Earnings Preview: Outlook Bright As First Solar Inc. (FSLR), SolarCity Corp. (SCTY) And SunPower Corp. (SPWR) Report First-Quarter Results

Leading U.S. solar power companies will begin reporting earnings this week just days after SunEdison Inc. filed for bankruptcy protection. Solar stocks have dipped since then as the clean energy giant’s misfortunes cast a shadow over the industry.

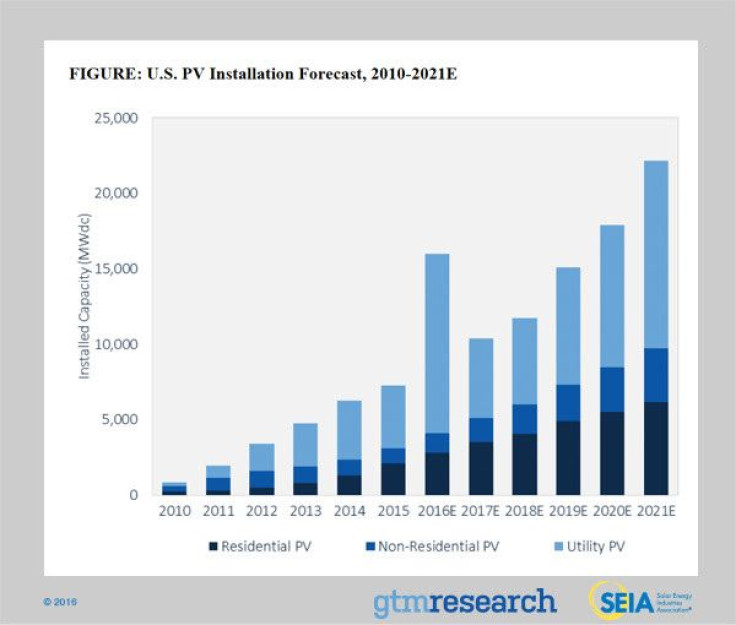

Yet analysts say the outlook for other companies in the sector remains relatively bright as solar projects keep booming. U.S. solar installations are on track to grow by 16,000 megawatts this year — a leap of 120 percent over 2015 installations, GTM Research forecast. Worldwide, new solar projects will total 68,000 megawatts this year, nearly a quarter more than last year’s additions, Bloomberg New Energy Finance (BNEF) estimated.

“It’s quite an exciting year,” Jenny Chase, BNEF’s head of solar analysis, said from Switzerland. Demand for solar projects is rising as technology and installation costs continue to plummet. In the U.S., the recent extension of a key federal tax credit for solar developers will also help drive more projects for the next five years, Chase said.

Solar developers still face continuous headwinds. Natural gas in particular is still cheaper on average per megawatt-hour than solar power, although the gap is narrowing globally. In U.S. states such as Arizona and Nevada, efforts by utility companies and regulators to curtail subsidies for solar customers could make it more expensive for some homeowners or businesses to adopt solar technology.

But the downfall of Missouri-based SunEdison was largely the result of an overly ambitious acquisition spree and chaotic business strategy rather than a reflection of the fortunes of the entire sector, analysts say. The company became the world’s largest solar and wind developer as it struck dozens of deals and amassed over $10 billion in debt. That approach left the firm with too little cash and a host of legal and regulatory problems.

“SunEdison’s bankruptcy says more about the company’s strategic decisions than about the solar industry as a whole,” Chase said.

U.S. solar companies reporting first-quarter earnings this week or next include First Solar Inc. (NASDAQ:FSLR), SunPower Corp. (NASDAQ:SPWR) and SolarCity Corp. (NASDAQ:SCTY).

First Solar Inc.

First Solar makes thin-film solar panels from cadmium and telluride (most other panels use polysilicon) and builds and sells solar projects. The company is scheduled to report first-quarter earnings Wednesday after the closing bell.

