Fed May Offer Clues On Rate Timing Conundrum

(Reuters) - U.S. policymakers have the chance this week to give clearer guidance on the future path of interest rates and settle markets that are uncertain over how and when a hike would occur.

Global financial markets are still on alert for developments in Ukraine, with the United States and its G-7 partners preparing tougher sanctions against Russia. But investors will have much to chew over, including Federal Reserve and Bank of Japan policy meetings and data from U.S. growth and jobs to euro zone inflation.

The Federal Reserve's Open Market Committee meets from Tuesday to Wednesday. The U.S. central bank is likely to announce a further $10 billion reduction of its monthly bond purchases, but markets will read its Wednesday statement closely for clues to when interest rates might start rising. In March, the Fed jettisoned its specific promise to keep borrowing costs low until unemployment falls below 6.5 percent - it was 6.7 percent in March. Instead, it said rates would stay low for "a considerable time" after its bond-buying program ends later this year.

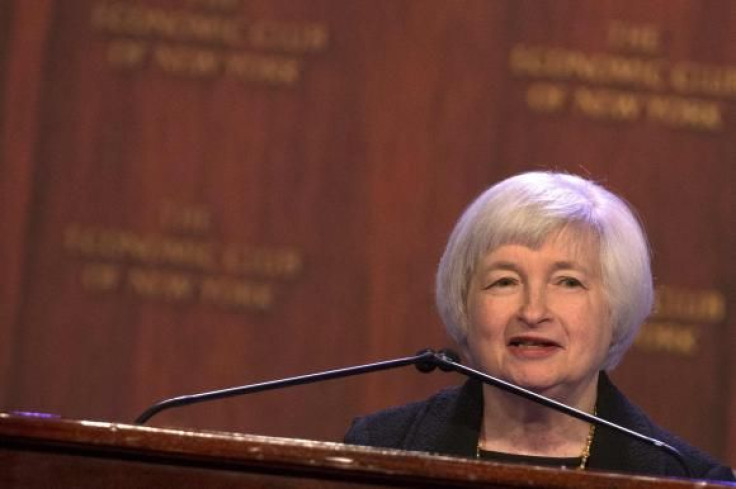

Fed Chair Janet Yellen knocked stocks and bonds in mid-March by saying that period could be around six months, indicating rate hikes as early as next spring. More recently, she had the opposite effect by reaffirming the bank's commitment to keeping interest rates low. Some Fed officials called this month for greater clarity on what economic conditions would prompt a rate hike. By Wednesday, investors will know how fast the U.S. grew in the first three months of 2014, when bad weather is likely to have dragged on activity.

U.S. GDP growth is seen easing to an annualized 1.3 percent from 2.6 percent in the final quarter of 2013, when consumer spending and business investment were strong. Exceptional cold and heavy snow capped retail sales, industrial output and the housing market in the first quarter, but economists see a spring thaw leading to sharply stronger growth of up to 4 percent in April-June. "We know that there were two months of disruption so it's going to be hard to read this data and extract meaningful signs about the underlying economy," said Laura Rosner at BNP Paribas in New York.

Clearer signals should come from Thursday's Institute for Supply Management index on national factory activity and particularly Friday's monthly jobs figures, the key driver of monetary policy. Non-farm payrolls improved from rotten levels in December and January to an increase of 197,000 in February and 192,000 in March. The figure is expected to push beyond 200,000 this month as temperatures rise and a later Easter prompts extra hiring.

LOW INFLATION RESPITE

It will be a three-day week for many Europeans, with the May Day public holiday in much of continental Europe on Thursday extended into a long weekend. Policymakers and investors will learn on Wednesday whether euro zone inflation bounced in April from March's 0.5 percent, its lowest level since November 2009. This year's later Easter, bringing higher prices for holiday items such as travel, is expected to pull the consumer price index up to 0.8 percent. That would ease pressure on the European Central Bank to act at its May meeting, although the figure would still be in ECB President Mario Draghi's "danger zone" below 1 percent.

"It's difficult to cut interest rates when inflation is going up again," said Citi economist Guillaume Menuet. "I think it's pointing to June rather than May." After rising in April, Menuet sees inflation falling to 0.7 percent in May and to 0.6 percent in June. Draghi gave his clearest indication yet last week that slowing inflation could prompt the ECB to undertake quantitative easing - printing money to buy assets - identifying a rise in the euro as a potential trigger for action.

"What has changed in the past week is that we think that QE is more likely than not, in the second half of this year. Before we thought the hurdle was quite high," Menuet said.

Outside the euro zone, Britain will issue its first estimate of first quarter growth on Tuesday. The economy is expected to have expanded by 0.9 percent in January-March, accelerating from 0.7 percent in the final three months of 2013 and restoring the British economy to within a whisker of its size before the global financial crisis struck. The data may also spark debate about the extent of slack within the economy and the timing of the Bank of England's first interest rate rise, currently expected by markets to come in the first or second quarter of 2015.

SALES TAX HIT IN JAPAN

The Bank of Japan will meet on Wednesday and deliver its twice-yearly economic outlook. The bank is expected to say it sees consumer inflation accelerating this year and staying around 2 percent for at least two years. That could dampen investor expectations for fresh monetary stimulus soon, although many investors expect the BOJ to ease again in July. Amid a slew of Japanese data, industrial output figures for March are expected to show a modest rebound after a snow-affected February, with a jump expected in retail sales as consumer sought to buy before April's sales tax hike.

Economists and policymakers expect the economy to contract in the current quarter due to the tax rise before returning to moderate growth in the following quarters. In China, more comprehensive purchasing managers' indices (PMIs) for manufacturing and services are expected to confirm the world's second largest economy is slowing. Factory activity shrank for a fourth consecutive month although the pace of decline slowed, according to the HSBC/Markit flash PMI for April.

(Article by Philip Blenkinsop. Additional reporting by Jason Lange in Washington, Tetsushi Kajimoto in Japan, William Schomberg in London; Editing by Catherine Evans)

© Copyright IBTimes 2024. All rights reserved.