Delphi Automotive Earnings: Strong Global Positioning Spells Robust 1Q Earnings

Delphi Automotive Plc (NYSE: DLPH), which makes car batteries and interiors, on Tuesday reported sharply higher earnings for the first quarter on higher sales and increased efficiency and raised its full-year earnings outlook.

The company increased its 2012 guidance to between $3.63 and $3.85 per share from $3.44 to $3.69.

Income rose to $342 million, or $1.04 per share, from $291 million, or 42 cents per share, in 2011. Likewise, revenue rose to $4.1 billion, an increase of 2.4 percent, or 4.7 percent adjusted for currency and commodity impacts.

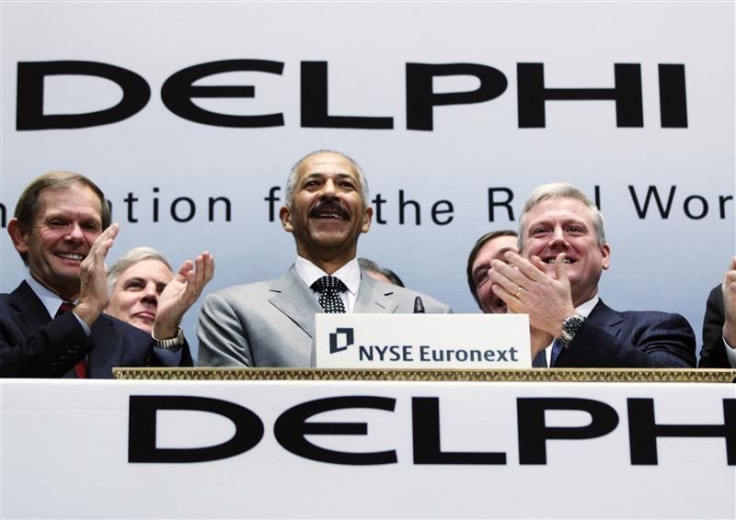

I'm really pleased with an outstanding first quarter. We achieved EBITDA margins of 14.1 percent and above market growth, Rodney O'Neal, CEO and president of Delphi, said Tuesday.

Rising revenue for Delphi resulted from robust growth of 12 percent in Asia, which was further bolstered by 6 percent growth in North America and 4 percent growth in Europe. Delphi revenue in South America dropped 11 percent because of reduced vehicle production in the region.

Earnings before taxes and other expenses (EBITDA) was $578 million, up from $529 million the year before with a margin of 14.1 percent, an improvement of 0.9 percent.

The improvement in EBITDA reflects the contribution margin from increased revenue, continued efficiencies resulting from operational improvements and the absence of non-recurring items, including a commercial settlement charge, in the prior year period, Delphi said in a statement.

However, improvements in margins and earnings were somewhat offset by unfavorable currency and commodity markets, decreased sales in Delphi's Thermal division as a result of weak South American production volume, and a $29 million expense related to the company's 2010 Long-Term Incentive Plan.

Interest expense for Delphi increased more than five times over to $35 million as a result of debt financing at the end of the first quarter of 2011 to redeem the ownership interests previously held by General Motors Co. and the Pension Benefit Guaranty Corp., the company said.

At the end of the first quarter, Delphi held cash and cash equivalents of $1.4 billion and access to $1.3 billion in undrawn bank credit for a total liquidity of $2.7 billion. Total outstanding debt for the company at the end of the quarter was $2.1 billion. Delphi's corporate credit ratings were raised from BB to BB+ by Standard & Poor's and from Ba2 to Ba1 by Moody's Investor Services during the first quarter, marked movement towards the company achieving an investment grade rating.

Delphi was expected to report earnings per share for the first quarter of just a hair under 95 cents, a 7.3 percent increase over first quarter 2011, according to Reuters' analyst consensus, due to a competitive product line, continued high powertrain margins and enduring strength in the European, North American and Chinese markets.

Revenue was expected to be approximately $4.11 billion, a 5.5 percent increase over the year before, and operating profits are likewise expected to climb to roughly $438 million with a profit margin of 10.6 percent.

Consistent with our view that Delphi will maintain above-average growth and profitability due to its attractive product line, we see Delphi posting strong 1Q12 results, Brian Johnson, U.S. autos and auto parts analyst for Barclays Capital, wrote in a report.

Delphi has enjoyed exceptional growth prospects in Europe during the first quarter, unlike many companies in the market. In 2011, 45 percent of Delphi's revenue came from Europe, but it has been largely insulated from the continent's economic hard times during the first quarter as its revenues derive from after-market and luxury sales in addition to sales to Volkswagen, which has been experiencing record global sales.

Powertrain margins for Delphi also remained strong during the first quarter, though they moderated somewhat from the fourth quarter of 2011. Delphi's earnings before interest and taxes margin in the powertrain segment were quite strong in the fourth quarter, reaching 18 percent due to a perfect combination of factors - increased volume in combination with high operating leverage, nearly perfect capacity utilization, and flawless execution and operations, according to Johnson.

However, although the exact combination of factors was not replicated in the first quarter 2012, an healthy margin of 15.4 percent was still predicted in the powertrain segment, Johnson wrote. The decrease is partly driven by the fact that additional capital has been required to increase capacity to meet volume increases. Powertrain sales grew 5.5 percent in the first quarter.

The powertrain segment particular benefitted from narrower fuel efficiency and emissions regulations which have drawn auto manufacturers to Delphi's components, according to a report from Guggenheim Partners. Automakers are expected to increase production of gas direct injection engines, which are more fuel-efficient, by 4 percent over the course of 2012.

Strong first quarter U.S. auto sales have also helped to give Delphi a boost in the first quarter, one factor which led Citi to upgrade Delphi to buy on March 28. North American production for Delphi rose 32 percent in the first quarter.

Delphi was also strong in China during the first quarter, a factor which contributed to strong overall performance by the company, according to the report by Citi. Delphi entered into a distributor agreement with TTI, Inc. to expand its entire Asia-Pacific distribution network in mid-March.

Joining forces with TTI in Asia expands the company's reach into the market, which is a direct benefit to customers by now offering Delphi's world-class connection systems products through TTI's far-reaching Asian distribution network and supply chain expertise, an announcement by Delphi said.

Shares fell 42 cents to $31.08 in morning trading.

© Copyright IBTimes 2024. All rights reserved.