Corporate Whistleblowers: Canadians, Chinese, & Brits, In SEC Whistleblower Program Report

A recent report from the U.S. Securities and Exchange Commission shows that international whistle-blowers flagging corporate fraud are coming out of the shadows, with China, Canada and the U.K. submitting the most tips.

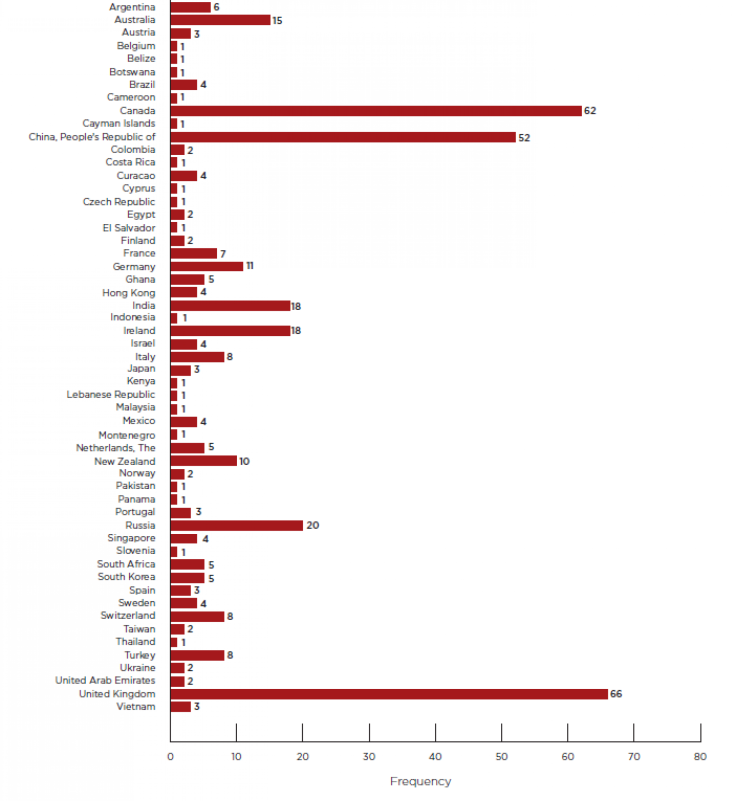

The annual report on the SEC Whistle-blower program, where tipsters receive money if investigations are successful, showed that Brits submitted 66 tips, compared to 52 from China and 62 from Canada.

As the Canadian Globe and Mail notes, tips from Canada were growing at the fastest rate among the top three rivals, up from just one submitted from Canada in 2011.

Tips from international sources grew more than 18 percent from the last fiscal year, said whistle-blower specialist and attorney Jordan Thomas to International Business Times.

“Given the global nature of the financial market, it’s not surprising that the SEC is seeing tips from outside the U.S.,” said Thomas to IBTimes on Monday. In fiscal 2013, people from 55 countries submitted tips.

“However, the percentage of tips is telling,” he said, underscoring that about 13 percent of the 3,238 tips received in total came from overseas sources.

In the U.S., California beat New York as the state submitting the most tips in the past year, at 375 vs. 215. Florida and Texas placed next.

Since the U.K. and Canada are English-speaking countries with markets “closely integrated” with the U.S. market, their prominence is unsurprising, said Thomas.

“Many of the companies that are in the U.K. and Canada are also listed on the U.S. exchanges,” he told IBTimes. “There would be greater awareness of the program in the U.K. and Canada. Almost any possible violations in those countries would most likely result in a violation of U.S. securities laws.”

A “natural nexus” connecting U.K. and U.S. businesses means that U.K.-based whistle-blowers are common, whistle-blower attorney Rebecca Katz told IBTimes in an email. She has represented whistle-blowers reporting to the SEC, protecting their interests and anonymity.

“I have several cases where the whistle-blower resides and works in the U.K…In addition, there are no similar whistle-blower statutes there. This is the same with Canada,” she wrote.

Katz, a partner with Motley Rice LLC, added that while non-U.S. citizens can receive cash in return for information, they may not be able to exploit antiretaliation protections, thanks to a recent U.S. Supreme Court decision restricting the extraterritoriality of U.S. laws.

Under the program, part of the 2010 Dodd-Frank Act, a whistle-blower can receive anonymity and protection against employee retaliation for helping the SEC investigate fraud. The largest award to date has been $14 million, announced in October.

There have been only a handful of payouts in the program’s three-year history, less than 10 in total.

China, on the other hand, is largely “underregulated,” according to Thomas. That means securities rules violations may be more common there.

Chinese companies have increasingly listed on U.S. exchanges in the past few years, despite concerns over accounting fraud and inadequate protection of U.S. investors. The "reverse merger" listing technique is especially common from Chinese companies and have been “wrought with fraud,” said Katz.

In fiscal 2013, tips relating to corporate disclosures and finances, offering fraud, and manipulation were most common, according to the report. Information on insider trading or violations of the Foreign Corrupt Practices Act, which bars bribery, was less forthcoming.

If a whistle-blower’s information leads to an enforcement case where more than $1 million is collected, the individual could earn 10 percent to 30 percent of that cash. That suggests the landmark $14 million case could involve a settlement of more than $140 million, though other details on that case are scarce and not on public record, under the program’s rules.

There is still $439 million left in the program’s fund, as a money pot for potential whistle-blowers, according to the report.

Here’s a chart showing tips received by country for fiscal 2013.

© Copyright IBTimes 2024. All rights reserved.