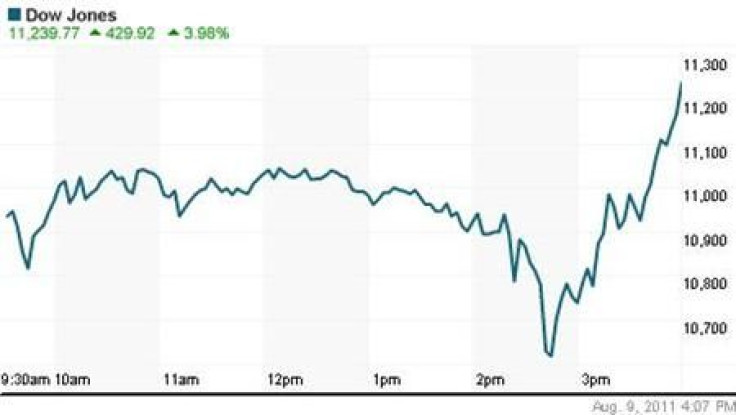

Dow Soars 423 Points, Investors Encouraged by Upbeat Reports

The Dow Jones industrial average rebounded on Thursday soaring 423.37 points, or 3.95 percent, to 11143.31, after a disappointing 520-point loss on Wednesday, the ninth-largest point drop ever, because of growing fears about the health of Europe's banks and the probabilities of a global economic recession.

Meanwhile, the Nasdaq gained 111.63 points, or 4.69 per cent, to 2,492.68.

Thursday's gains are being credited to investors finding favorable improvements in employment data and a strong weekly employment report from networking-equipment maker Cisco Systems. It's the second recovery this week, with the first being on Tuesday.

"It's great to have these up days, but I think that we are going to continue to be in a choppy period with these big swings," Margaret Patel, senior portfolio manager at Wells Capital Management, told The Wall Street Journal. "The reason we had our meltdown was really over in Europe. It made the markets look like one of the dark days in 2008, melting away with no rhyme or reason."

The 30 Dow Jones blue-chips were all higher, but the strongest was a 16 percent jump from Cisco Systems, which had reported higher-than-expected earnings per share for the fiscal fourth quarter after the market closed Wednesday.

Chief Executive John Chambers told the Wall Street Journal that the company was making "solid progress" on its turnaround effort.

Coming in second was Bank of America, which rose 7.1 percent after slumping 11 percent on Wednesday.

Patrick O'Hare of Briefing.com told The Economic Times that this is "an extremely volatile equity market."

"The massive swings are symptomatic of a market that is racked with uncertainty and where every rumor is treated as truth until the real truth can set one free from the rumor," O'Hare said. "The cycle soon begins anew, though, when the next rumor hits the wires."

Earlier this week, America bank stocks were hugely affected because investors remain worried that the debt problem overseas may hit home in the U.S.

The Associated Press reported that France is under pressure because there are concerns that it could be the next country to lose its triple-A credit rating. The French president has cut a vacation short and promised to lower the country's debts, the news agency said.

After French President Nicolas Sarkozy recently called a meeting with German Chancellor Angela Merkel that was aimed at preventing the eurozone debt crisis from forcing Italy and Spain into default, the markets rebounded.

© Copyright IBTimes 2024. All rights reserved.