Crude Oil Futures Decline As China Manufacturing Activity Slows Down In April, Below Economists Expectation

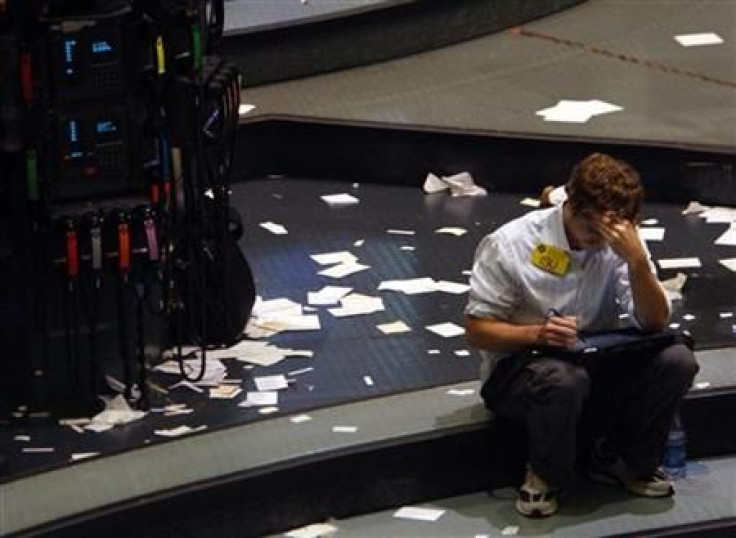

Crude oil prices declined and hovered below $89 a barrel in Asian trading Tuesday after a private survey showed that China’s manufacturing activity slowed in April.

Light sweet crude for June delivery declined 0.64 percent or 57 cents to $88.62 a barrel in electronic trading on the New York Mercantile Exchange during Asian trading hours. Brent crude oil futures for the June delivery fell 0.54 percent or 54 cents to $99.85 a barrel on the ICE futures exchange in London.

Traders’ sentiment turned negative after a preliminary reading of the HSBC Flash Purchasing Managers’ Index (PMI) showed that Chinese manufacturing activity fell in April compared to that in March. The HSBC Flash PMI, a measure of the nation-wide manufacturing, declined to 50.5 in April compared to 51.6 in March and also missed economists’ estimate of 51.5.

The data came a few days after an official report showed that China’s economic growth slowed unexpectedly in the first quarter. GDP grew at an annual rate of 7.7 percent in the first quarter, down from 7.9 percent growth recorded in the fourth quarter of 2012, and also fell short of economists’ estimate of 8 percent growth, fueling fears that economic recovery in the world’s second-largest oil consuming nation is losing steam.

“More investors are swinging around to a view that the growth rate for China’s economy might get a little bit weaker than had previously been assumed," Ric Spooner, a chief market analyst at CMC Markets in Sydney, told Bloomberg. "The past three days of gains for crude were a corrective rally against a deeper downtrend."

Economic data from the U.S. was also not encouraging and added to investors' worries that demand from the world's top consumer of oil may weaken. Data released by the National Association of Realtors (NAR) on Monday showed that existing home sales declined 0.6 percent to 4.92 million in March from a downwardly revised 4.95 million in February, while economists expected sales to rise to 5.01 million units, reinforcing concerns about economic growth in the world’s largest economy.

On Monday, Light sweet crude for the June delivery gained 1 percent or 92 cents and settled at $89.19 a barrel on the New York Mercantile Exchange while Brent crude for the June delivery rose 0.7 percent or 74 cents and settled at $100.39 a barrel.

© Copyright IBTimes 2024. All rights reserved.