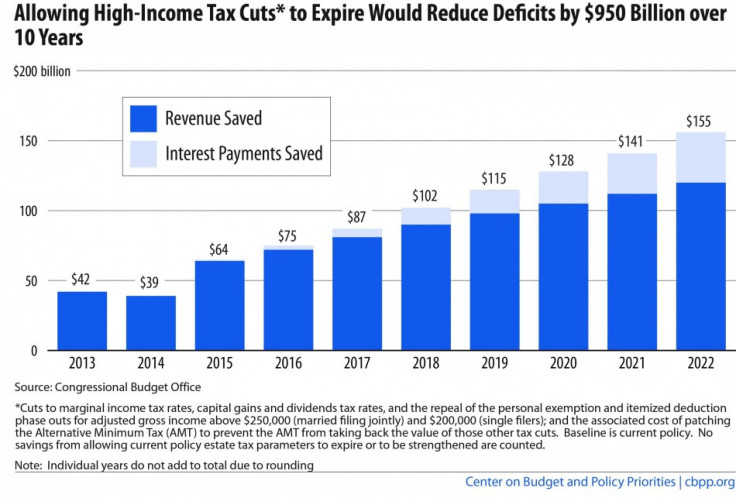

Allowing those tax cuts to expire on schedule, while extending them for middle- and low-income Americans, would save $823 billion in revenue and $127 billion on interest in the nation's debt, according to Chuck Marr, the director of federal tax policy at the Center on Budget and Policy Priorities. Overall, that would lead to a $950 billion deficit reduction over a decade.

As Marr notes, in a previous analysis the CBO concluded that only extending those tax cuts for incomes below $250,000 would be "more cost-effective in boosting output and employment in the short run, because the higher-income households that would probably spend a smaller fraction of any increase in their after-tax income would receive a smaller share of the reduction in taxes (relative to current law)."

© Copyright IBTimes 2024. All rights reserved.