European Recession 2012: How Would It Affect The US Economy?

A recession is typically defined as two or more consecutive quarters of economic contraction. Early in 2012, Europe is already halfway there: The euro zone's economy shrank by 0.3 percent in last year's fourth quarter from the previous three months.

The European Commission predicts the 17-member euro zone will enter a mild recession and shrink by 0.3 percent for 2012, citing austerity measures, the region's sovereign-debt crisis, fragile financial markets and the weakness of the global economy.

As Europe's economy struggles, the United States watches warily.

Since 2010, U.S. stocks have suffered whenever there is bad news about the euro zone debt crisis, mainly because U.S. banks are heavily exposed to Europe's financial system.

If a recession does hit the region, bond investors might be led to assume that European countries will have a harder time repaying debts. Such an assumption could then prompt them to sell European debt, only exacerbating the current crisis.

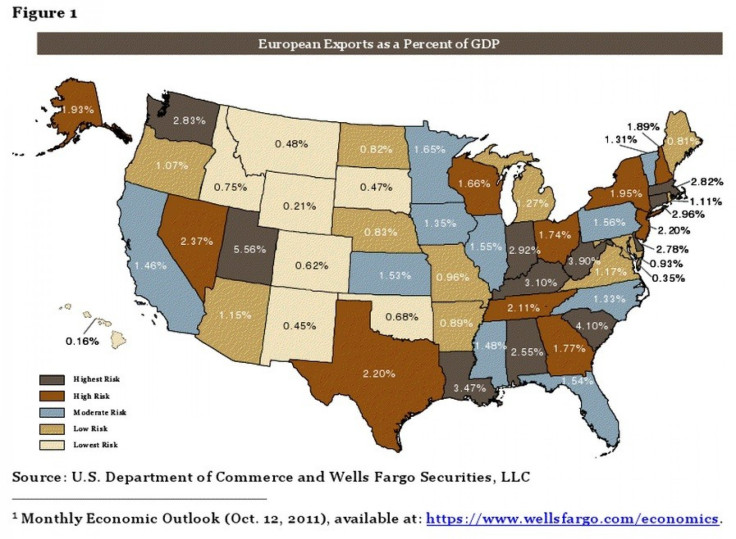

Over 22 percent of U.S. exports in 2010, or about 2.7 percent of gross domestic product, went to Europe, data from the European Union show.

Source: European Commission

Europe is a big investor in the United States, and vice versa.

In 2007, U.S. foreign direct investment on the continent totaled $1.4 trillion while European FDI in the United States was $1.3 trillion.

In 2008, U.S. affiliates of companies with majority-European ownership racked up $1.7 trillion in sales and employed about 3.5 million people, according to the Commerce Department's Bureau of Economic Analysis.

In today's interconnected global economy, however, the impact of a European recession is felt beyond the confines of the trans-Atlantic relationship.

The EU is, collectively, the world's biggest economy, second-biggest exporter and second-biggest importer, according to the CIA World Factbook. The bloc is also the largest global investor and the largest recipient of foreign investment, according to the European Commission, the EU's executive arm.

In an interview with financial-news site Caixin Online, billionaire investor George Soros pointed out that in the first quarter of 2011, European banks lent $3.7 trillion to the developing world, compared with $1.5 trillion from U.S. banks and $700 billion from banks in Japan.

If a recession were to hurt European banks, funding to the developing world, which has generated a healthy portion of global economic growth in recent years, could be cut.

In response to recession forecasts and the ongoing debt crisis, the European Central Bank could resort to more monetary stimulus. If it does, the value of the euro could drop against the dollar, making European exports more competitive internationally than U.S. exports.

A further look at Europe's global economic clout shows that German exports slightly exceed those of the United States. Goods and services sold abroad by U.S. companies are roughly equal in value to the combined exports France, the Netherlands and Italy.

It has been noted that Germany benefits from the cheap euro that the European debt crisis has produced. Moreover, German firms have access to cheaper loans thanks to low-interest rates from the ECB and an influx of cash as investors abandon peripheral European countries.

Continued softness of the euro will likely accelerate Europe's climb out of any recession. But recovering in this way would probably harm the U.S. economy, including exports, in the process.

© Copyright IBTimes 2024. All rights reserved.