The Fed, ECB and the US Dollar

Tom Sowanick is co-president and chief investment officer at Omnivest Group in Princeton Junction, N.J.

This week we had two key central bank leaders discuss their views on the risk that the recent rise of inflation is more than simply transitory. And while the mandates that govern these two central banks are different, their views/actions can have significant impact on global currency movements.

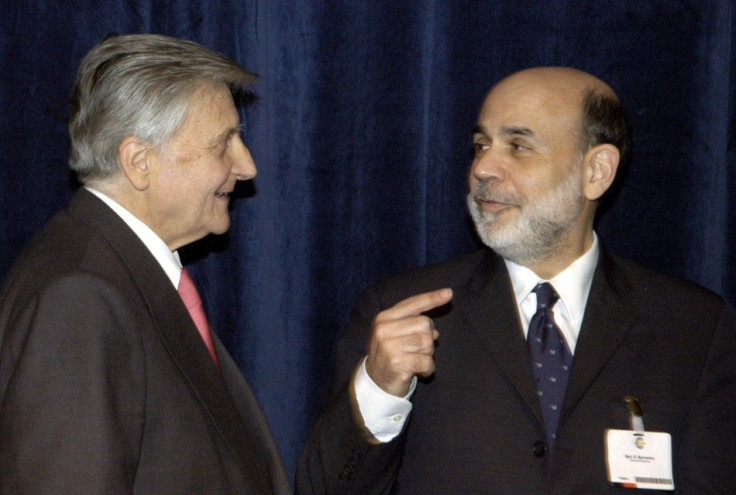

Fed Chairman Ben Bernanke spoke at length this week on his view that the recent upward pressure on inflation is likely to be transitory - “As I have explained, most FOMC participants currently see the recent increase in inflation as transitory and expect inflation to remain subdued in the medium term”.

In contrast, ECB President Jean-Claude Trichet said today that “strong vigilance is warranted on inflation”.

We interpret this statement to mean that the ECB will likely raise interest rates at their next meeting on July 7th.

The contrasting views clearly imply that the ECB will continue to lift interest rates while the Fed will continue to keep interest rates near zero for a prolonged period of time. The Fed has a dual mandate of “maintaining stable prices” and “full employment” while the ECB has a strict mandate of keeping inflation at or near 2 percent.

The clear difference between the two mandates can, from time to time, exert unwanted, largely artificial currency movements, such as what has recently occurred between the US dollar and the euro.

Though interest rate differentials are not the only deciding factor in determining currency movements, they are nevertheless important. It is now widely expected that the Federal Reserve will keep its current interest rate policy steady for the balance of the year.

While it is true that QE2 will end at the end of June, the Fed will keep its balance sheet at its current size; in short thereby continuing to supply significant amounts of liquidity to the financial system. Meanwhile, the ECB is likely to steadily increase rates over the balance of the year.

As a consequence, the risk to the euro is higher, not lower, versus the US dollar. There is also a significant risk that the US credit rating may be downgraded which would put even further downward pressure on the US dollar. In broad terms, the US dollar is also more likely to weaken versus emerging market currencies.

Generally speaking, emerging market central banks have been more aggressive in lifting rates to control inflation than developed market central banks.

In summary, until the Fed joins the central bank community in lifting rates, the US dollar will continue to struggle. And while this will continue to aid exports, one cost of a lower US dollar will be to drive the standard of living lower for US consumers.

The rising costs of imported goods will also continue to keep upward pressure on commodities. Asset allocators should continue to focus on exposure to commodities and short-dated non US dollar denominated notes.

© Copyright IBTimes 2024. All rights reserved.