China’s Service Sector Picked Up In March, But New Hiring Slowed, As Chinese Economy Grapples With Rebalancing

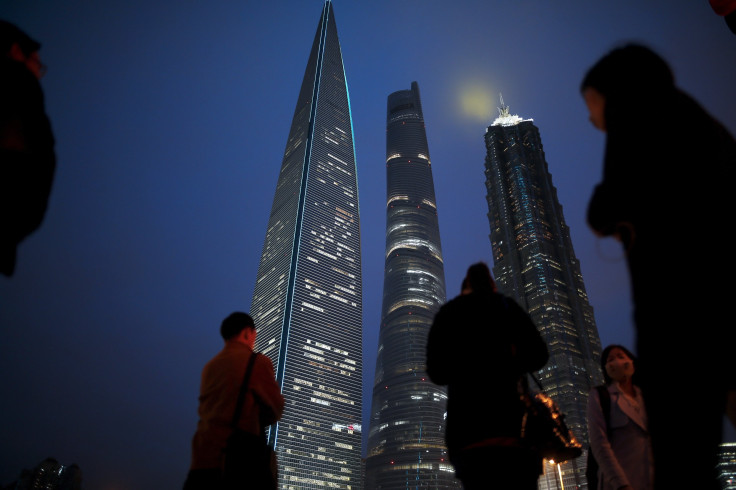

SHANGHAI — A survey of activity in China’s service sector — seen as key to the nation’s continuing growth — came in above expectations in March, fueling hopes of a soft landing for the world’s second-largest economy, which saw growth fall to its lowest level in 25 years last year, though concerns still abound.

The Caixin/Markit China services purchasing managers' index (PMI), which measures activity at smaller, mainly private firms, rose to 52.2 points in March, compared to February’s reading of 51.2 (with any figure above 50 a sign that the sector is expanding). Combined with a slower-than-expected fall in manufacturing activity, announced last week, this took the overall Caixin Composite PMI into positive territory again, at 51.3, after it contracted to 49.4 in February. Caixin said this was “the strongest expansion of overall business activity” in China in 11 months.

The figures come soon after news that China’s official manufacturing PMI data — which measures activity at larger and state-owned companies and typically shows more positive results — also rebounded into positive territory last month.

But Caixin’s Chief Economist Dr. He Fan said that while the service sector had “developed well” overall, China’s economy was still “riding choppy waves, indicating the lack of a solid foundation for a recovery."

Despite rebounding from February, a month when data is sometimes influenced by China’s New Year vacation, the service PMI remains lower than January’s rating of 52.4.

And though new orders in the service sector — which accounted for 50.5 percent of China's gross domestic product last year — grew by a similar rate in March compared to the month before, Caixin said the prices charged for services fell, indicating greater competition. The number of new workers hired by the service sector, meanwhile, fell last month for the first time since August 2013. With manufacturers also reducing hiring, Caixin said this made for the fastest fall in overall employment in China since January 2009, amid the global financial crisis.

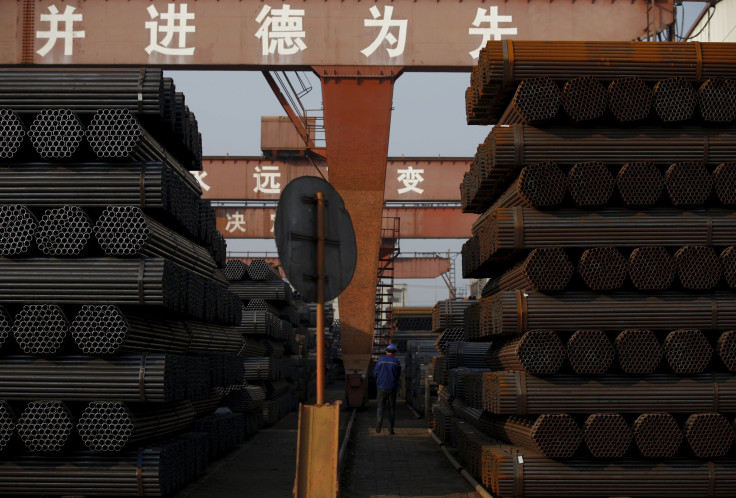

The Chinese government has pledged to take advantage of the slowdown in global export manufacturing orders and demand for commodities to restructure the economy, by cutting jobs at underperforming industries, including many in the state sector. And, it has said that a still growing service sector, which saw growth rise to 8.3 percent last year, compared to 6 percent for the industry, will provide new jobs to prevent urban unemployment rising above its current figure of some 5.1 percent.

Chinese media reported this week that the government had reduced the number of days most coal mines are allowed to produce this year, from 330 to 276, as part of its plans to cut overcapacity. Officials have said China’s coal and steel sectors could see combined job losses of 1.8 million in the coming years.

Yet, some economists have predicted a gradual knock-on effect on the service sector from last year's slump in industrial profits. Greater China Economist at HSBC Julia Wang said last week that March’s growth had been boosted by a sharp rebound in China’s property sales over the past two months — yet with concerns about overheating in property market in big cities, the government has introduced new restrictions on property purchases in Shanghai and Shenzhen over the past week, which may lead to a cooling of the sector. Caixin also noted that in many smaller cities, sales remain slack, with unsold inventory a major drag on the sector.

Despite recent data showing that industrial profits rose by 4.8 percent year-on-year in January and February, compared to a fall of 4.7 percent in December, worries remain.

The Chinese government has pledged to maintain growth of at least 6.5 percent this year, down from last year’s 6.9 percent. But International Monetary Fund head Christine Lagarde said Tuesday that China’s transition to a model based on domestic demand was one of several factors that could drag down the global economy in the near future — though she has also said that such a transition is necessary. And ratings agency Standard & Poor’s last week downgraded China’s credit rating from stable to negative, following a similar move by Moody’s earlier in March.

Caixin’s He said that despite some positive signs, it was clear that the Chinese government "needs to push forward with 'supply-side reform' to encourage the development of emerging industries."

The government has said it will make such reforms a priority this year. Next month, it will cut business tax for many companies, and replace it with VAT. Yet the impact of the tax change on consumer behavior remains to be seen, and the jury is still out on whether China will move as fast on market-based reforms as many economists are hoping.

Some experts have expressed concern that in its search to maintain growth the government may rely too much on pump-priming spending on infrastructure, seen as the main cause of the rapid growth of overcapacity in China's industry since the global crisis seven years ago. The Bank of China said in a recent report that there was a risk of money being wasted, and infrastructure projects being left "half-finished," if such spending was not carefully managed. But it said investment was necessary, and could be beneficial if care was taken that “credit flows should be directed into the real economy.”

© Copyright IBTimes 2024. All rights reserved.