Despite European Debt Crisis, Faros Goes Long Euro Against U.S. Dollar

Despite the worsening European debt crisis, forex services firm Faros Trading recommends investors to go long with the battered euro against the surging U.S. dollar.

Faros' recommendation is controversial because the current environment almost begs investors to do the opposite. The global sentiment is risk-off and Europe is one of the main reasons; the logical trade, therefore, is to short the euro versus a safe-haven currency like the U.S. dollar.

Faros points out that market sentiment is excessive, which would give the trend reversal (i.e. euro rally) ammunition as weak hand euro shorts would be eventually squeezed out of their positions.

According to Faros, last week's options market shows the largest short euro, long dollar position since 2003. Bank analysts, moreover, are forecasting more downside euro moves.

The market is positioned for European failure at the time when Europe is most likely to act, said Douglas Borthwick of Faros.

Borthwick believes there is enough political resolve -- both within the Eurozone and internationally -- to forge a bailout solution to the crisis, especially given the severity of the global market turmoil in reaction to it.

He believes there are many viable options from a wide range of entities -- the ECB, ESFS, the IMF, and BRIC countries -- to support the Eurozone.

There is still considerable uncertainty. But we believe EUR/USD shorts are looking down the barrel of a gun with most chambers filled, he said.

Why is Faros initiating its short recommendation now?

Borthwick explained that previously, Faros was worried that China would re-peg its currency to the U.S. dollar, which involves China buying the U.S. dollar.

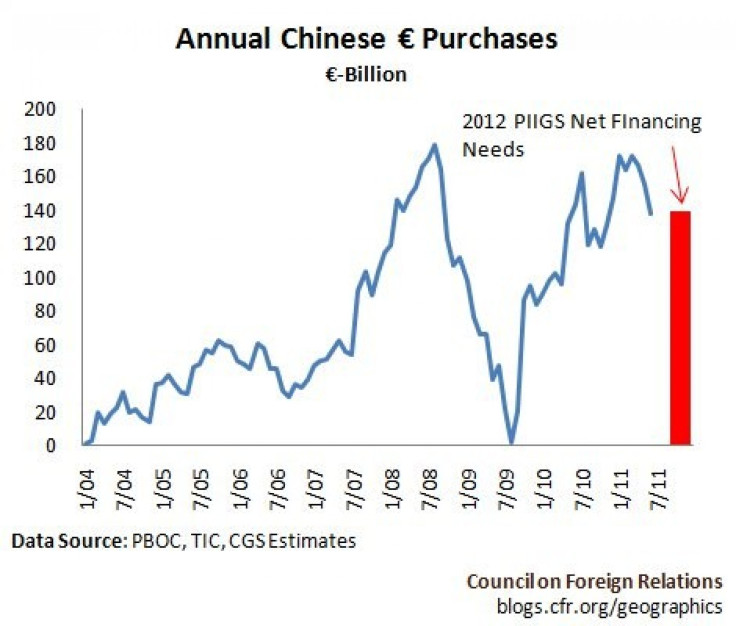

Not pegging to the dollar, on the other hand, involves China selling the dollar and buying the euro, said Borthwick, citing the Council on Foreign Relations chart below and Faros' own research.

Yesterday, China said it has decided to not peg to the dollar.

Borthwick's investment thesis, however, may be premature.

The IMM commitment of traders positioning on currency futures shows the U.S. dollar long reading of 11.7 to be only the highest since June 2010. Below is an IMM table from Nomura Securities International.

Moreover, historical IMM data shows that extreme positions, like readings above 20 for long U.S. dollar, can persist for several weeks, like it did during the 2010 European debt crisis.

Borthwick is right that Eurozone leaders are trying to fix the problem. But with reluctance from Germany and political pressure against Eurozone integration from the voters of northern European countries, it may just take authorities several weeks to come up with a solution to spark a euro rally.

E-mail Hao Li at hao.li@ibtimes.com.

For more useful global markets information, visit ibtimes.com/sections/global-markets.

© Copyright IBTimes 2024. All rights reserved.