February US New Auto Sales Forecast: Incentive Spending Highest In 4 Years; Nissan Growing Sales Most While Ford Leads In Market Share Retreat; 1.2 Million Units Sold, Say Forecasters

Note: Click here to follow the February U.S. 'Big 8' auto sales live blog.

It’s fairly easy right now to guess why U.S. new-auto sales in the country are expected to be flat in February: Who wants to visit a dealership when something as ominous as a polar vortex is hovering over your head?

The nation entered the month with much of the same winter weather that impacted January auto sales, leaving many of the heavier populated parts of the country covered in snow and ice and sending Arctic blasts into areas of the country accustomed to mild winters.

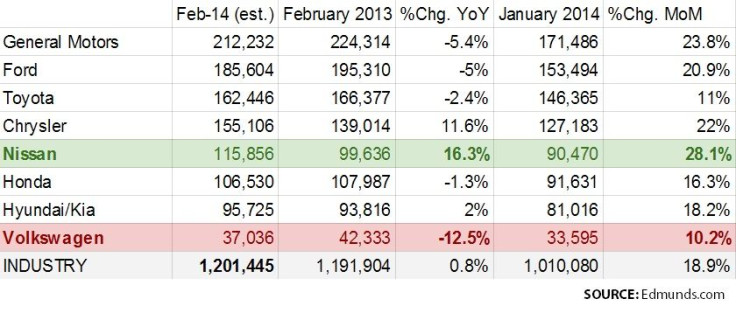

Automakers will announce their February U.S. sales figures on Monday. Forecasters see sales volume at around 1.2 million units, up from 1.19 million in February 2013 and just over a million units last month. Historically speaking, the first two months of the year are typically anemic. February is usually better than January, followed by a rebound in March, a retreat in April (the month income taxes are due) and an increase in May heading into the important summer months.

So far this pattern seems to be playing out: January was down from December and February is seen up from January. The seasonally adjusted annualized rate, or SAAR, the key metric that tracks a 12-month estimate of U.S. new-auto sales, is seen coming in at between 15.3 million and 15.7 million.

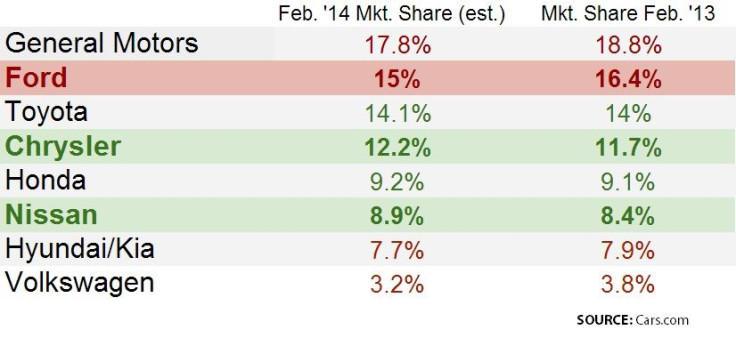

February sales are seen rising only 1.1 percent, according to automotive pricing and industry data provider Cars.com. Estimates vary between a 0.2 percent decline (according to Kelley Blue Book’s forecast) and 3 percent (according to J.D. Power and ALG Automotive).

If weather is in fact the main headwind, then we should see a noticeable rebound in March as car buyers who delayed their purchases due to the weather start heading to showrooms again.

“March is going to be a ‘must-win’ month for dealers if they hope to have a successful 2014,” said Larry Dominique, president of auto industry research firm ALG and executive vice president of TrueCar.

Long story short: There are some lucrative new-auto deals out there right now, not just because of the weather but also because of rising used car inventories. Edmunds.com’s fourth quarter used car market report says used car prices are declining right now, which will put pressure on new-car dealers to attract consumers from the aftermarket.

Inventories are putting pressure on car prices, too. Stock is usually high this time of year as automakers build up ahead of the spring. But in January, the available stock was up between 3 percent for Nissan and 28 percent between Hyundai and Kia compared to January 2013. So stock is up even by January standards. All of the Big 8 global automakers had inventories above the healthy 60-day supply.

“Inventory levels always rise in January, though the cold weather last month clearly exaggerated the effect. It’s too early to know if this represents a larger, fundamental issue or a short term bubble that will work itself out naturally,” said Karl Brauer, senior analyst at auto price and industry information provider Kelley Blue Book.

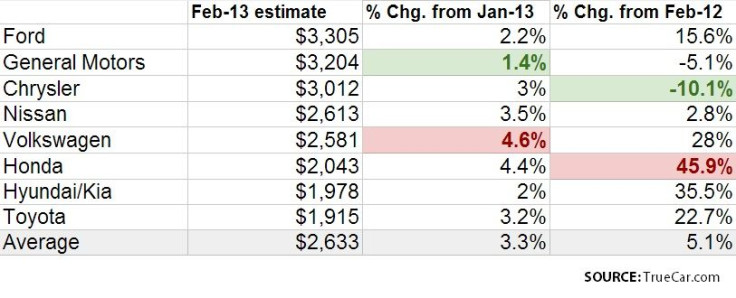

That’s the big question. High inventories means high incentive spending on rebates and other deal-sweeteners, which means lower profit margins. Incentive spending is seen rising an average of 3.3 percent for the Big 8 automakers compared to January, according to automotive pricing and information provider TrueCar.com. Five of the eight companies will see increases compared to February 2013; four are expected to boost incentives by double digits. Honda, which is traditionally tight on incentive spending, could see a year-over-year rise of nearly 46 percent.

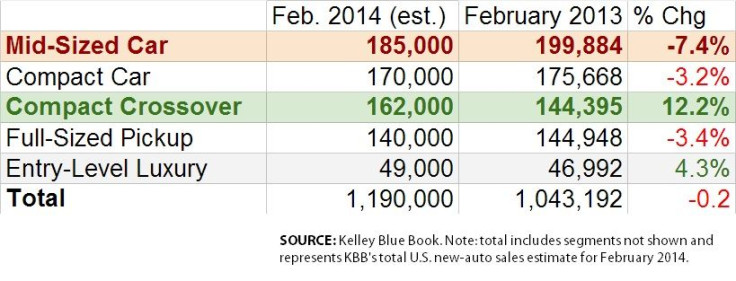

As far as segments are concerned, sedans sales are expected to retreat while crossover SUV sales are expected to continue climbing at a robust rate.

“Consumers can’t get enough small SUVs,” said Jesse Toprak, Cars.com chief analyst. “The segment’s market share reached a record high 18 percent this month, up from 15 percent this time last year.”

The February forecast takeaway is simple: Blame the weather for now, but if sales don’t see a good jump in March, then there are other factors in play.

© Copyright IBTimes 2024. All rights reserved.