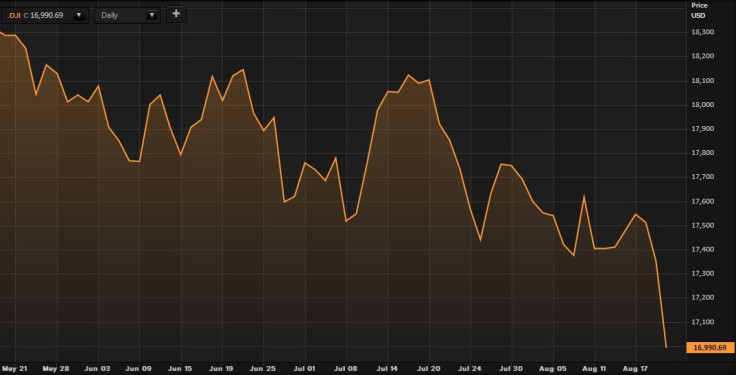

Dow Jones Industrial Average Plummets 358 Points, Suffers Worst Day Of The Year On Global Growth Concerns

U.S. stocks closed sharply lower Thursday, with the Dow Jones Industrial Average tumbling more than 350 points, marking its worst day of 2015. The S&P 500 turned negative for the year after all 10 sectors closed lower, led by a nearly 3 percent decline in consumer discretionary stocks.

The Dow closed below 17,000 for the first time since October 2014.

"There was more blood in the markets today, than there might be at a crime scene," Stephen Guilfoyle, managing director of NYSE floor operations at Deep Value Inc., said in a note. "While many industries were roughed up, it was those darn media stocks that were absolutely punched in the teeth."

All 30 stocks in the Dow closed lower, led by Walt Disney Co. (NYSE:DIS), which shed 6 percent after Bernstein downgraded the company to Market Perform from Outperform following the company's warning earlier this month that it was losing more subscribers than expected to its ESPN network.

The losses Thursday were fueled by global growth concerns after the U.S. Federal Reserve hinted a day earlier the central bank may wait until after September to raise interest rates, which have hovered at historic lows since the Great Recession. Central bankers need more confidence that inflation is moving toward their goal before the Fed will lift rates, minutes from the Fed’s July meeting showed on Wednesday.

The Dow Jones Industrial Average (INDEXDJX:.DJI) tumbled 358.04 points, or 2.06 percent, to close at 16,990.69. The S&P 500 index (INDEXSP:.INX) lost 43.88 points, or 2.11 percent, to end at 2,035.73. And the Nasdaq composite (INDEXNASDAQ:.IXIC) dropped 141.56 points, or 2.82 percent, to finish at 4,877.49.

For the year, the Dow has lost 829 points, or 4.7 percent and the S&P 500 has lost 23 points, or 1 percent. However, the Nasdaq has gained 144 points, or 3 percent.

Concerns regarding the health of the global recovery continued to dominate investor sentiment this week, with market professionals watching three key things: the Federal Reserve, China and oil prices.

Even before Greeks voted to reject bailout proposals from the country’s international creditors and China’s stock market began to tumble last month, the U.S. Federal Reserve was questioning its stance on an interest rate increase planned for sometime later in 2015.

Sharp losses in China's Shanghai benchmark index this week raised concerns about Beijing's efforts to stabilize financial markets. The losses this week increased fears that the world’s second-largest economy would devalue the yuan further to boost slowing growth.

The Fed's dovish minutes don't include China's devaluation of the yuan because the meeting took place on July 28-29, ahead of Beijing's currency moves this month.

Meanwhile, U.S. oil prices closed mildly higher Thursday after tumbling to six-year lows to nearly $40 a barrel in early trading after an unexpected rise in crude stockpiles. West Texas Intermediate crude, the benchmark for U.S. oil prices, rose 0.8 percent to $41.14per barrel for September delivery on the New York Mercantile Exchange. On the London ICE Futures Exchange, Brent crude, the global benchmark for oil prices, fell 1 percent to $46.13.

© Copyright IBTimes 2024. All rights reserved.