China's One-Child Policy Backfires For Entrepreneurs

The original story appeared in Huxiu.com; Translated by Sophie Song.

Inheritance of family-owned businesses has become an issue on the minds of many entrepreneurs in China, so it's not surprising that it received plenty of attention at the 2013 Boao Forum for Asia on April 8.

Choosing a successor within the family is the norm in China. According to a survey by Forbes China, 65.8 percent of business owners in the country hope for a second-generation family member to take control of the business.

While the inheritance topic got a lot of play, much of the talk centered especially on China's one-child policy, often referred to as a family-planning policy, adopted by the government in 1979 in an effort to control its population growth.

“If family-owned businesses are to be inherited effectively, the current one-child policy should be adjusted to allow a few more children,” said Jiang Xipei, president of Far East Holding Group.

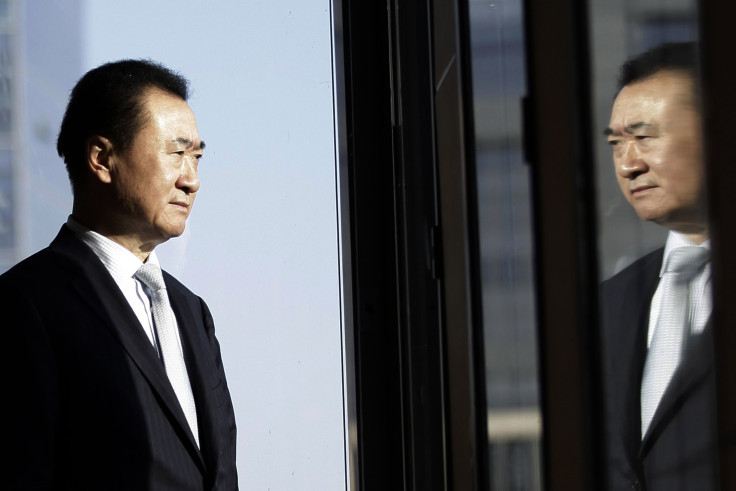

Liu Donghua, the founder of Zhenghe Island, a company that provides a secure Internet forum for entrepreneurs to exchange ideas, also got in on the discussion: “I was talking to Wang Jianlin, the chairman of Dalian Wanda Group [a Chinese entertainment giant that owns AMC Theatres among other holdings], and I asked him, ‘How come you only had one son?’ Wang Jianlin said, ‘My wife didn’t want to have more when we were young, and now it’s too late.’”

Wang also told Liu that if someone within a family is to inherit a company, there should be more choices that allows a person who is well-equipped to take the reins, Liu noted.

The one-child policy has been questioned by many, for a variety of reasons. It's a particular problem for first-gen business owners. Many businesses were established in the 1980s, after China’s economic reform took form under Deng Xiaoping’s leadership in 1978. Fast forward 20 years, and many of the same companies are now on the cusp of being transferred between original entrepreneurs and their children.

“This would be the first time Chinese family owned businesses face this problem,” said Harvard Business School professor John Davis. “Part of the problem is their lack of experience in transferring company ownership and control. On top of that, under the one-child policy, the leadership pool available to family-owned businesses is limited. A potential successor may lack experience or even ability, but the older generation will have little choice in the matter. This limited choice may hinder a company’s sustained growth. A lack of successor may even become the norm for these companies.”

In a broader sense, the one-child policy influences the overall talent pool in China. “For a relatively developed country, its innovation is highly correlated with the proportion of its young people to the overall population,” said Liang Jianzhang, chairman of the travel site ctrip.com. "When a country’s population ages, not only does the number of people capable of innovation decreases, its overall ability to innovate lowers as well. Economists agree that this will hinder a country’s economic development.”

The one-child policy is already showing some signs of relaxing. But for the current generation of entrepreneurs, it's too late to fix the problem of entrepreneurs having simply too few successors.

© Copyright IBTimes 2024. All rights reserved.