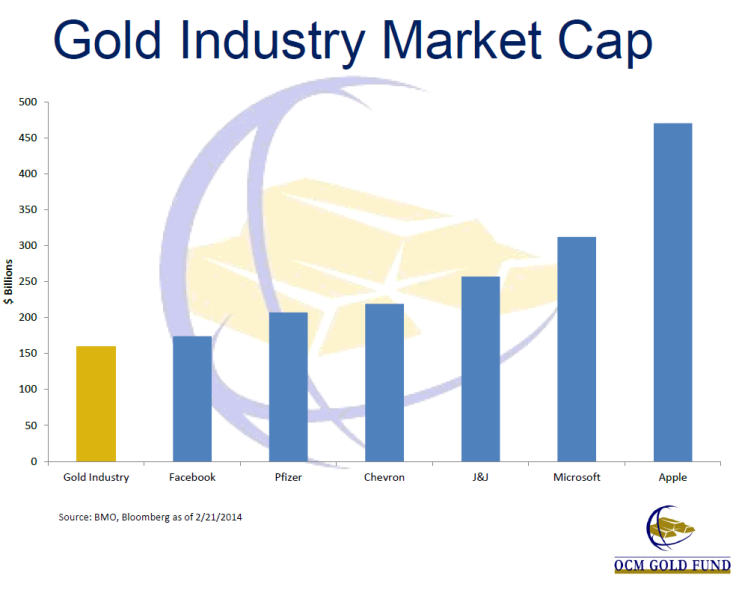

Facebook Vs. Gold Mining Industry: One Could Buy The Other [CHART]

This chart throws investor sentiment behind tech and gold mining industries into sharp relief.

The chart measures the market capitalization of the entire gold mining industry, as measured by Bank of Montreal’s (TSE:BMO) coverage universe, and pits that against the market cap of household names like Facebook Inc. (NASDAQ:FB), Chevron Corporation (NYSE:CVX) and Apple Inc. (NASDAQ:AAPL)

The point: Investor money thrown behind Facebook ($175 billion market cap) outweighs all the money thrown behind the gold mining industry (just over $150 billion), thanks partly to the gold industry’s massively devalued shares over the past few years.

California’s $80 million OCM Gold Fund produced the chart for a presentation at a Denver Gold Group industry forum last week in New York, entitled “Gold Equity Investing for Value Seekers and Contrarians.”

The presentation, which pitched unpopular gold mining equities, comes amid recent calls by some investors that gold miners’ shares represent an attractive bargain, especially if gold reverses its dismal 2013 performance.

“A little bit of money moving into the sector out of other sectors would have a significant impact on the market cap of the whole industry,” OCM Gold Fund portfolio manager Greg Orrell told IBTimes. “The gold industry overall has become quite insignificant in some ways.”

“For what Facebook was paying for WhatsApp, you could buy the entire South African gold sector, plus throw in North America and all the [gold] reserves and all the capital that went with it,” Orrell added.

Orrell wasn’t the only one circulating charts comparing Facebook and gold miners at the industry conference, according to another participant at the event. At least three speakers made similar comparisons. Some compared the $40 per user Facebook paid for WhatsApp to the $50 you’d pay for precious metals ounces still in the ground among junior miners.

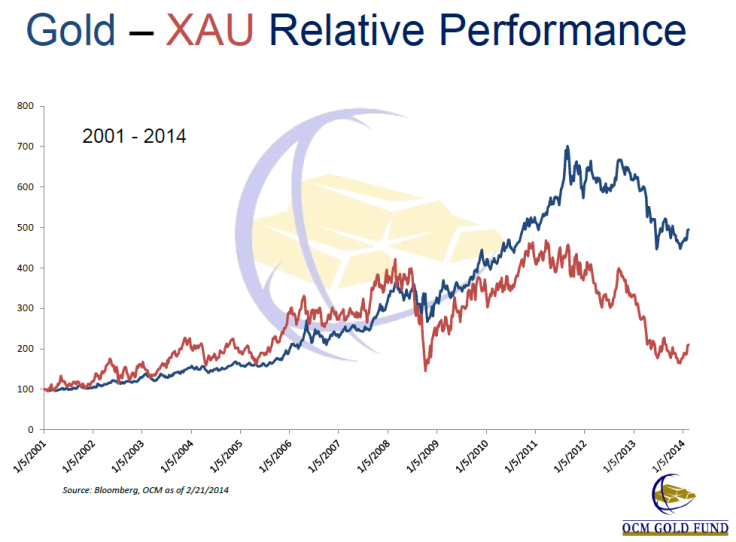

Orrell sees more upside for gold mining shares relative to gold itself. Choosing to bet on precious metals by investing in mining companies versus the actual metals is a perennial and popular debate in the sector.

“Do I like the shares more than the physical metal right now? You know, I tend to lean in that direction right now,” Orrell said. “If you have a view that the gold price is going down, that’s not going to give you a warm and fuzzy feeling that gold shares are going to outperform gold."

“But even in a relatively stable gold price environment, there’s room for gold shares to appreciate, as companies address these issues they’d stumbled over previously,” he added.

Corporate governance problems and high capital budgets, along with little consideration shown to shareholders, plagued the gold mining industry over a decade-long boom of gold prices. Gold equities have fallen steeply in the past years, since about 2011, and have done worse than gold itself.

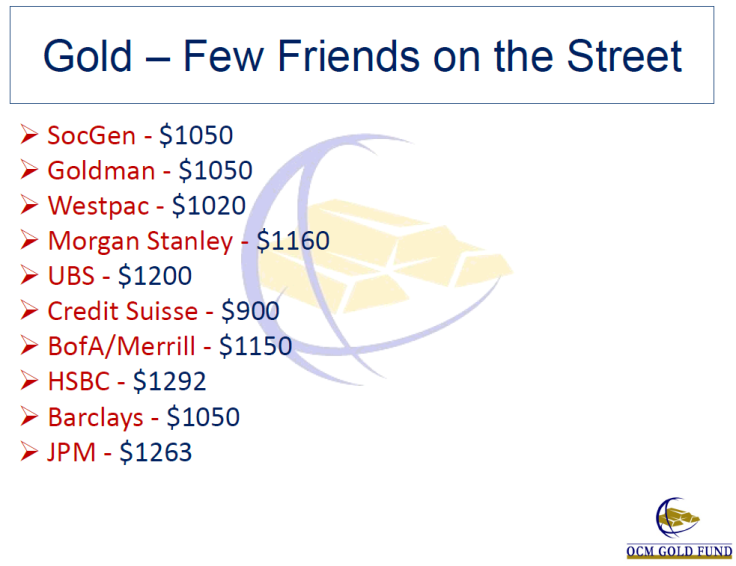

As Orrell notes in his presentation, Wall Street is hardly bullish on gold prices these days, after the metal saw its worst showing since 1981 last year. Average 2014 price forecasts from banks range from $900 to $1,292 per ounce.

The OCM fund took a beating last year too, with negative returns of -47 percent in 2013, relative to the S&P 500’s gain of 32 percent.

© Copyright IBTimes 2024. All rights reserved.