China's Central Economic Work Conference Preview: 2014 GDP Growth Target, Inflation Target

[Update: China's central authorities started the Central Economic Work Conference on Tuesday, according to the state-run Xinhua News Agency.]

China’s leaders will likely gather in Beijing for a closed-door annual economic work conference this week where they will set economic growth targets and policy priorities for 2014, building on the decisions taken at the Third Plenum.

The date of the conference has not yet been announced, but it usually takes place over two to three days in mid-December. The official Xinhua news agency usually reveals the date just before the meeting opens and announces details once it is over. It was held Dec. 15-16 last year and Dec. 12-14 in 2011.

The meeting, which will bring together top party leaders, ministers and provincial officials, normally concludes with a lengthy statement that presents decisions on fiscal and monetary policy stance.

There has been some speculation that the economic growth target for 2014 will also be announced after the conference. It may not be. The gross domestic product and inflation targets were accurately leaked in 2012 shortly after the conference. But they are usually revealed at the National People’s Congress in March.

The GDP target was 7.5 percent in 2012 and “about 7.5 percent” this year. The difference reflects a subtle downgrading of the target as a policy goal. Officials, including Premier Li Keqiang, have started to talk of two “bottom lines,” the other being for employment.

A recent Reuters poll showed GDP growth this year could slow to 7.6 percent -- the weakest in 14 years. Beijing had maintained an annual growth target of 8 percent for eight years before cutting it to 7.5 percent in 2012.

The GDP target will provide an important signal on how serious China’s top leaders are about pushing reform.

Capital Economics’ Mark Williams and Qinwei Wang expect the target to be lowered to 7.0 percent so that policymakers have more breathing room to focus on structural reform rather than next quarter’s GDP figures. “Efforts to meet a 7.5 percent target would probably lead to faster credit and investment growth, and thereby deepen China’s structural problems,” they said in a note to clients.

“While we accept that reform itself should not have a major impact on growth over the next couple of years, we anticipate a slowdown in the pace of expansion of credit that will weigh on wider economic growth,” Williams and Wang said, adding that consumer price inflation will probably remain little changed from current levels through much of 2014.

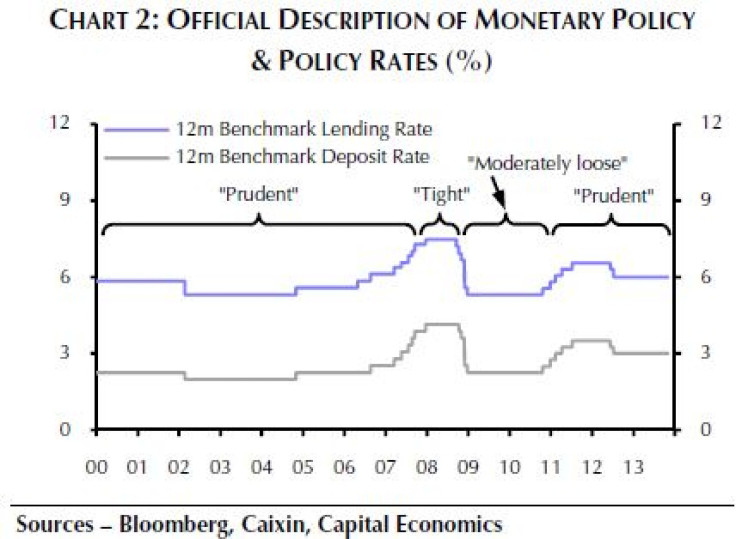

Economists expect Beijing to maintain a "prudent" monetary policy in 2014.

“We expect further gradual tightening to continue into 2014 as policymakers attempt to slow the growth of credit,” Williams and Wang said. “But changes in policy and in how policy is described don’t go hand-in-hand.”

For example, the shift from “prudent” to “tight” policy at the end of 2007 only happened when the tightening cycle had almost come to an end.

Fiscal policy has been “proactive” in 10 of the last 14 years, including in the last few years in which the (cyclically-adjusted) fiscal deficit was first reduced and then rebounded. Monetary policy has been “prudent” since 2011 and will probably remain that way in 2014. In practice, monetary conditions have been tightened since June.

The Chinese Communicate Party’s Third Plenum approved a comprehensive reform agenda for the next decade. While implementation will be key to ensuring success, economists think the government is heading in the right direction in terms of its reform priorities.

China-watchers will probably also see a succession of detailed reform plans being published in key areas, including the long-awaited urbanization plan that has been championed by Premier Li.

Implementation will remain fastest in the financial sphere. China took an important step toward interest-rate liberalization with the launch of a financial instrument that allows banks to trade deposits with one another at market-determined prices on Sunday. Meanwhile, a deposit insurance scheme could be announced as early as next year, Caixin Century Weekly, a magazine published by Caixin Media, reported Monday, citing unnamed sources close to the central bank.

However, Capital Economics remains skeptical that the People’s Bank of China will follow through on its stated goal of ending regular foreign exchange intervention.

Further fiscal reform also appears to be on the cards, starting with another expansion of VAT to cover new service sectors. And there are likely to be pilot programs liberalizing the hukou system and one-child policy and on land reform.

Finally, Williams and Wang think there’s a good chance that changes are coming to the state-owned enterprises. The pledge to raise the share of profits SOEs hand over to the state to 30 percent by 2020 was one of the more eye-catching parts of the Plenum Decision document, which otherwise steered clear of specific mention of SOE reform. The move has been under discussion for a while and should be straightforward to implement in a staggered manner.

China’s top leaders appear committed to tackling complex issues that could reduce risks and unleash growth potential, such as land reform, fiscal relations between central and local governments, private and foreign capital entry into monopolized sectors, service sector liberalization and diversified corporate structures for SOEs.

© Copyright IBTimes 2024. All rights reserved.