Earnings Preview: Lennar (LEN), KB Home (KBH), Nike (NKE), Carnival (CCL)

Federal Reserve Chairman Ben Bernanke blinked. In other words, third-quarter earnings results will probably be less relevant in the eyes of the market.

This week’s Federal Open Market Committee meeting was the most significant non-event of the year. And just by doing nothing, the Fed managed to push both the S&P 500 (INDEXSP: .INX) and the Dow Jones Industrial Average (INDEXDJX: .DJI) to new all-time highs.

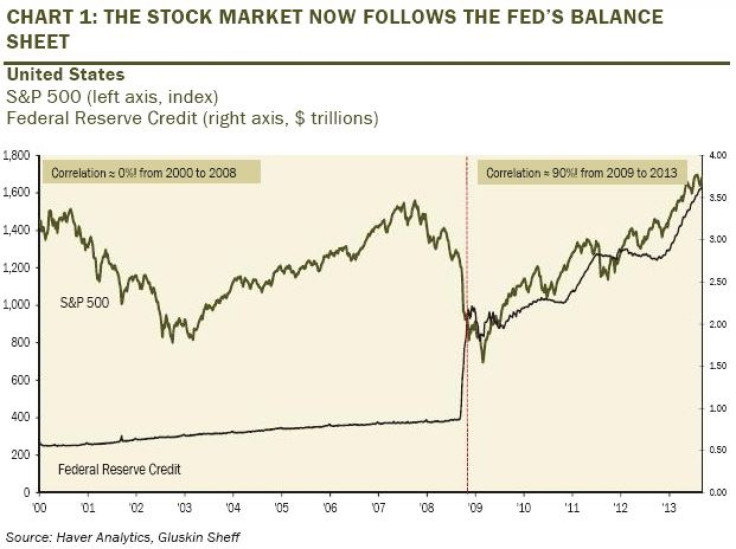

“The correlation between the Fed’s balance sheet and the direction of the stock market at 90 percent is higher than the 70 percent correlation between the market and earnings,” writes David Rosenberg, chief economist and strategist for Gluskin Sheff, in a research note to clients.

Fed’s renewed commitment to keep flooding the system with cheap money is a much bigger driver of stock prices than the other side of the investment equation -- earnings fueled by supply and demand for goods and services.

Check out this chart from Rosenberg:

“Rather incredible,” Rosenberg noted. “I feel sorry for the next chairperson … his or her task is going to be all the more challenging.”

We ran a screen and produced a list of seven notable companies set to report their earnings between Sept. 23 and Sept. 27. We've highlighted their expected reporting dates and times, along with analysts' earnings-per-share (fully reported) and revenue estimates from Reuters, as well as the stocks' year-to-date performances.

Tuesday Before Markets Open, or BMO:

Carnival Corporation (NYSE: CCL) is a cruise company. The company has a market capitalization of $29.25 billion. It is expected to report FY 2013 third-quarter EPS of $1.30 on revenue of $4.65 billion, compared with EPS of $1.71 on revenue of $4.68 billion in the year-ago period. Carnival Corporation is trading at around $37.72 a share. So far this year, the stock has gained 2.7 percent.

KB Home (NYSE: KBH) is a builder of single-family residential homes, townhomes and condominiums. The company has a market capitalization of $1.55 billion. It is expected to report FY 2013 third-quarter EPS of 21 cents on revenue of $569.30 million, compared with EPS of 4 cents on revenue of $424.50 million in the year-ago period. KB Home is trading at around $18.38 a share. So far this year, the stock has gained 17 percent.

Lennar Corporation (NYSE: LEN) together with its subsidiaries, engages in homebuilding, financial services and real estate businesses in the U.S. The company has a market capitalization of $7.01 billion. It is expected to report FY 2013 third-quarter EPS of 46 cents on revenue of $1.56 billion, compared with EPS of 40 cents on revenue of $1.10 billion in the year-ago period. Lennar Corporation is trading at around $36.30 a share. So far this year, the stock has lost 6 percent.

Wednesday After Markets Close, or AMC:

Bed Bath & Beyond Inc. (Nasdaq: BBBY) is a chain of retail stores. The company has a market capitalization of $16.44 billion. It is expected to report FY 2013 second-quarter EPS of $1.15 on revenue of $2.81 billion, compared with EPS of 98 cents on revenue of $2.59 billion in the year-ago period. Bed Bath & Beyond Inc. is trading at around $75.51 a share. So far this year, the stock has gained 35.1 percent.

Jabil Circuit Inc. (NYSE: JBL) is a providers of worldwide electronic manufacturing services and solutions. The company has a market capitalization of $4.79 billion. It is expected to report FY 2013 fourth-quarter EPS of 7 cents on revenue of $4.52 billion, compared with EPS of 39 cents on revenue of $4.34 billion in the year-ago period. Jabil Circuit Inc. is trading at around $23.66 a share. So far this year, the stock has gained 22.6 percent.

Thursday AMC:

Accenture Plc (NYSE: CAN) is engaged in providing management consulting, technology and outsourcing services. The company has a market capitalization of $62.21 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.02 on revenue of $6.89 billion, compared with EPS of 88 cents on revenue of $6.84 billion in the year-ago period. Accenture Plc is trading at around $77.80 a share. So far this year, the stock has gained 17 percent.

Nike Inc (NYSE: NKE) is a seller of athletic footwear and athletic apparel worldwide. The company has a market capitalization of $62.33 billion. It is expected to report FY 2014 first-quarter EPS of 79 cents on revenue of $6.97 billion, compared with EPS of 62 cents on revenue of $6.47 billion in the year-ago period. Nike Inc is trading at around $69.74 a share. So far this year, the stock has gained 35.2 percent.

© Copyright IBTimes 2024. All rights reserved.