Economic Events: FOMC Minutes, Jackson Hole, US Housing Data, China August Flash HSBC Manufacturing PMI

In a light data week in the U.S., the focus will be on the minutes of the July Federal Open Market Committee meeting and housing data. The July FOMC minutes are due out on Wednesday afternoon.

“Often the FOMC minutes aren't a big market mover since, by the time they are released three weeks after the Fed's meeting, the debate has moved on; either because of more recent incoming data or post-meeting speeches made by key officials,” Paul Ashworth, chief U.S. economist at Capital Economics, said in a note to clients. “In this case, however, these minutes, and what they have to say about the possibility of the Fed beginning its QE3 taper in September, could have a big impact.”

The post-meeting data releases haven't changed the outlook much and, aside from a few regional Fed Presidents, there have been no key speeches.

All the expected no shows at this year's Jackson Hole symposium means that the minutes and then the August employment figures are the only two events that could shift market expectations ahead of that mid-September meeting. The annual Jackson Hole conference runs from Thursday night to Saturday.

Right now, expectations are mixed.

Economists at Capital Economics expect the Fed to begin reducing its $85-billion-per-month of asset purchases in September, while those at Bank of America Merrill Lynch think a December taper is more likely.

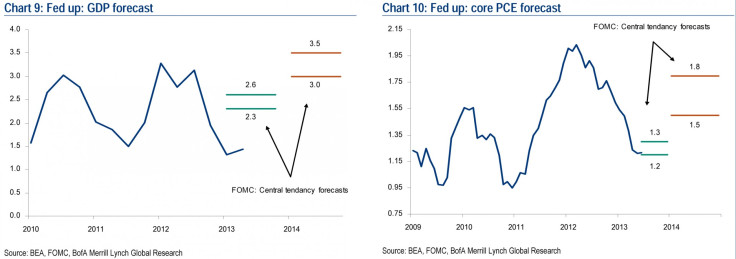

The Fed’s policy plans assume a significant pick-up in both growth and inflation. Hence, if growth and inflation pick up less than the Fed expects, they will delay, not accelerate the Fed exit from QE, according to Bank of America economists Ethan Harris.

“While both the consensus and markets are increasingly zeroing in on tapering in September, we still think December is a bit more likely,” Harris said.

However, if the Fed is close to a September taper, then he would expect some discussion of operational details in next week’s minutes, such as how much to taper and in which assets – mortgage-backed securities (MBS) or Treasuries. Harris said his base case is that the Fed will taper equally in both assets. But nothing is set in stone at this point.

Data coming out of the euro zone, which officially emerged from its record-long recession in the second quarter, will likely show that manufacturing and consumer sentiment both inched up further in August, suggesting that the single currency bloc’s economic growth may rise again in the third quarter.

In China, economists expect the HSBC flash PMI (due out on Wednesday night) to rise to 48.5 in August from 47.7 in July, as growth momentum looks like it may have stabilized in August, albeit at a low level.

Elsewhere, Malaysia and Thailand will post their second-quarter gross domestic product figures. Growth probably slowed in Thailand, but a modest rebound is expected in Malaysia’s economy.

Below are entries on the economic calendar for Aug. 19-23. All listed times are EDT.

Monday

No significant events or releases in the U.S.

Non-U.S.:

Thailand – Q2 GDP.

Chile – Q2 GDP.

Tuesday

No significant events or releases in the U.S.

Non-U.S.:

Australia – RBA board minutes.

Turkey – Benchmark repo rate, overnight lending rate and overnight borrowing rate.

Japan – June index of all-industry activity.

Taiwan – July export orders.

Norway – Q2 GDP.

Mexico – Q2 GDP.

Wednesday

7 a.m. -- The Mortgage Bankers Association's, or MBA's, mortgage-applications indexes for the week ending Aug. 16.

10 a.m. – Existing home sales are likely to increase 1.6 percent month-on-month in July to 5.16 million units versus 5.08 million units in June. Pending home sales fell slightly in June but remain well above the March-April period, suggesting momentum in existing home sales in July. Existing home sales covers closed contracts, whereas pending home sales covers signed contracts that typically convert into closed contracts within one or two months. Therefore, pending home sales are a good leading indicator of existing home sales.

2 p.m. – FOMC minutes for the July 30-31 meeting.

Non-U.S.:

Thailand – Benchmark interest rate.

Malaysia – Q2 GDP.

China – August flash HSBC manufacturing PMI index.

Thursday

All Day – Kansas City Fed Jackson Hole Economic Summit.

8:30 a.m. – Initial jobless claims are expected to rise to 330,000 for the week ending Aug. 17. In the prior week, initial jobless claims settled at 320,000. This would put the four-week moving average at 328,000, down from 332,000.

8:58 a.m. – Markit flash manufacturing PMI for August.

9 a.m. – Economists look for the FHFA Home Price Index to rise to 0.6 percent in June, consistent with the improvement seen in other home price indices during the same period. That would translate into a year-over-year increase of 7.4 percent.

10 a.m. – The Conference Board’s index of leading indicators in July will likely see a 0.5 percent gain from the previous month.

2 p.m. -- Dallas Fed President Richard Fisher (FOMC non-voter) speaks in Florida.

Non-U.S.:

Switzerland – July trade balance.

France – August flash manufacturing PMI index.

Germany -- August flash manufacturing PMI index.

E 17 -- August flash manufacturing PMI index, flash services PMI index and flash composite PMI index.

Sweden – July unemployment rate.

Friday

All Day – Kansas City Fed Jackson Hole Economic Summit.

10 a.m. – Economists look for new home sales to fall 2.4 percent month-on-month in July, to 485,000, from 497,000 in June.

Non-U.S.:

Peru – Q2 GDP.

Singapore – July CPI.

Germany – Q2 GDP, final reading.

Taiwan – July industrial production.

U.K. – Q2 GDP, second release.

E17 – August flash consumer confidence index.

Sources: Central banks, European Commission, Thomson Reuters, Market News, Capital Economics, Barclays, Bank of America Merrill Lynch, Societe Generale, Nomura

© Copyright IBTimes 2024. All rights reserved.