Chrysler IPO: What Fiat Wants You To Know As The US Automaker Heads To The Stock Exchange

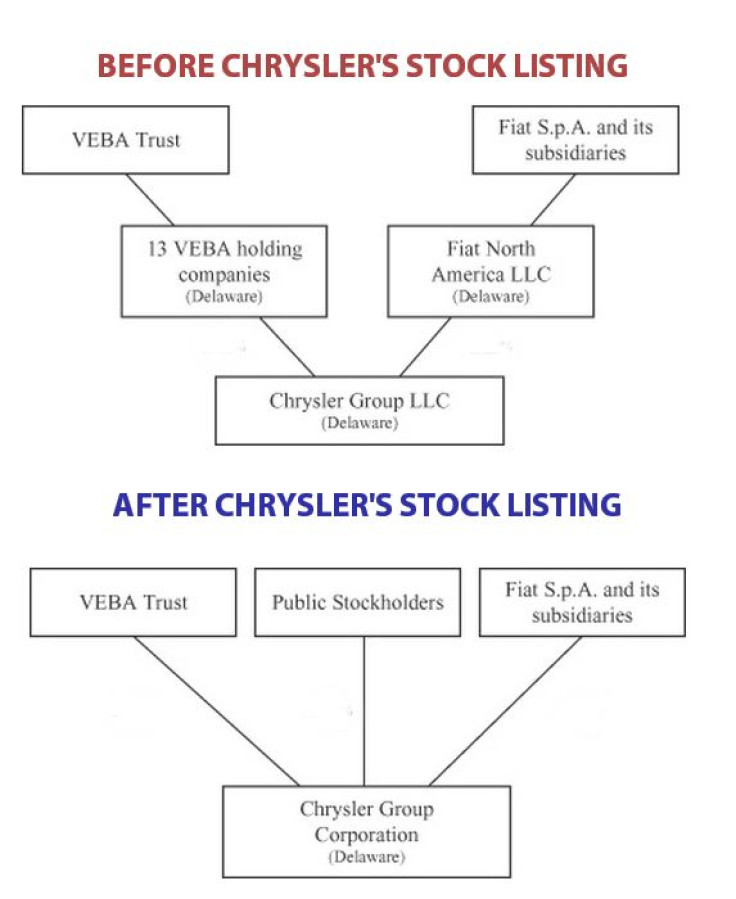

A portion of U.S. automaker Chrysler Group LLC is headed to the stock exchange, pitting the two owners of the company against each other in a deal that poses a risk for everyone involved.

Here’s a rundown:

Italian carmaker Fiat SpA (BIT:F) owns 58.5 percent of Chrysler while the United Autoworkers’ Voluntary Employees Benefits Association (UAW VEBA) owns the rest.

Fiat says Chrysler is worth about $3 billion, but the UAW trust says the company is worth more than $10 billion. Thanks to the terms of Chrysler’s 2009 Chapter 11 reorganization, the trust has the right to demand that 16 percent of Chrysler be listed on the stock exchange as the trust tries to convert its stock into cash for the highest price possible.

The trust believes that the market will decide that Chrysler is worth more than Fiat says it’s worth, and it hopes the listing will prove that so it can continue to sell the rest of its stake in the open market. For its part, Fiat is trying to grab at least 90 percent of the outstanding shares, which would allow it to fully merge the two companies without a shareholder vote, opening the way for full ownership of the Auburn Hills, Mich.-based maker of Ram, Dodge and Jeep by the Italian owner of Maserati.

There are risks for both sides -- not to mention anyone buying stock in what would become Chrysler Group Corp. (the proposed ticker has not been released publicly yet). The share price could rocket, forcing Fiat to pay more to take complete control over Chrysler. Or the share price could be lower than the union trust expects, leaving it pretty much where it is now except with a smaller stake in the company.

Tuesday afternoon’s S-1 filing with the U.S. Securities and Exchange Commission offers one of the more comprehensive looks at the state of Chrysler as a separate entity.

In order to comply with regulatory standards, Chrysler has had to list risks to future profitability in the S-1 filing. Therein you’ll find the usual boilerplate about the future health of the auto industry, the company's ability to implement attractive products moving forward and the possible effects of commodity prices on profit margins.

But Fiat’s part in all of this is a unique aspect in this announcement. CEO Sergio Marchionne, who controls both Fiat and Chrysler, would like to see the two companies merged in order to tap Chrysler’s cash flow to help Fiat as it flounders in the European auto sector crisis that has sent car sales to historic lows. He also believes that Chrysler needs Fiat technology to go global and to help improve the company’s average fuel economy and emissions standards.

