Dean Foods Ex-Boss Said He Tossed Phone Into Creek To Hinder FBI Probe

Dean Foods Co.'s former chairman Thomas Davis said he threw his cell phone into a Dallas creek to hide his role in an insider-trading scheme after FBI agents visited his home, according to a transcript of his guilty plea.

In a secret hearing in New York City on Monday, Davis told a federal judge about his efforts to hinder the investigation into the scheme as FBI agents and regulators closed in on him.

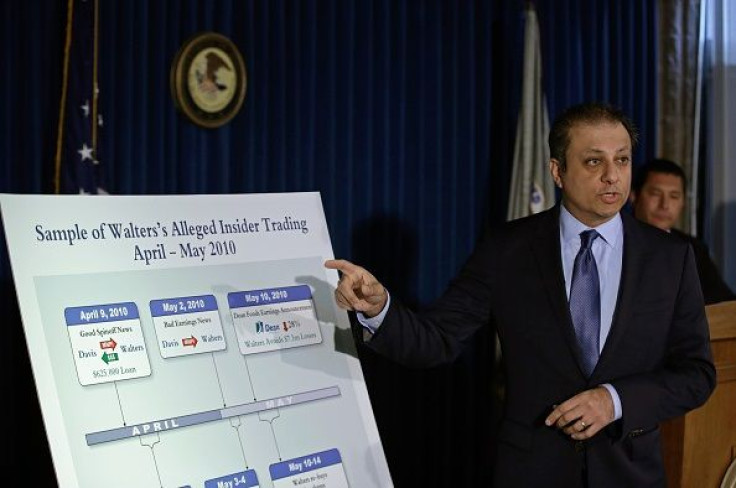

U.S. authorities on Thursday unveiled charges against Davis and gambler William "Billy" Walters for running the insider trading scheme that netted over $40 million and included a tip that benefited professional golfer Phil Mickelson.

Davis, 67, pleaded guilty at the Monday court hearing to charges including securities fraud, according to the transcript made available on Friday.

In it, Davis said Walters gave him a prepaid cellular phone so he could give the famed sports bettor inside information about Dean Foods, according to a transcript made available Friday.

Davis said he threw the phone into a creek after lying to Federal Bureau of Investigation agents who visited his Dallas home in May 2014 and asked if he provided Walters, 69, inside information about the dairy company.

"I did so with the intent both to impair the integrity of the cellular phone and to make it unavailable for any subsequent criminal proceeding," said Davis, who pleaded guilty at the hearing to charges including securities fraud.

Davis said his efforts to hinder the probe continued in May 2015 when, in a deposition to the U.S. Securities and Exchange Commission, he falsely claimed he had not provided Walters material nonpublic information.

Davis's lawyer declined comment. He is cooperating in the probe.

Barry Berke, Walters' lawyer, did not respond to a request for comment on Friday, but has said the allegations are "based on erroneous assumptions, speculative theories and false finger-pointing."

Prosecutors said from 2008 to 2014, Walters earned profits of $32 million and avoided losses of $11 million trading on inside information about Dean Foods from Davis and another $1 million trading on a tip about Darden Restaurants Inc.

Mickelson was not accused of wrongdoing, but he reached an agreement with the U.S. Securities and Exchange Commission to pay back $1.03 million the regulator said he earned trading Dean Foods' stock on Walters' recommendation.

The case is U.S. v. Davis, U.S. District Court, Southern District of New York, No. 16-cr-338.

© Copyright Thomson Reuters 2024. All rights reserved.