China’s Oversupply Of Cement Reached Uncontrollable Level; Government Orders Cutbacks

China's oversupply of cement has reached an uncontrollable level as companies, focused on profits, continue to increase production, said Chen Guoqing, vice chairman of the China Building Materials Federation, the Securities Times reports. Chen added that if production continues at the same pace the industry could face disaster.

China has been shutting down companies in overcapacity for a decade, and the cement industry has been a key sector in the government's past efforts to eliminate overcapacity.

Thanks to the Chinese government’s 4-trillion-yuan ($652 billion) stimulus package unleashed in November 2008 to counteract the effects of a global financial crisis, cement production marched ahead.

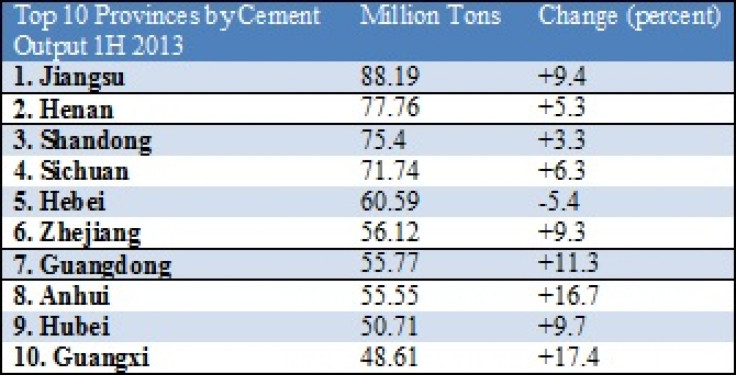

In 2009, capacity stood at 800 million tons, but that number rose to 2.9 billion tons at the end of 2012, with 75 percent actually being used. In July, China’s cement output rose 9.1 percent from the year-ago period to 211.82 million tons, the National Bureau of Statistics said.

“Among all the problems the Chinese economy is facing, overcapacity is at the top,” Wang Yong, a researcher with CITIC Securities Co. Ltd., told Beijing Review. “In some industries the problem has been quite serious, causing low prices and reducing the profits of enterprises.”

Beijing-based cement maker BBMG Corp., among other publicly listed Chinese cement companies, is suffering profit declines due to the overcapacity and intensified competition among companies in excess capacity. Some of them even partially suspended production because of huge losses. BBMG is expected to record a profit decline of 15 percent in the first half of this year.

Concerns over the sector have prompt Standard & Poor’s and Fitch to lower their ratings and outlook for two of China’s largest cement companies: China Shanshui Cement Group Limited (HKG: 0691) and West China Cement Limited (HKG: 2233).

Premier Li Keqiang has pledged to curb overcapacity as part of the drive to restructure the economy; growth this year is poised for the weakest pace since 1990. Last month, Beijing announced plans to eliminate almost 1,300 poorly performing companies in the aluminum, cement, steel and shipbuilding industries, where capacity utilization rates range from just 67 percent to 78 percent -- far lower than international averages. Excess capacity must be idled by September and eliminated by year-end.

Under the government’s plan, more than 92 million tons of excess cement capacity and about 7 million tons of excess steel production capacity will have to be wiped out, according to Nomura’s Chief China Economist Zhang Zhiwei.

The first-batch target for cement is bigger than the full-year number the Ministry of Industry and Information Technology announced back in April. In the April statement, the ministry ordered the closing of 73.45 million tons of cement, 7.81 million tons of steel, 273,000 tons of aluminum and 665,000 tons of copper this year.

According to the China Cement Association, cement demand is not likely to see a strong rebound in the second half of this year as “the odds of fiscal stimulus are low.” “The industry as whole will continue to suffer excess capacity, strained capital and tougher environmental standards,” the association added in a report posted on its website.

© Copyright IBTimes 2024. All rights reserved.