Fiat Acquisition Of Chrysler Will Smooth Operations, But Add To Its Mounting Debt Woes; Car Buyers Won’t Feel Effects Of Chrysler-Fiat Alliance

Fiat SpA’s $4.35 billion deal to acquire the part of Chrysler it doesn’t already own, which was announced on New Year’s Day, is a victory for Fiat and Chrysler CEO Sergio Marchionne. It removes financial hurdles that have prevented Fiat from accessing Chrysler’s profits amid a booming U.S. auto market, albeit at a cost of increasing the company’s already heady debt burden. It opens the way for Marchionne to move Fiat-Chrysler to The Netherlands to lower the group’s tax burden. And Chrysler could soon find its way back on the New York Stock Exchange in an IPO in 2014. The combined group would replace Honda as the world’s seventh-largest automaker in terms of the number of units produced each year.

After years of wrangling with the United Auto Workers (UAW), Marchionne managed to land a deal that transfers ownership of 41.5 percent of Chrysler to Fiat, which is now the complete owner of the 88-year-old U.S. maker of the Ram pickup, the Jeep Grand Cherokee and the Dodge Charger.

What will not change anytime soon is what consumers will see coming out of the two auto companies. The all-new 2015 Chrysler 200 that will debut at the North American International Auto Show this month is the latest example of the collaboration between Fiat and Chrysler in the wake of Chrysler’s Chapter 11 bankruptcy in 2009. The compact executive sedan is the latest Chrysler offer to be built using the Alpha Romeo architecture, which was also used for the recent Dodge Dart and Jeep Cherokee.

“I don’t think much changes because of this in terms of rolling out product,” said Michelle Krebs senior analyst for the automotive pricing and information provider Edmunds.com. “[Fiat’s acquisition of the rest of Chrysler] is really a financial issue. We may see more joint-products, faster refreshes of old products, those sorts of things. It helps the product portfolio that was already set in motion anyway. Now they don’t have to deal with some of the firewalls between the two companies.”

That means both Fiat and Chrysler will be able to continue improving their economies of scale while becoming more nimble by merging many administrative and financial operations. The UAW will no longer be there to impede Marchionne’s efforts after the two sides agreed that Chrysler would bear the financial brunt. The two companies will share the cost of the $1.9 billion paid upfront this week and the $1.75 billion due on Jan. 20, when the deal is expected to close. On top of that, Chrysler will dole out an additional $700 million over the next four years.

The co-ownership of Chrysler between Fiat and the union was the outcome of the $4 billion bailout of Chrysler in the wake of the sub-prime mortgage meltdown that sent the economy into recession and the auto industry crashing to record-low sales in 2009. The U.S. taxpayer ended up paying $1.3 billion for the Chrysler bailout. Robert Naftaly, chair of the committee that governs the UAW trust, lauded the agreement as being in the best interests of the more than 117,000 Chrysler retirees who depend on the medical benefits. IPO advisers have estimated that Chrysler is worth about $10 billion, so the UAW stake appears to be where it was expected to be.

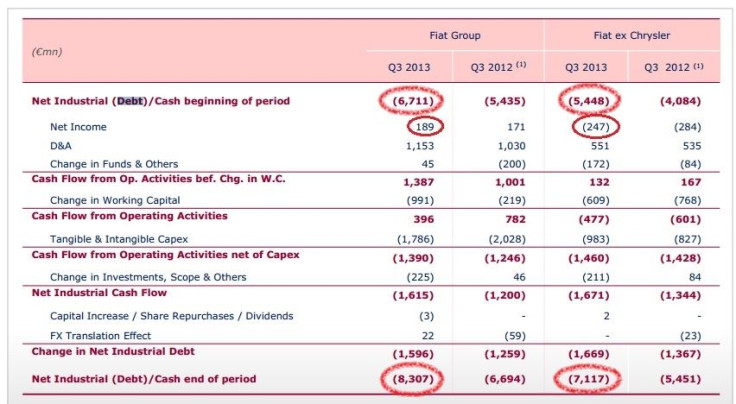

But the deal also comes at a price for Fiat, whose industrial debt stood at 8.3 billion euros (about $11.3 billion) at the end of its fiscal third quarter ending Oct. 30, while sales have been battered hard by tumult in Fiat’s core market: Europe. On Thursday Citigroup expressed concerns about the financial impact of the deal.

"The group's net debt will rise to 10 billion euros once the transaction is completed," Citigroup said. "We continue to have concerns about the sustainability of the debt levels.” But at least now Fiat will be able to draw capital from Chrsyler, and it could float shares on the stock market in New York to see how investors price the company.

As to where the company will be based, Marchionne said earlier this year that he would move the merged company’s tax base out of Italy, where the corporate tax rate is among the highest in Europe at 31.4 percent. The Fiat-Chrysler group could take the same route as Fiat Industrial took earlier this year when Fiat’s farm-equipment maker moved its tax residency to the U.K. after merging with CNH Global, an agricultural and construction equipment maker headquartered in The Netherlands but operating out of the U.K., where the corporate tax rate is expected to drop to 20 percent by 2015.

© Copyright IBTimes 2024. All rights reserved.