The Tempe, Arizona-based company is expected to report earnings of 88 cents per share for the quarter, up from a loss of 62 cents in the first quarter of 2015, according to analysts polled by Thomson Reuters. Non-GAAP earnings are expected to reach 88 cents from a loss of 55 cents. Net income could rise to $95 million from a loss of $55.6 million last year.

Revenue for the quarter could total $952.2 million, up from nearly $470 million in the first three months of 2015, according to the poll.

Analysts at Morningstar Inc., an independent investment research firm, said they are bullish on First Solar, whose thin-film panel technology is increasingly competitive with lower-cost Chinese polysilicon panels.

“We are becoming increasingly confident that First Solar truly has the brightest future of any company in the sector,” the analysts wrote in a research note provided by email. “Its technology road map and cost-reduction plans are enough to ensure that the company will remain solidly profitable beyond the next couple years.”

SunPower Corp.

The Silicon Valley company manufactures solar panel and installation technologies and develops projects at the residential, commercial and utility scale.

Chase said that because SunPower and rival First Solar develop and sell large projects throughout the year, their results tend to be “lumpy” from one quarter to the next.

Analysts polled by Thomson Reuters said they expect 31-year-old SunPower to report a wider loss of 42 cents per share for the three months ended March 31 from a loss of 7 cents for the same period in 2015. Non-GAAP losses are expected to reach 14 cents per share for the quarter, down from earnings of 13 cents per share last year. Net income is expected to decline by $11 million for the first three months of 2016 compared with income of nearly $20 million last year.

The analysts expect first-quarter revenue to total $328.2 million, a less than 10 percent dip from revenue of $360.6 million in the same period last year.

SunPower said in February it expects non-GAAP revenue in 2016 between $3.2 billion and $3.4 billion, up from full-year non-GAAP revenue of $2.6 billion. Total solar project deployments are expected to rise between 1,700 megawatts and 2,000 megawatts, up from last year’s 1,150 megawatts.

SunPower is expected to report first-quarter earnings May 5, although the company has not yet confirmed that date.

SolarCity Corp.

SolarCity, whose largest investor is Tesla Motors Inc. founder Elon Musk, has seen its stock quiver in recent months after the company said it was dialing back an aggressive expansion strategy. The Silicon Valley company primarily develops rooftop solar installations on homes and office buildings.

SolarCity is expected to report a loss of $1.78 per share compared with a loss of 22 cents in the same period last year, analysts polled by Thomson Reuters said. Adjusted for one-time events, losses are expected to plunge to $2.34 a share compared with an adjusted loss of $1.52 in the first quarter of 2015.

SolarCity’s stock in February plunged by over 30 percent after the company forecast a bigger-than-expected loss for the first quarter as installations fell below its target. SolarCity deployed 272 megawatts in the fourth quarter of 2015, below its forecast of 280 to 300 megawatts.

CEO Lyndon Rive surprised investors last fall by announcing the company would slow installation growth as it seeks to reduce costs and become cash-flow positive. SolarCity has installed more than 1,000 megawatts of solar panels since its 2006 launch, an expansion driven largely by its expensive marketing campaign to entice homeowners to slap panels on their rooftops.

Andrew Bischof, an equity analyst at Morningstar in Chicago, said he would be watching closely to see if SolarCity can meet its revised goals for new installations and cost reductions this year. “I don’t think the switch in strategy is necessarily a bad thing,” he said. “But I think management needs to be able to deliver on these new targets that they set out for themselves.”

The Thomson Reuters poll found that analysts expected first-quarter revenue of $108.5 million, up slightly from $102.8 million in the year-earlier period. But income losses were seen falling to $241.5 million, down from a loss of $155.7 million in the first quarter of 2015.

Chase, the BNEF analyst, said the wide mismatch between SolarCity’s revenue and reported income reflect the company’s heavy spending on marketing — including television and billboard advertisements and door-to-door campaigns — to attract new customers, although the company is vowing to curb these expenses. “The more revenue it makes, the more negative its net income is,” she explained.

The company is expected to report first quarter earnings on May 3, although the company has not yet confirmed that date.

© Copyright IBTimes 2024. All rights reserved.