Ford Motor Co. (F) Sees Total 2013 New Vehicle Sales Up 14.2% In China, Up 7.4% In U.S., Down 2.9% in Europe

Ford Motor Co. (NYSE:F), North America's second-largest automaker, used its third-quarter report to provide a window into the company's China operations, offering upbeat estimates of present and future market share plus unusually detailed sales figures for its activities in the world's most populous nation.

The estimates show just how much China and the U.S. lead the world in sales while Europe continues to economically stagnate as it struggles with sovereign debt issues. Ford and other automakers have been spending heavily to decrease capacity in the region, which has pulled down profits, especially for automakers with heavy exposure to the so-called superclass segment – bread-and-butter, low-margin, high-volume sedans and compacts. At the same time, the automakers with larger footprints in China for superclass cars, SUVs and luxuries have been able to offset the European headwinds.

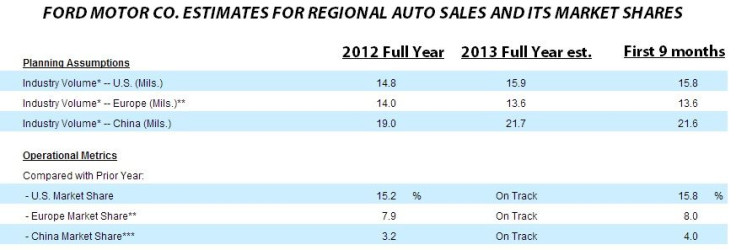

Ford sees total China auto sales rising from 19 million last year to 21.7 million in 2013, a 14.2 percent jump. Ford is coming into this market late, behind General Motors Co. (NYSE:GM) and Volkswagen AG (FRA:VOW3), which are the big foreign players in the market.

Ford’s share of the Chinese new-vehicle market is 4 percent in the first nine months, in line to beat last year’s 3.2 percent as the company continues to expand domestic Chinese capacity. Ford has a long way to go: This is the first time a third-quarter earnings report has data on China-only market share separate from the Asia-Pacific region.

In the U.S. Ford has seen its market share rise in the first nine months to 15.8 percent; that’s above the full-year share of 15.2 percent in 2012. The company expects U.S. auto sales to rise to 15.9 million this year from 14.8 million last year, a 7.4 percent increase. Ford includes heavier pickup trucks like its F-350 in its estimates, which is sometimes excluded in estimated annual new-car and light truck sales.

Europe sales are seen falling 2.9 percent this year to 13.6 million. Ford controlled 8 percent of the European market in the first nine months of the year, a tick above the 7.9 percent it had in all of 2012.

© Copyright IBTimes 2024. All rights reserved.