Facebook Filing for $5-Billion IPO: Key Facts and Statistics Behind Biggest Tech IPO

Facebook Inc. will list a preliminary fund-raising goal of $5 billion on Wednesday, which is smaller than some earlier estimates of the offering, reports said.

International Financing Review reported, citing sources close to the deal, that the social networking giant is planning to raise half of the previously estimated $10 billion as it decided to start with a conservative base before deciding whether to increase.

This move by Mark Zuckerberg's company is seen as essentially a placeholder, a foundation used by companies to spawn interest among potential investors.

Facebook is expected to offer shares to the public in May, and if the prevailing speculations prove correct, the eventual offering would be the largest for an Internet company, bigger than Google's in 2004 or Netscape's, nearly a decade before that.

According to the International Financing Review report, Morgan Stanley will lead the effort. However, Goldman Sachs, Bank of America Merrill Lynch, Barclays Capital and JP Morgan are also included in the list of initial bookrunners.

It was the Wall Street Journal that reported the timing of the IPO last Friday, while a Bloomberg report had earlier hinted that Facebook might go public very soon. The report stated that shareholders of Facebook would face a three-day suspension of trading on secondary markets starting Jan. 25.

Facebook's recent product roll outs also explain an upcoming share offering, Mashable reported. Last week the company announced it would be rolling out its new profile templateTimeline, to all users, at a speed that left us scratching our heads, the report said.

The week before, it revealed 60 apps that are tightly integrated into Timeline, and announced a process for developers to create more Timeline apps, the report continued.

Once Facebook files its S-1 paperwork, it would be required to enter a quiet period, a period without product announcements, interviews or any other public statements.

What Did it take to Create the Biggest Tech IPO in History?

Created in Zuckerberg's dorm room at Harvard in 2004, Facebook started its journey as a quirky Web site for college students. Gradually, it turned into a popular platform that was used to sell cars and movies, win over voters in presidential elections and organize protest movements.

With 50 million users in 2007, Facebook reportedly took a huge leap to cross the 800 million mark in 2011. But how did simple status updates and random photos of users help create what will likely be the biggest tech IPO till date?

Facebook has been effectively assembling user's personal data for more than seven years now. It has been compiling the information that its millions of users deliberately share about themselves and their desires.

Each and every activity of a Facebook user, whether it is sharing a link, listening to a song, clicking on the ever-present Like buttons or even changing a relationship status to engaged, gets added to the site's huge library. These chunks of data are available to advertisers to leverage them to match their ads with the right audience.

The Valuation

Reports said that the public stock offering will probably value the company at $80 billion to $100 billion. Considering that personal data is what powers the company's engine, Facebook's value will be determined by whether it can leverage this commodity to magnetize advertisers, and how skillfully it can handle privacy concerns raised by its users and government regulators worldwide, according to The Economic Times.

Facebook provides advertisers a global platform, with reportedly three-fourths of its users outside the U.S. The only exception here is China, where Facebook does not operate.

A Look at the Numbers

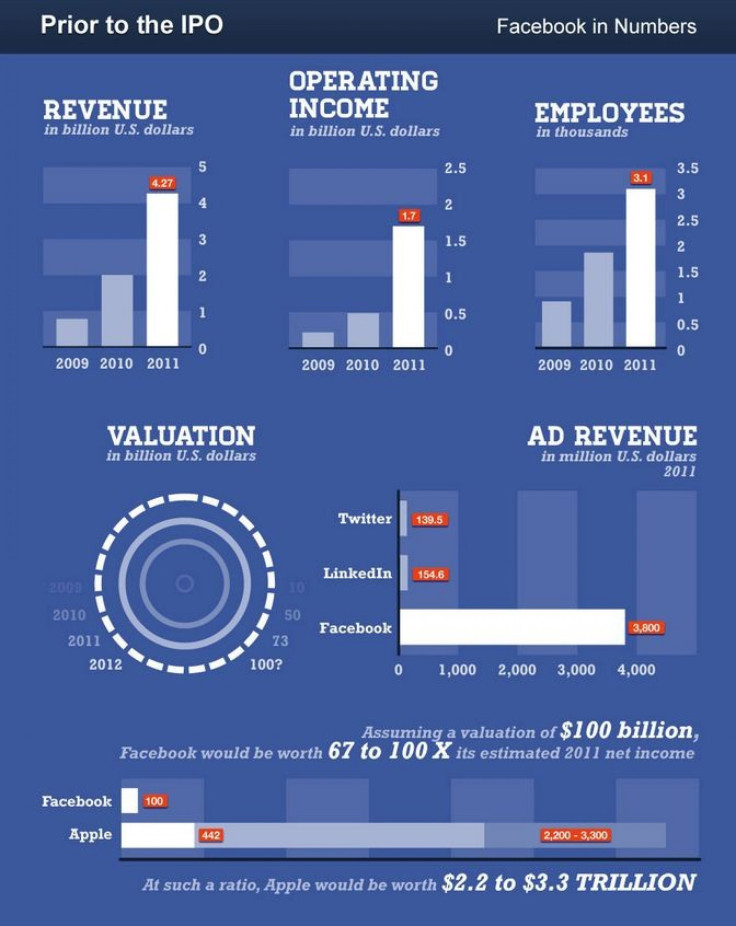

Folks at Statista have compiled an infographic based on Facebook's far-fetched ascendance in recent years.

According to the statistics, Facebook's ad revenue has outdone its contemporaries, while its revenue per employee and per user is on a stable rising scale. Its user base is also expected to grow in 2012.

Have a look at the statistics given below.

[Infographic Courtesy: Statista.com]

© Copyright IBTimes 2024. All rights reserved.