Comcast TWC: Merger Or Monopoly? ‘Disaster’ Deal Must Be Stopped, Warn Media Consolidation Opponents

Following rumors that the Comcast Corporation (NASDAQ:CMCSA) will gobble up Time Warner Cable Inc. (NYSE:TWC) in an all-stock deal worth $45.2 billion, advocates for media diversity and affordable Internet access are warning that the result will be a nightmare for consumers and a slap in the face to American antitrust laws.

The deal, confirmed by Comcast Thursday morning, still needs approval from antitrust regulators and the FCC. But if it goes through, it would combine the country’s largest and second-largest cable providers into one massive pay-TV leviathan.

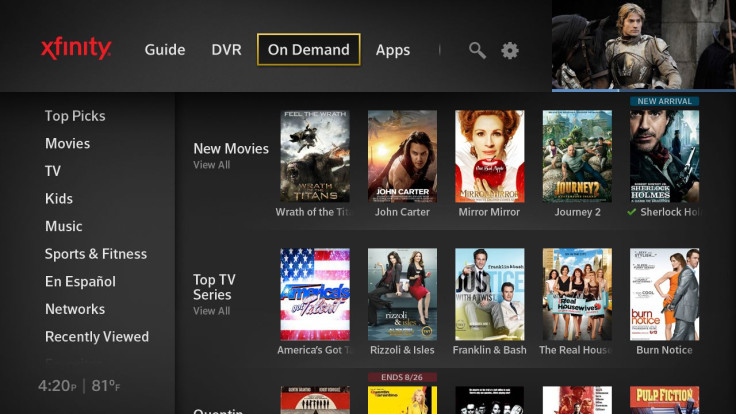

The nonprofit Free Press, which opposes media consolidation, said such a deal should be “unthinkable” in an “already uncompetitive” market of increasingly higher cable and Internet bills. Craig Aaron, the group’s CEO and president, said in a statement Thursday that the deal would give Comcast control of close to a third of the pay-TV market and more than half of the “triple-play” (cable, phone and Internet) market in the United States. The result, Aaron said, will be “unprecedented market power over consumers and an unprecedented ability to exert its influence.”

“No one woke up this morning wishing their cable company was bigger or had more control over what they could watch or download,” Aaron said. “But that -- along with higher bills -- is the reality they'll face tomorrow unless the Department of Justice and the FCC do their jobs and block this merger. Stopping this kind of deal is exactly why we have antitrust laws.”

In December, the Wall Street Journal speculated about a possible merger between the two companies, quoting an FCC official who told the paper that such a deal would face “a number of hurdles.” Chief among them is the 33 percent market share of pay-TV subscribers the new conglomerate would control. That percentage exceeds the cap of 30 percent formerly imposed by the FCC.

In the 2000s, in fact, Comcast itself successfully fought to have the 30 percent cap overturned by the U.S. Court of Appeals, arguing that it was arbitrary and out of date. The cap -- like many regulations governing media ownership in the U.S. -- goes back to the 1992 Cable Television Consumer Protection and Competition Act, which predates the era of satellite and other competitors in the pay-TV market.

Perhaps an even greater hurdle is the resulting influence Comcast-TWC would have over Internet services. The merger, according to Gigaom’s Om Malik, could potentially make Comcast the largest broadband provider outside of China. Such muscle would give the company greater influence in key negotiations with content creators, particularly since it already owns NBCUniversal. It’s no wonder the deal is sparking fear among media diversity advocates. While pay-TV providers will trumpet their need for negotiating power amid rising retransmission fees -- particularly for sports networks -- cable bills have only gone up as media consolidation has proliferated over the last two decades. Speculating about a rumored TWC sale last month, Susan Crawford of Bloomberg.com said bluntly that it will “cost us all.”

However, TWC shareholders could benefit handsomely from the deal. In a Thursday morning note, Macquarie Research Equities called the merger the “best possible scenario” for TWC shareholders, offering the chance to put “Time Warner Cable in the hands of a management team with a proven operational track record and conservative financial planning.”

At Free Press, Aaron sees it a different way. “Americans already hate dealing with the cable guy -- and both these giant companies regularly rank among the worst of the worst in consumer surveys,” he said in the statement. “But this deal would be the cable guy on steroids -- pumped up, unstoppable and grasping for your wallet."

Got a news tip? Email me. Follow me on Twitter @christopherzara

© Copyright IBTimes 2024. All rights reserved.