Chrysler has yet to offer a date for the IPO, but here are the relevant excerpts from the 136-page S-1 filing outlining the risk to Chrysler as a publicly traded entity vis-à-vis its alliance with Fiat:

Fiat could pull out of the alliance. . .

Fiat has informed us that it is evaluating the various potential impacts that a public offering and the consequential introduction of public stockholders may have on its views of the Fiat-Chrysler Alliance, and as such, is considering whether or not to continue expanding the Fiat-Chrysler Alliance . . . A termination of the Fiat-Chrysler Alliance would likely have a material adverse effect on us [Chrysler]. Fiat may terminate the master industrial agreement dated June 10, 2009, and related ancillary agreements at any time on 120 days’ prior written notice.

Or Fiat could force a merger. . .

Fiat indirectly owns more than 50 percent of the voting power of our equity ownership, and will continue to own more than 50 percent of the voting power of our common stock . . . The concentration of ownership will also make some transactions, including mergers or other changes in control and issuances of additional equity securities, impossible without Fiat’s support. Moreover, in the event Fiat acquires 90 percent of the outstanding shares of common stock, Fiat would be able to effect a merger of the Company with Fiat . . . It is possible that Fiat’s interests may, in some circumstances, conflict with your interests as a stockholder. For additional information about our relationships with Fiat . . . it is likely that Fiat’s ability to exert control over our business policies and officers will continue for the foreseeable future.

Chrysler needs Fiat to comply with more stringent environmental standards. . .

A disruption of Fiat’s supply of such vehicles, or of technology or powertrains, to us [Chrysler] could have an effect on the model year average fuel economy ratings of our fleet, which, in turn, could affect consumer perception of our company and our sales . . . Manufacturing delays and consequential product shortages outside of our [Chrysler’s] control could threaten the supply of the refrigerant in sufficient volumes to meet our compliance needs. Moreover, our current vehicle technology cannot yield the improvement in fuel efficiency necessary to achieve compliance with the requirements of the proposed 2017-2025 joint rule, and certain regulatory provisions dictate that our fleet of vehicles must be combined with the fleet of vehicles from our industrial partners Fiat Group Automobiles and Maserati S.p.A. for GHG [Greenhouse Gas] and CAFE [Corproate Average Fuel Economy] purposes.

Chrysler is wholly dependent on state of U.S. economy. . .

Economic recovery in North America has been slower and less robust than many industry analysts predicted. This limited recovery in vehicle sales may not be sustained. For instance, renewed weakness in the U.S. new home construction market would likely depress sales of pick-up trucks, one of our strongest selling products, representing approximately 17 percent of our U.S. vehicle sales in 2012 and 18 percent of our U.S. vehicle sales in the six months ended June 30, 2013 . . . One of our longer-term strategic objectives is to capitalize on opportunities presented by the Fiat-Chrysler Alliance, and we intend to actively pursue growth opportunities in a number of markets outside North America . . . Meeting our objective of increasing our vehicle sales outside North America is largely dependent upon access to Fiat’s network of distribution arrangements, manufacturing capacity and local alliance partners.

Chrysler needs Fiat’s cost reduction and production strategy. . .

We are continuing to implement a number of cost reduction and productivity improvement initiatives in our automotive operations, through the Fiat-Chrysler Alliance and otherwise, including, for example, increasing the number of our vehicles that are based on common platforms, reducing our dependence on sales incentives offered to dealers and consumers, leveraging our purchasing capacity and volumes with Fiat’s.

Chrysler needs Sergio Marchionne and other Fiat execs. . .

Several of our senior executives, including our Chief Executive Officer, Sergio Marchionne, are important to our success because they have been instrumental in establishing our new strategic direction and implementing the 2010-2014 Business Plan. If we were to lose the services of any of these individuals this could have a material adverse effect on our business, financial condition and results of operations. We believe that these executives, in particular Mr. Marchionne, could not easily be replaced with executives of equivalent experience and capabilities.

As a publicly listed company, Chrysler will incur additional regulatory costs. . .

Reporting obligations as a public company and our anticipated growth are likely to place a considerable strain on our financial and management systems, processes and controls, as well as on our personnel ... As a result, we may be required to incur substantial expenses to test our systems, to make any necessary improvements, and to hire additional personnel.

© Copyright IBTimes 2024. All rights reserved.