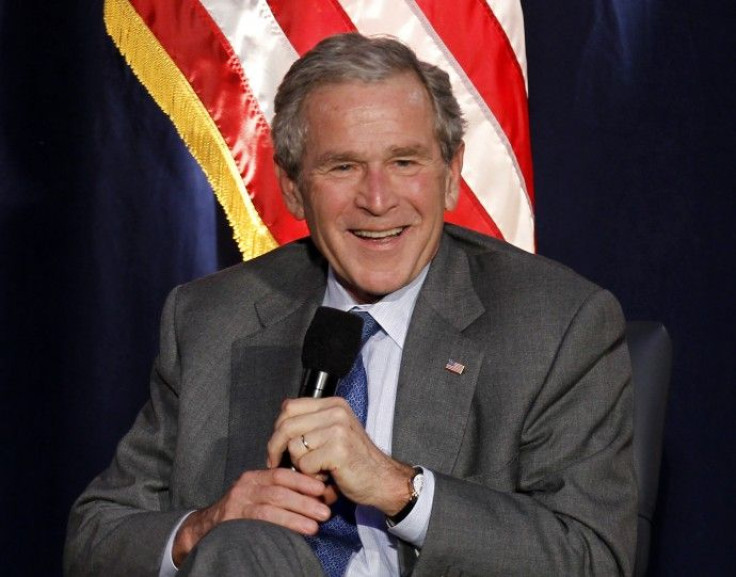

Extension/Repeal of Bush tax cuts coming down to the wire

The saga surrounding the extension (or repeal) of George W. Bush’s tax cuts seems to be changing daily, almost hourly. It’s a highly complex and contentious issue that will (perhaps unfortunately) be decided solely by politics.

Boiling it down to its simplest elements, the Obama Administration and the vast majority of Democrats want to extend the tax cuts only for the poor and middle class (that is, those Americans who earn less than $250,000 annually), but let them expire for upper-income people.

By contrast, virtually all Republicans (and even some Democrats) wish to extend the tax cuts across the board for all income groups.

But if Congress does nothing, tax rates will revert to their (higher) levels from before 2001 at the end of this calendar year.

If the tax cuts expire for the wealthy, the highest two income categories would see their income tax rates climb to 36 percent (from 33 percent) and 39.6 percent (from 35 percent), respectively.

According to the IRS, only about 4 percent of the U.S. population fall into the highest-income earning category (that is, those who make more than $200,000 per year). However, it is these very people who tend to be heavily invested in stock and bond markets and who own businesses that hire employees and drive the economy.

Tax rates for lower-earning people, which are currently at 10, 25, 28 percent, would rise 15, 28, 31 percent, respectively, should the tax cuts expire.

In addition, taxes on capital gains and dividends (among others) will also rise.

Complicating all this, of course, is the fact that the U.S. economy remains weak, unemployment is stubbornly high, the federal budget deficit is mushrooming, and the Republicans just gained a majority in the House of Representatives in the recent mid-term elections.

The arguments go back and forth.

For instance, when Congress passed the tax relief act in 2001, the U.S. Treasury had a surplus -- now the U.S. is carrying a deficit that is estimated at about $1.34-trillion. If the government chooses to extend all the tax cuts, some believe the country might be facing a deficit of as much as $10-trillion over the next decade.

James Kwak, an economist and author of the recent book about the financial crisis, 13 Bankers, estimates that over the medium-term if the tax cuts are extended permanently, by 2020 the deficit will be 5 percent. On the other hand, allowing the tax cuts to expire will remove 1.5 percent of GDP from the deficit going forward.

The basic argument in favor of extending the tax cuts is quite simple – the more money people have in their pockets (regardless of their income), the more they are likely to buy goods and services, thereby boosting the economy and supporting the fragile recovery. Small businesses, which drive job-creation in the country, often file under the highest tax rates and therefore would be particularly hurt by a repeal of the tax cuts.

The arguments opposing tax cut extensions for the wealthy is that rich people don’t really the extra money they would save (and if they had it, they might not spend it anyway).

Miguel G. Farra, partner-in-charge of the Tax and Accounting Department at Morrison, Brown, Argiz & Farra LLP, a Miami-based public accounting and consulting firm, said if tax cuts for the wealthy are repealed, it would have a significant impact on the stock market.

“We would see a repositioning of investments,” he said.

“Right now, under the existing Bush tax structure, qualified dividends are taxed at 15 percent. If and when that rate rises to 39.6 percent, people who have been invested in dividend-paying, income-producing stocks would likely sell those off; and move into growth stocks in order to get the capital gains. Even though capital gains taxes would also go up, they will not do so as dramatically -- up to 20 percent from 15 percent.”

In addition, Farra noted, bond investors would likely unload their taxable fixed income securities and move into tax-free bonds.

On the other hand, Farra believes, an extension of the tax cuts for the highest earners might spark a rally in the stock market next year.

“Under the lower tax regime, there would be more money to invest in securities,” he said. “More money circulating in the economy benefits everybody -- because it would likely accelerate consumer spending, which would trickle down to various sectors of economy.”

In fact, Farra said he thinks raising taxes now when the economy has yet to fully recover, unemployment is high and many businesses are struggling, would be a “bad move.”

Meanwhile, the Democrats and Republicans in Washington have only about six weeks remaining to sort out this debacle – either way, virtually every taxpayer in the country will be impacted one way or another.

© Copyright IBTimes 2024. All rights reserved.