Digital China eyes iPad supplier rights

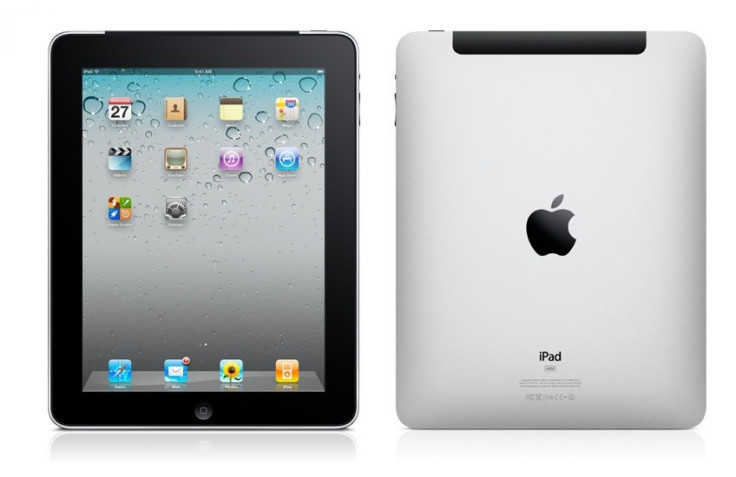

Technology services provider Digital China Holdings Ltd is bidding for the rights to sell Apple Inc's iPad and Research in Motion Ltd's tablet PC in China, its chief executive said.

The company was also aiming to ultimately raise its gross margin to 20 percent from 6.8 percent last year by focusing more on tech services, Guo Wei told Reuters in an interview on Friday.

Our future development is still looking for products that fit into our vision of a digital city, Guo said. We'll be looking for business opportunities there, whether it's Apple or Blackberry.

Shipments of tablet PCs such as the iPad are expected to surge 200 percent this year to 55 million units, with Apple likely to take a huge chunk of the total market despite inroads by rivals such as RIM and Samsung.

This has made distribution of the device and its fat margins lucrative for resellers in the world's most populous nation, especially as companies such as Digital China try to push up its own profit margins.

Our gross margins are on the low side right now, and that's because we're still heavy on the device side, Guo said. If we can raise the percentage of revenue that comes from services, that will definitely push up our margins.

RIM began selling its Blackberry smartphone in China through Digital China's sales network last year, the first time the Canadian company is selling its products through retail channels.

Digital China is looking to expand the number of retail stores it has in the country to 2,000, up from the 597 it currently runs, most of which are located in smaller cities.

China has about 3,000 counties, and even if we opened 2,000 stores, we still wouldn't have covered the entire country, Guo said.

Digital China is the digital services and direct sales unit spun off from the parent of the world's No.4 PC brand Lenovo group Ltd. Its shares are down about 2 percent in 2011, largely in line with the benchmark Hang Seng Index

Some 12 analysts polled by Thomson Reuters I/B/E/S have an average target price of HK$17.84 on Digital China shares, representing a 25 percent upside from Tuesday's close of HK$14.20.

© Copyright Thomson Reuters 2024. All rights reserved.