Etsy Planning To Host IPO Before April: Report

Etsy is reportedly planning to raise about $300 million by hosting an initial public offering, or IPO, sometime this quarter. Etsy, an online marketplace known for handmade items and other crafts, is working with Goldman Sachs and Morgan Stanley to prepare for the IPO, according to a Bloomberg report.

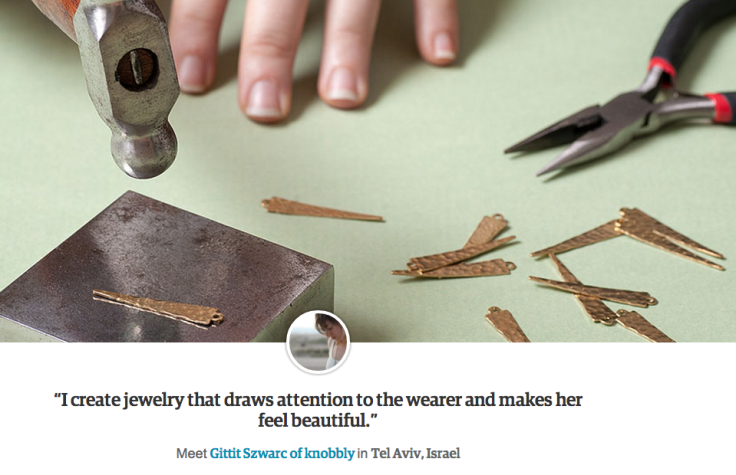

Etsy has carved out a niche as the destination for online shoppers looking for items that don't appear to be mass-produced and that are difficult to find on retail sites like Amazon or Ebay. Etsy makes most of its money charging sellers $0.20 to list an item, and another 3.5 percent of the total sale when it’s sold.

Sellers on Ebay Inc. often pay $0.50 to list an item and 10 percent of its total sale price, while Amazon.com Inc. charges up to 25 percent and listing fees of $1, but both boast significantly higher numbers of visitors and customers. Etsy has a customer base of 40 million, while Ebay and Amazon each have more than 200 million customers, according to CIO. Chinese marketplace giant Alibaba raised $25 billion with an IPO in 2014.

Etsy, like its competitors, also processes payments and sells ads. Etsy has been profitable since 2009 and raised $91.7 million in funding since its inception, CEO Chad Dickerson told Business Insider in 2013. Etsy also faces competition in the U.S. from startups like Bonanza, which focuses on clothing and fashion, as well as similar sites like DaWanda and Ezebee in Europe.

© Copyright IBTimes 2024. All rights reserved.