China Leads 16% Jump In Global Clean Energy Investments; Solar, Wind Sectors Grow

Clean energy investment is rising again after three years of steady declines in the sector. The world spent $310 billion last year on solar and wind power, electric cars and energy efficiency and storage, up 16 percent from the previous year, according to Bloomberg New Energy Finance.

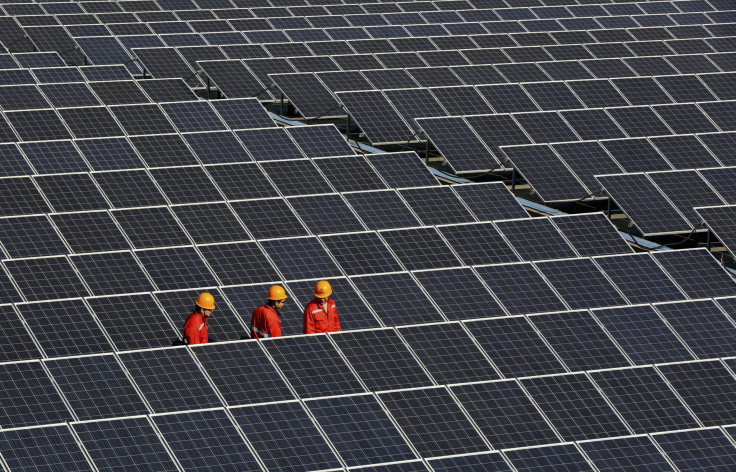

China led the spending surge, accounting for more than a fourth of the global total. Chinese investment jumped by 32 percent, to $89.5 billion, thanks to heavy government spending on its solar and wind power sectors, part of a broader effort to diversify China’s energy supplies and reduce pollution from coal-fired power plants. The government aims to get 11.4 percent of its electricity from renewable supplies by the end of this year, a target China seems on track to meet.

U.S. investment rose 8 percent, to $51.8 billion, the highest boost since 2012. In Europe, where debt-saddled governments have begun slashing incentives for renewable energy projects, investment grew only 1 percent, to $66 billion.

“Healthy investment in clean energy may surprise some commentators, who have been predicting trouble for renewables as a part of the oil price collapse,” Michael Liebreich, who chairs the London-based research firm’s advisory board, told Bloomberg News.

Global oil prices plummeted by more than half in recent months as crude supplies, led by U.S. shale production, outpace the weakening demand for fuel. International and U.S. benchmark crude prices hit their lowest levels since 2009 earlier this week, dropping below $50 a barrel. Last month, solar companies experienced share price declines -- for example, U.S. leaders SunPower and First Solar saw their stocks fall by 7 percent and 5 percent, respectively -- amid concerns that cheapening crude oil would weaken demand for renewable energy.

Even so, Liebreich said the crude price drop came too late last year to have any noticeable effect on 2014 clean energy investment. And he said the “the impact of cheaper crude will be felt much more in road transport than in electricity generation,” Bloomberg reported.

Solar power saw the largest gains of any renewable sector last year, the research firm found. Funding for solar rose 25 percent, to $149.6 billion, its highest share of the total ever. European investment in massive offshore wind energy projects helped push wind sector funding to a record $99.5 billion last year, for an 11 percent gain.

“Smart” energy technologies, including back-up power storage systems, energy efficiency products and electric vehicles such as the Chevy Volt and Nissan Leaf gained 10 percent, to $37 billion. Small-scale “distributed” electricity generation, a category that includes rooftop solar projects and on-site combined heat and power systems, saw improvements as consumers increasingly shifted away from giant centralized power stations, Bloomberg noted.

Biofuels experienced declines, one of the few segments to do so, with investment falling 7 percent, to $5.1 billion. The category includes alternative fuels made from corn, sugarcane, algae, wood products and other sources.

© Copyright IBTimes 2024. All rights reserved.