China Extending Its Economic Diplomacy To EU Infrastructure Fund

BRUSSELS -- China will pledge a multibillion-dollar investment in Europe’s new infrastructure fund at a summit here June 29, according to a draft communique seen by Reuters. The investment will represent Beijing’s latest foray into checkbook diplomacy to win greater influence.

While the exact amount is still to be decided, the pledge is in line with China’s efforts to shape global economic governance at the expense of the U.S., and it will follow major European Union governments’ decisions to join the Chinese-led Asian Infrastructure Investment Bank (AIIB) in defiance of Washington.

It is expected to come with a request for return investment in China’s westward infrastructure drive -- the so-called One Belt, One Road initiative -- constructing major energy and communications links across Central, West and South Asia to as far as Greece.

“China announced that it would make (X amount) available for co-financing strategic investment of common interest across the EU,” the draft final statement says, adding that agreements will be finalized at another meeting in September.

An EU diplomat said the Chinese contribution was likely to be “in the billions.”

EU and Chinese officials have told Reuters that Chinese banks are looking mainly at telecommunications and technology projects.

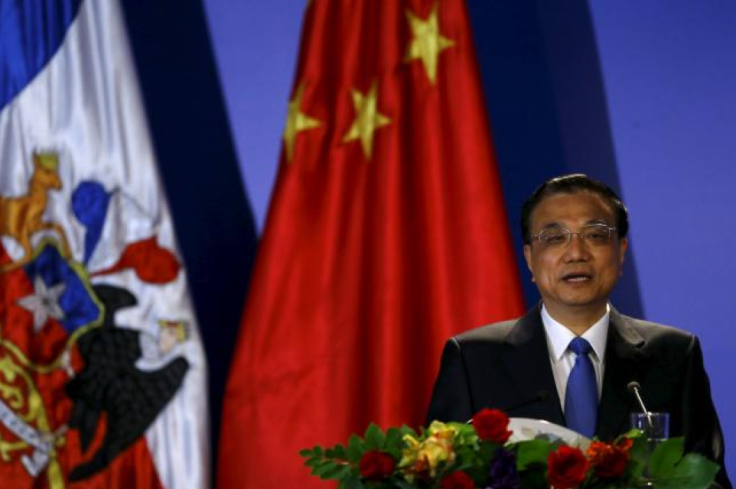

Chinese Premier Li Keqiang, who will attend the summit in Brussels, will agree with EU leaders that the 315 billion euro ($354.69 billion) fund will “create opportunities for China to invest in the EU, in particular in infrastructure and innovation sectors.”

If sealed, the deal will be a success for European Commission President Jean-Claude Juncker, who faced skepticism last year when he proposed the European Fund for Strategic Investment (EFSI), because EU governments are putting in little seed money.

France, Germany, Italy and Poland have each announced they will contribute 8 billion euros ($9.01 billion), while Luxembourg and Spain have pledged smaller contributions.

The bloc is relying mainly on private investors and development banks to fund projects selected from an initial list of almost 2,000 submitted by the EU’s 28 member states, ranging from airports to flood defenses, which together are worth 1.3 trillion euros ($1.46 trillion).

A big Chinese investment might raise questions about governance of the fund, which is so far strictly a European institution. An EU diplomat said it was not known whether China would seek representation commensurate with its stake.

The decision to invite China into an EU fund could cause some friction with Washington, which is wary of Beijing’s rising influence and upset that Europe rebuffed its calls to stay out of the AIIB.

China is already testing the U.S. dominance in Latin America, offering the region $250 billion in investment over the next decade, while Chinese companies have poured money into Africa to guarantee commodity supplies in exchange for building new hospitals, rail lines and roadways.

The U.S. and human-rights groups complain that China and its firms are wielding influence partly through corruption and turning a blind eye to labor and environmental standards and human rights. Similar criticisms were long leveled at Western multinational companies in developing countries.

EU-China Quid Pro Quo

Alessandro Carano, an adviser to the European Commission on the fund, defended the decision to welcome Chinese investors. “The purpose is to mobilize the liquidity in the market. We don’t differentiate among the owners of the funds,” Carano said. “China is a big investor already. We don’t want any prejudice.”

In return for its investment, China wants a quid pro quo with Europe, whereby European companies and governments would take a greater interest in President Xi Jinping’s One Belt, One Road initiative.

China aims to create a modern Silk Road economic belt with railways, highways, oil and gas pipelines, power grids, Internet networks, maritime and other infrastructure links across Central, West and South Asia to as far as Greece.

“We are looking for ways to build up synergies between the One Belt, One Road initiative and the Juncker plan to invest in good products,” China’s ambassador to the EU, Yang Yanyi, told Reuters, describing the exercise like a “dating agency” to line up the right European projects with Chinese money. “There is a strong political commitment, there is common ground for cooperation,” he said. “China is in a position to invest.”

Senior EU officials have already met with Chinese banks and technology companies

Present at one seminar attended by Reuters were executives and officials of the Bank of China, China Construction Bank Europe, HSBC Holdings PLC and Industrial and Commercial Bank of China, as well as the Chinese telecoms companies Huawei Technology Co. Ltd. and ZTE Corp.

In addition, the European Commission is exploring whether the EU could become collectively a member of the AIIB, since the bank is open to “economic entities” rather than just states -- a term crafted to enable Taiwan to participate, but which could create a loophole for Brussels. That would require some capital contribution from the small EU external-relations budget. It remains to be seen whether EU states prickly about national sovereignty, such as Britain, agree to the EU joining the bank.

Meanwhile, an EU diplomat said the European Investment Bank has quietly been providing advice to China behind the scenes on best practices and governance standards in setting up the AIIB. “That has largely paid off so far,” he said.

(Reporting by Robin Emmott and Paul Taylor; Editing by Sophie Walker)

© Copyright Thomson Reuters 2024. All rights reserved.