First Facebook Trade At $38? Not If History Has A Vote

Facebook (Nasdaq: FB), the No. 1 social network, has decided to pitch its initial public offering of 421 million shares at $38, which could raise as much as $18.1 billion, assuming -over-allotment options.

Demand for the Menlo Park, Calif., websites's shares is huge, ginned up by a huge sales and marketing campaign last week.

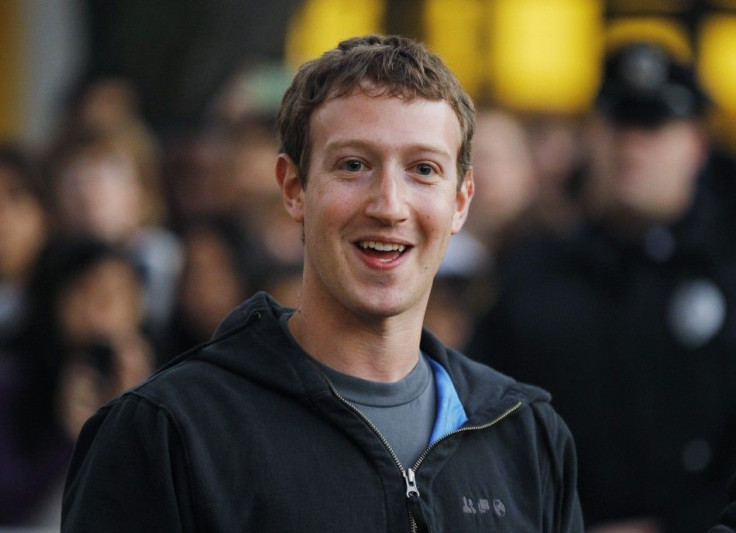

CEO Mark Zuckerberg turned 28 on Monday. He's selling Facebook shares valued at $4.8 billion. After the IPO, he'll still own about 57 percent of the company, possibly valued around $19 billion.

How likely is it the first trade Friday will be at $38? If history has a vote, probably not. The price could be as high as $70 or even $90, if past experience with hot Internet stocks is considered -- not to mention all the publicity Facebook has already ginned up through its 901 million members and movies like The Social Network, which was nominated for eight Oscars and won three, for best script, sound and vision.

Facebook's three principal underwriters, Morgan Stanley (NYSE: MS), JPMorgan Chase & Co. (NYSE: JPM), and Goldman Sachs Group Inc. (NYSE: GS), already have vast links to Facebook.

Goldman Sachs is a long-time investor and helped clients including Russia's Digital Sky Technology earlier buy into the company. Digital Sky plans to partially cash out, selling 157 million shares. Its $200 million investment in 2009 could be valued as high as $5.8 billion in the deal.

Given the hype, there's little doubt that $38 price, technically, the top of a range that could start as low as $34, will stick. After the roadshow, the underwriters, including the latest, TDAmeritrade, will discuss demand for the shares and preliminary orders, then conduct the actual IPO among themselves on Thursday.

Watch for announcements after the markets close that day on the pricing. Consider some of these earlier IPOs:

Netscape Communications, the company that morphed from the Mosaic web browser inventor Marc Andreessen, was the pioneer of hot Internet stocks.

Scheduled to IPO at $14, the underwriters doubled the price to $28 on Aug. 9, 1995. On Aug. 10, the first Netscape trades soared as high as $75 a share before easing to close at $58.25, valuing the company at $2.9 billion.

By the end of 1995, Netscape traded at $171. In 2003, AOL (NYSE: AOL) acquired the company for $4.2 billion.

Yahoo Inc. (Nasdaq: YHOO), the No. 3 search engine, was also red hot, coming to Nasdaq just after two more tech IPOs for Excite and Lycos.

The Sunnyvale, Calif., company that was everybody's first search engine decided to sell $2.6 million shares for $13 each. When Yahoo shares first traded on April 12, 1996, they debuted at $24.50, hit $43 and closed at $33.

In Wednesday trading, Yahoo was at $15.50, up a dime, valuing the company at $18.9 billion, although activist investor Third Point Capital, which owns about 8 percent of the company, believes it's worth far more.

Google Inc. (Nasdaq: GOOG), the No. 1 search engine, was also red hot, but its 2004 IPO had some problems and also was bisected into an auction IPO for some shareholders and then the official Nasdaq IPO for others.

After first pricing the shares at $95, underwriters Morgan Stanley and Credit Suisse (NYSE: CS), detecting auction demand, trimmed it back to $85. The first day's activity saw a high of $100.33 as the company raised about $1.67 billion in the third-largest IPO to that date.

Google shares Wednesday traded at $628.73, up $17.99, giving the Mountain View, Calif., company a value of $204.9 billion.

© Copyright IBTimes 2024. All rights reserved.