Did Indonesia’s Financial Market Enter ‘Euphoria Mode’?

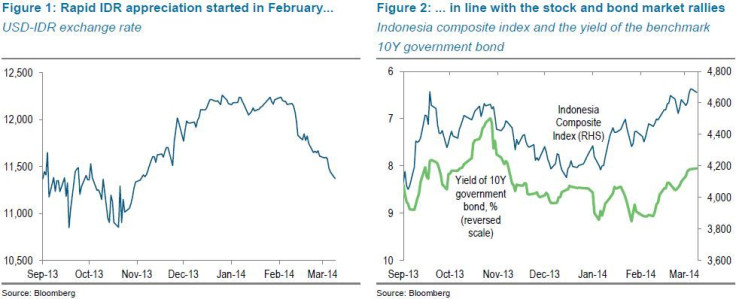

Indonesia is starting to make a comeback. In a sign of how attitudes have changed, the rupiah has become the best performer among Asia's emerging market currencies this year. Last year, it was its worst -- easily earning a place among the “fragile five” economies of the developing world.

The reversal of fortune is a sign that the country’s economy is recovering. But is the market a little too optimistic?

“We think that the recent rally may be justified to a certain extent by Indonesia’s improving fundamentals,” Standard Chartered's economists Eric Sugandi and Fauzi Ichsan said in a note. “However, we also see an element of market euphoria driving it.”

When the U.S. Federal Reserve hinted last May that it was considering plans to scale back its bond-buying, the prospect of higher yields in developed countries made investors reluctant to pour money into emerging markets.

Dubbed the "fragile five" by investment bank Morgan Stanley, Indonesia, South Africa, Brazil, Turkey and India -- which together represent around 7 percent of the world's economy -- were among those feeling the effects. These countries all have large current account deficits -- the broadest measure of the trade gap -- which means that they rely on external financing. So, these countries have relied on money flowing into their borders, and investors pulled out as the end of the era of cheap cash loomed.

Investors welcomed Indonesia’s significant improvement in its current-account deficit in the last quarter of 2013. Many say they are now returning partly because last year's selloff was overdone and bargains are on offer.

Indonesia’s benchmark index has gained 9 percent this year after losing 11 percent in the last six months of last year. The rupiah, meanwhile, has gained about 6 percent against the U.S. dollar after losing 21 percent last year. The rupiah ranks as the world's best-performing currency against the dollar this year.

Recent economic reports have painted an encouraging picture, with real GDP growth remaining strong at 5.8 percent in 2013, falling inflation and rising foreign exchange reserves. Market players largely shrug off the decline in exports in January, attributing it to the mineral-ore export ban.

However, many have also expressed concern that the market is already overstretched, indicating that current euphoria overstates Indonesia’s actual economic recovery, according to Standard Chartered.

Bank Indonesia has also adopted a cautious tone toward the recent rally in the rupiah and Indonesian assets. The Jakarta Post quoted the central bank's senior deputy governor, Mirza Adityaswara, saying that rupiah appreciation is “not necessarily a good thing” for the economy as it could swell imports and hamper exports, thus widening Indonesia’s current account deficit. Mirza added that the central bank is monitoring the effects of rupiah appreciation and its impact on the currency’s real effective exchange rate.

While maintaining their bullish view of Indonesia’s economy, Sugandi and Ichsan highlight three risks over the next six months:

1. Political risk

Indonesia is due to hold parliamentary elections in April, to be followed by a presidential vote in July. Much of the optimism is centered on the reform-minded and youthful mayor of Jakarta, Joko Widodo, known as Jokowi.

But Sugandi and Ichsan “see a risk that the outcome of the presidential election may differ from market and public expectations, especially if Jokowi does not run for president.”

“While market players may react negatively to such an outcome, we think this would be short-lived. They will have to accept the new president, who in turn will recognize the need to attract foreign investment to fund Indonesia’s current account deficit,” Sugandi and Ichsan said.

2. Risk of current account deterioration in the second quarter

Based on historical data, every year the current account balance tends to deteriorate in the second quarter compared with the first, due to increased income repatriation by foreign investors as the end of the first half approaches.

Sugandi and Ichsan think current account deterioration that may come in the second quarter will be seasonal, and should not derail the full-year improvements in the current account in 2014.

3. Geopolitical risk across emerging markets

As global financial markets continue to integrate, they expect geopolitical risk to increase.

“This will make Indonesia’s financial market more susceptible to external shocks in other emerging market economies,” Sugandi and Ichsan said. “Nonetheless, we think the impact of such geopolitical risk on Indonesia will be short-lived, as it mostly affects market psychology and should subside when participants perform a reality check on Indonesia’s macroeconomic fundamentals.”

© Copyright IBTimes 2024. All rights reserved.