China’s ‘Mountain’ Of Foreign Debt Is Not As Scary As It Looks

The amount of debt China owes foreign lenders is rising at a rapid pace, but the level of China’s external borrowing is still low, and claims that the world’s second-largest economy has suddenly become reliant on mountains of foreign cash are way off, according to Standard Chartered.

Beijing's State Administration of Foreign Exchange (SAFE) said the country had a whopping $3.85 trillion of external debt at the end of 2013 – about 40 percent of China’s gross domestic product.

This debt buildup has started to cause panic among observers. Some suggested that rising external debt is a sign of desperation, signaling that China has maxed out its domestic credit. They went on to claim that when dollar borrowing rates start to rise, the subsequent deleveraging will be cataclysmic.

Standard Chartered’s Stephen Green thinks such concerns are exaggerated.

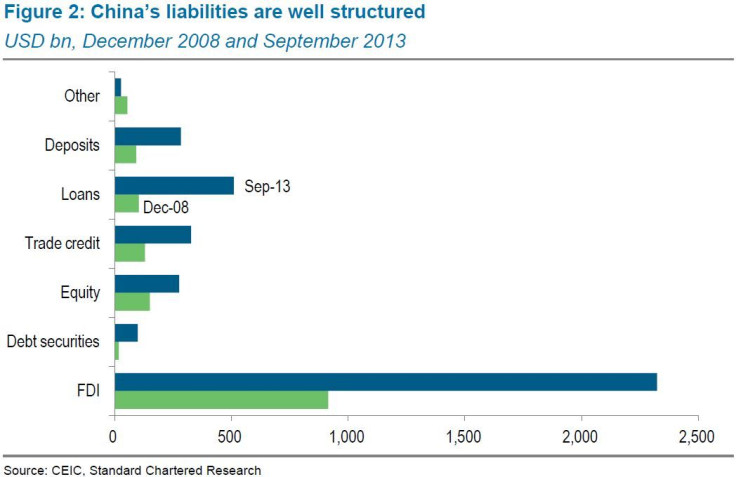

“China’s liabilities are dominated by foreign direct investment, the best kind of liability,” he wrote in a research note to clients, pointing to China’s international investment position data, “the most comprehensive measure of the total liabilities that China Inc. owes the world.”

According to the IIP data, China’s liabilities totaled $3.8 trillion as of September 2013, equivalent to 43 percent of GDP. But the lion’s share of those liabilities – some $2.3 trillion – consists of highly illiquid inward FDI.

“Generally, funds invested in factories are not going anywhere quickly, so there is little risk here,” Green said. “The fact that FDI dominates China’s liability structure is a big positive.”

On top of that, a further $374 billion is foreign portfolio investment in China's stock and bond markets. That's money that has flowed in under Beijing's qualified foreign institutional investor program, whose rules impose strict limits on the size and frequency of repatriation payments.

The rest ($1.1 trillion) is made up of trade credit, loans from foreign creditors and deposits of foreign firms in China.

“Overall, there has been no significant increase in China’s liabilities with the rest of the world -- and when FDI is excluded, the absolute number is small and flat,” Green said, so there’s “no impending cataclysm here.”

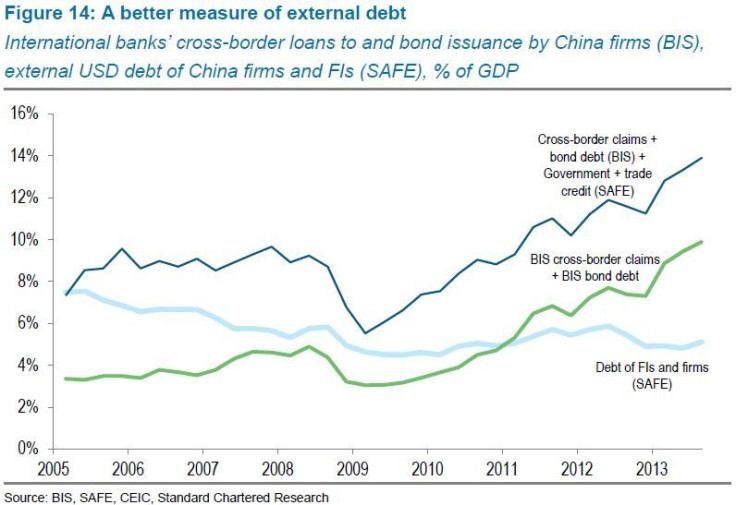

Whichever metric one uses, the absolute level of China’s foreign debt is still low relative to the size of China’s economy.

According to Green: The recent debt expansion has been the normalization of what was an abnormal situation: a massive economy shutting itself off from offshore funding sources. Foreign borrowing of 10 percent to 14 percent of GDP is entirely normal for an economy that is now the world’s second largest, is the world’s biggest trading economy, and is poised to become a major international investor.

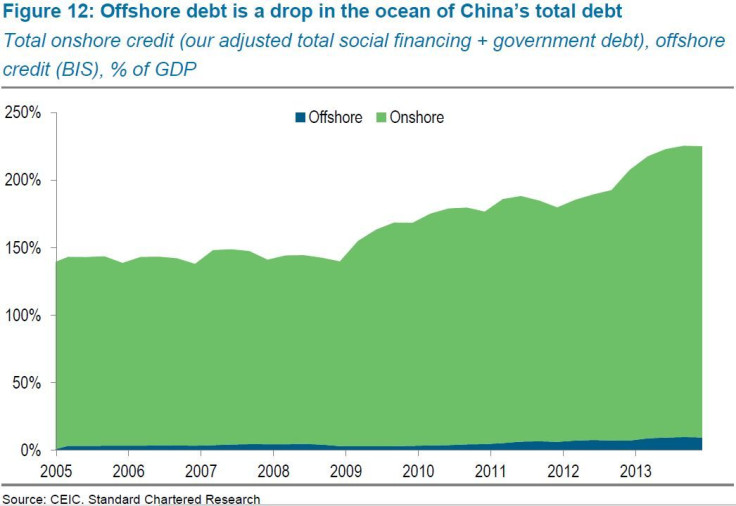

Moreover, China’s external debt plays only a minor role in funding the corporate and government space. In contrast to domestic credit of 215 percent of GDP at year-end 2013, external debt (as measured by Bank for International Settlements numbers) is only 10 percent of GDP.

Green expects China’s external debt to continue to expand in 2014-15, although at a slower pace than in 2012-13.

© Copyright IBTimes 2024. All rights reserved.