Finance Sector Rebound In 2014: Banks And Lenders Set To Benefit

Wall Street looks set for a sustained post-crisis rebound in 2014, as an improving U.S. economy and jobs landscape provides big lenders with more customers, reports the Wall Street Journal.

Funds like the $5.3 billion Pioneer Fund and the $367 million Federated Investors fund are bullish on banks like Wells Fargo & Co. (NYSE:WFC), the nation’s largest mortgage lender.

Banks that profit substantially from commodities and proprietary trading, though, like Goldman Sachs Group Inc. (NYSE:GS), could suffer from new regulations like the recently approved Volcker rule. Banks could also benefit from their roles as underwriters in initial public offerings, after 2013 saw a bumper crop of public launches of domestic and foreign companies.

Banks will report quarterly earnings early in January, led by JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo on Jan. 14. The finance sector typically kicks off earnings season.

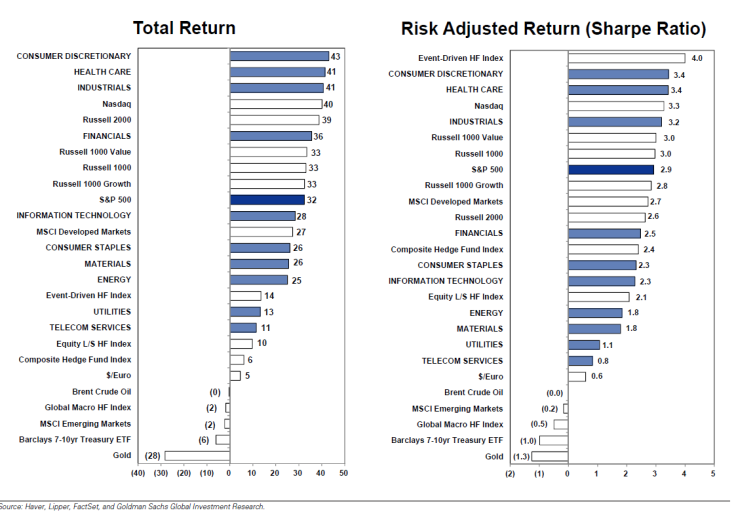

The financial sector saw total returns of 36 percent in 2013, according to a Goldman Sachs note from Monday. As a sector, it contributed the most on a weighted basis to the S&P 500’s total return in 2013, during a year when the index broke multiple records.

Wells Fargo, JPMorgan, Bank of America Corp. (NYSE:BAC) and Visa Inc. (NYSE:V) were among the top 20 stocks in the S&P 500 with the highest returns in 2013.

Still, those returns were lower than those offered by other sectors, like consumer, health care and industrial sectors, which scored returns of just over 40 percent. In terms of risk-adjusted returns, too, financial stocks ranked in the middle of the pack.

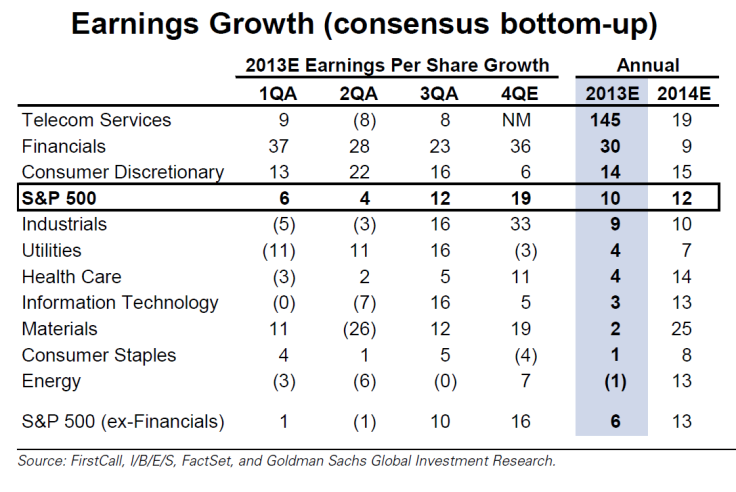

Financial firms grew earnings per share by about 30 percent in 2013, according to Goldman estimates. That’s better than overall S&P 500 earnings growth, at 10 percent. But financial companies could fare worse in 2014, where they’re expected to grow EPS by only 9 percent, below the market’s 12 percent.

Ironically enough, Goldman maintains a "neutral" rating for the financial sector.

© Copyright IBTimes 2024. All rights reserved.